This is a review of the 6th chapter of John J. Murphy’s Technical Analysis of the Financial Markets.

Continuation Patterns

Continuation patterns are shorter terms patterns that indicate that a current price action is nothing more than a pause in an existing trend and that the previous trend will resume later.

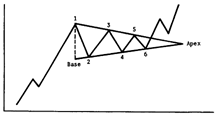

Triangle

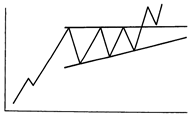

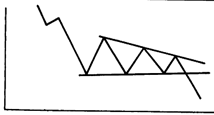

There are three types of triangles:

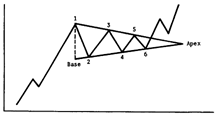

- Symmetrical (coil): Formed out of two trendlines where the upper one descending and the lower line ascending.

- Ascending: Formed out of a rising lower line and a flat upper line.

- Descending: Formed out of a flat lower line and a descending upper line

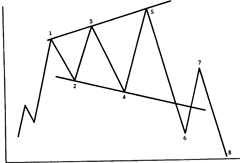

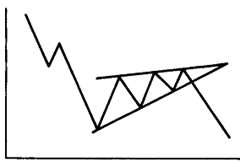

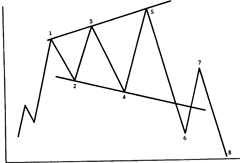

The Broadening Formation (Megaphone Top)

It looks like a triangle turned backwards and represents an out-of-control market. Volume tends to increase along with the wider price swings.

It looks like a triangle turned backwards and represents an out-of-control market. Volume tends to increase along with the wider price swings.

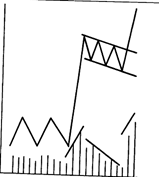

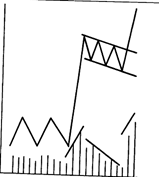

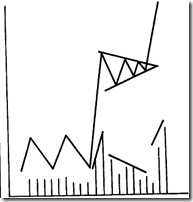

Flags and Pennants

Flags and Pennants represent brief pauses in a one-directional market and they need to be preceded by sharp, straight line moves.

A flag should slope against the trend and volume should dry up during the formation and build again during the breakout. The flag usually forms during the mid-point of the move.

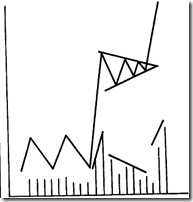

A Pennant represents a small symmetrical triangle.  Volume should be light during its formation. The move after the pennant should duplicate the move before its formation.

Volume should be light during its formation. The move after the pennant should duplicate the move before its formation.

Both patterns are short-term and should be completed within 1-3 weeks with volumes drying up during their formation.

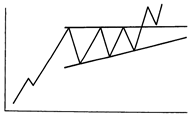

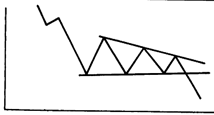

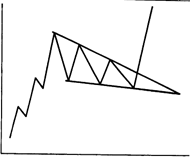

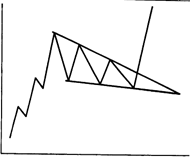

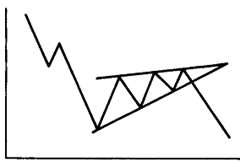

The Wedge

The wedge formation is very similar to a symmetrical triangle, except that it has a prominent slant. A falling wedge is considered bullish whereas a rising wedge is considered bearish.

The Rectangle (Trading Range)

It usually just represents a consolidation area after which the previous trend resumes. A decisive close outside the upper/lower boundary signals a completion.

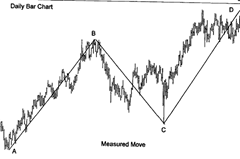

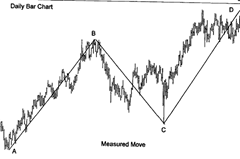

The Measured Move (Swing)

It describes the movement of a stock when a major advance or decline is divided into two equal and parallel moves. The moves should be fairly orderly and well defined.

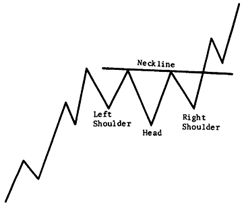

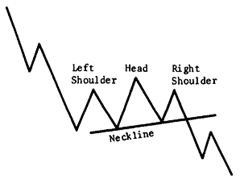

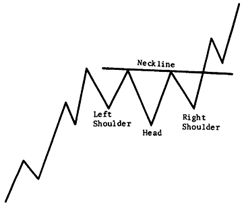

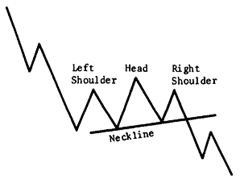

The Continuation Head & Shoulders

The price action looks similar to a Rectangular pattern except that the middle trough, in an uptrend, tends to be lower than the other two shoulders. In a downtrend, the middle peak exceeds the other two peaks.

Next: Chapter 7 – Volume & Open Interest