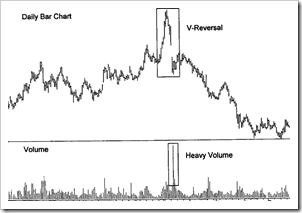

Image via Wikipedia

Note to self: no matter what, do not outsource customer service.

Fiat has a decent lineup of cars in India. However, they have been extremely unlucky in choosing an Indian partner. Fiat cars were one of two models that were available during the dark days of the license-permit raj. Their earlier models (more than 30 years old) are still used as taxis in Mumbai. Why is it that given a choice, most people would not buy a Fiat now? I guess the answer is fairly simple: poor customer service.

Back in the 90’s Fiat partnered with Premier motors to introduce the Uno. I remember my dad “booking” a vehicle and waiting for over six months to actually take delivery. It was a complete disaster in terms of service levels. Parts were unavailable, mechanics did not know how to service the vehicle and there just weren’t many service centers accessible. Fast forward to 2011 and they are still where they were 20 years ago, except that they now have Tata Motors screwing things up for them.

How do you expect a partner to do a good job servicing your product when the same partner has equivalent models competing under his own brand name? No wonder Fiat gets a step-brotherly treatment. Ask me, its two weeks and counting to get parts for my Linea. Pathetic.