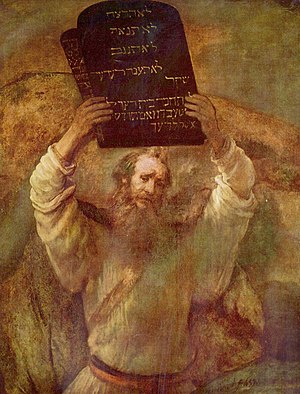

Image via Wikipedia

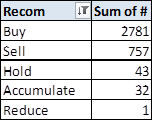

Pythagorean theorem: 24 words

Lord’s prayer: 66 words

Archimedes’ Principle: 67 words

Ten Commandments: 179 words

Gettysburg address: 286 words

US Declaration of Independence: 1,300 words

US Constitution with all 27 Amendments: 7,818 words

EU regulations on the sale of cabbage: 26,911 words