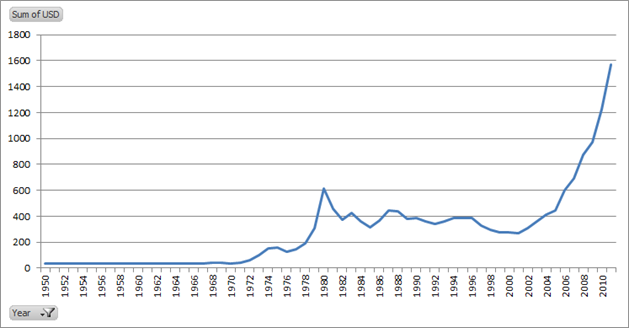

Image via Wikipedia

The carnage in Airtel stock continues – down close to 10% since their results were announced. Their Revenue Per Minute (the amount they charged you) increased by 3.2% while minutes rose only 0.8% And the worst part is that Idea’s minutes grew 7.3% during the same period, in spite of those annoying Abhishek Bachan ads.

I am not sure which network traders are on, but having suffered through Airtel’s network for the better part of three years: no signal, dropped calls, annoying ring-tones, having to pay to talk to a customer service rep, being told that I had to buy a Rs. 20,000 “booster” to fix the lack of network around my house; it comes as no shock to me that people “used” less minutes. I have lost track of the number of times I’ve carried the rest of a conversation on Skype because Airtel dropped the call.

I guess all of those dropped calls finally translated to a disappointing quarter.

The stock is hovering around Rs. 350 now. It was around Rs. 320 in early Jan so I’m tempted to say that a correction was overdue and I’m actually warming up to a bull case here.

You can read all the news stories about Airtel here.