Equities

Commodities

| Energy |

| Brent Crude Oil |

+6.74% |

| Ethanol |

+9.76% |

| WTI Crude Oil |

+7.49% |

| Heating Oil |

+8.72% |

| Natural Gas |

+0.73% |

| RBOB Gasoline |

+5.02% |

| Metals |

| Copper |

+6.28% |

| Gold 100oz |

+0.48% |

| Silver 5000oz |

+3.23% |

| Palladium |

+7.45% |

| Platinum |

-1.99% |

| Agricultural |

| Cattle |

-11.66% |

| Coffee (Arabica) |

+4.31% |

| Corn |

+11.53% |

| Cotton |

+3.42% |

| Orange Juice |

+12.02% |

| Coffee (Robusta) |

+11.36% |

| Feeder Cattle |

-12.32% |

| Lean Hogs |

-21.49% |

| Lumber |

+7.60% |

| Soybean Meal |

-4.46% |

| Soybeans |

-0.52% |

| Sugar #11 |

+13.72% |

| Wheat |

+10.82% |

| Cocoa |

-5.72% |

| White Sugar |

+12.46% |

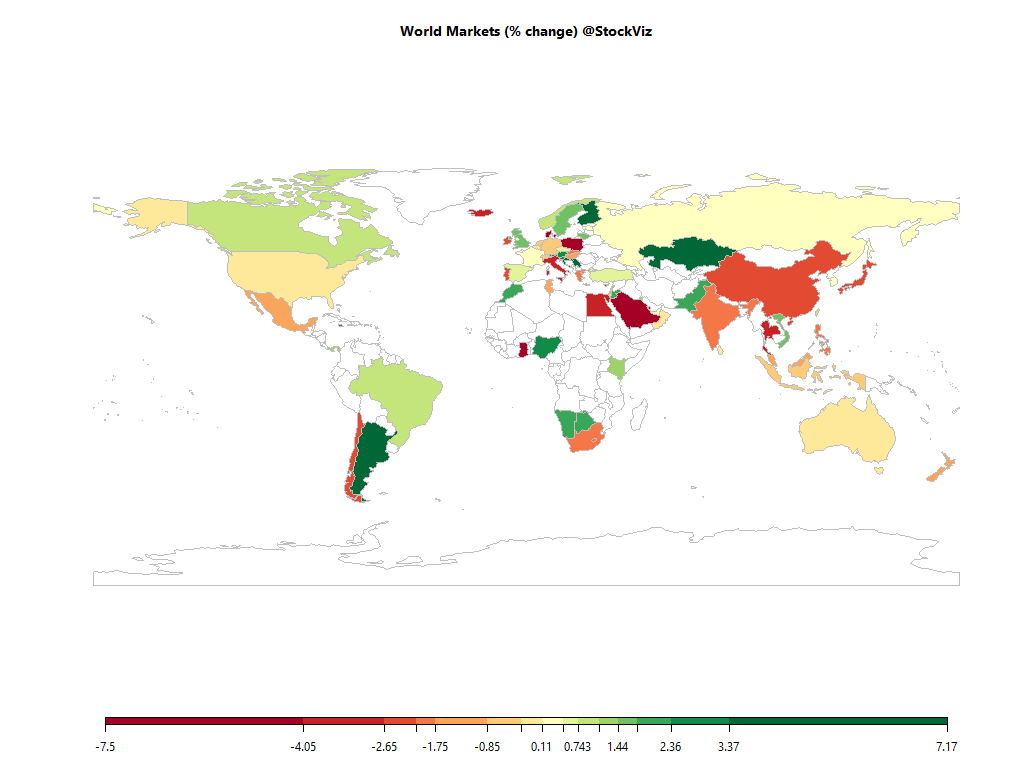

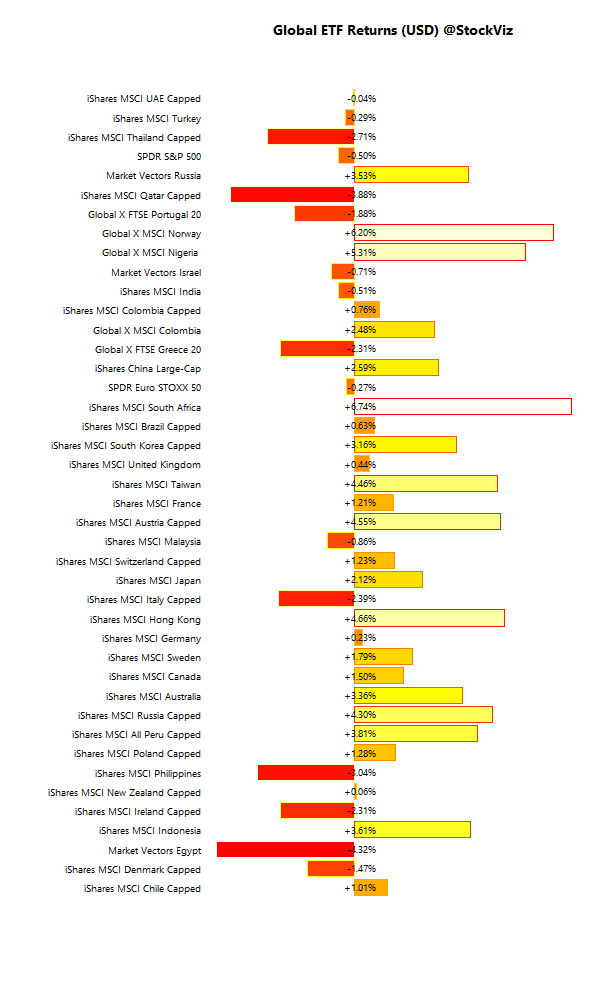

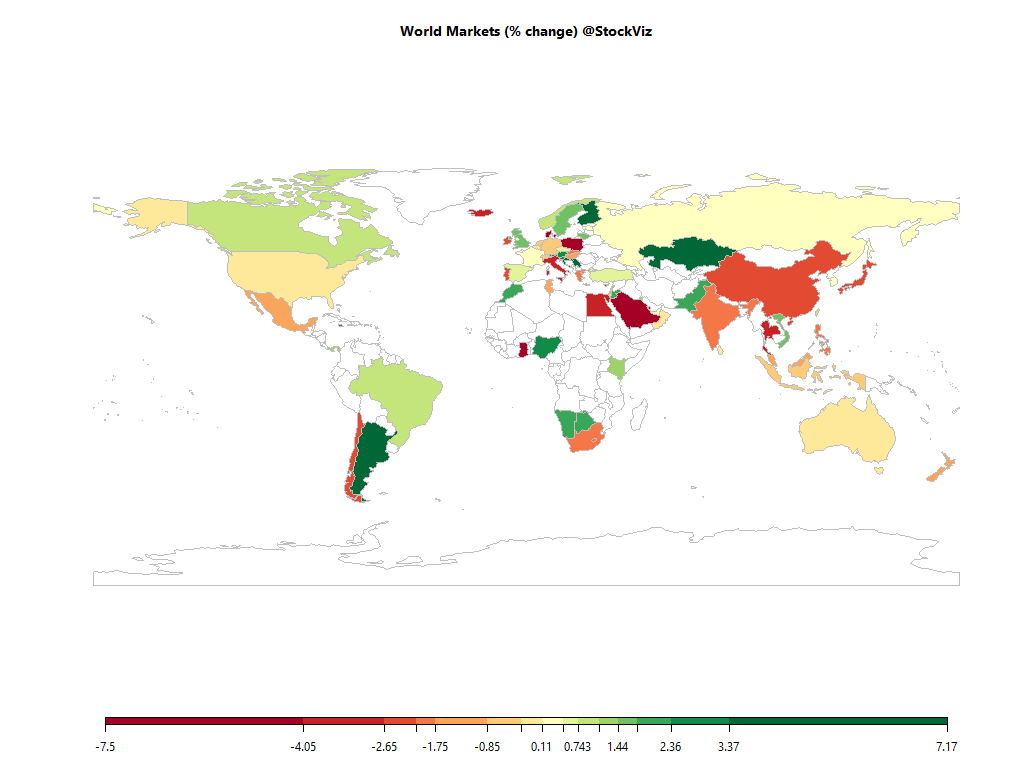

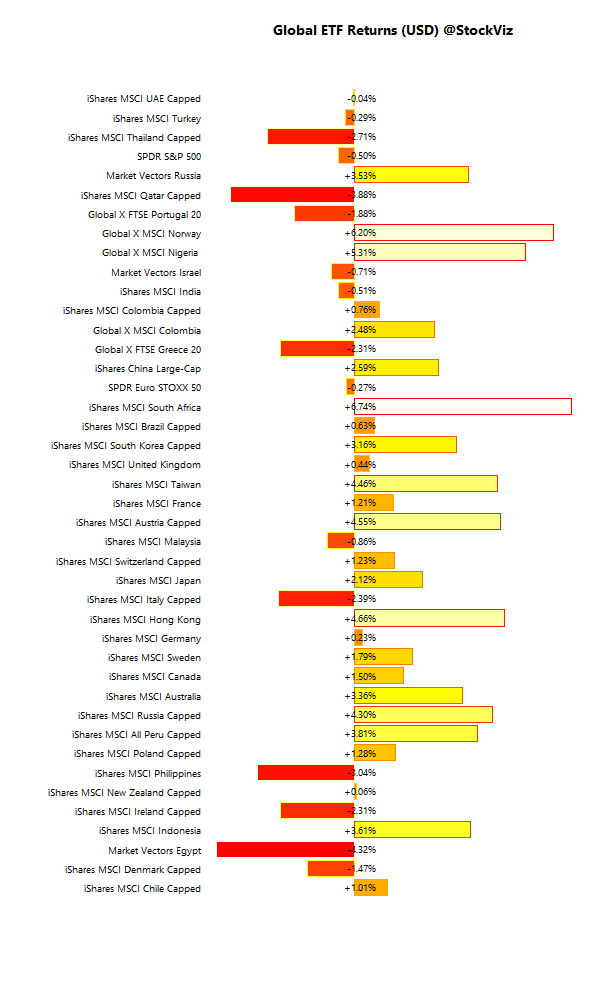

International ETFs (USD)

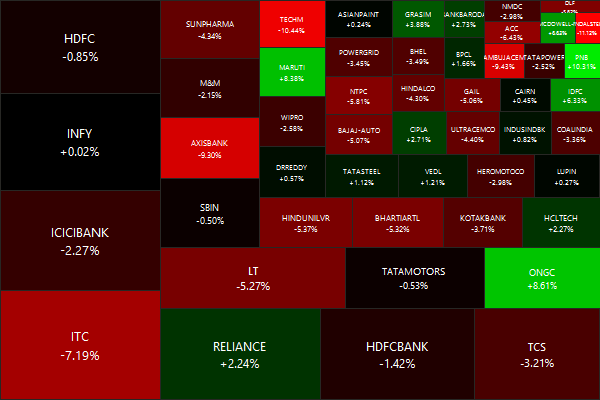

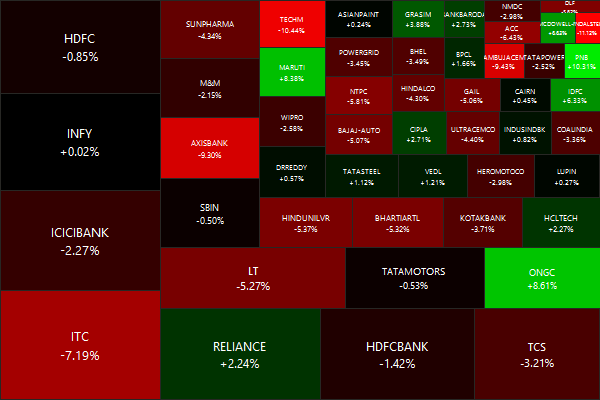

Nifty Heatmap

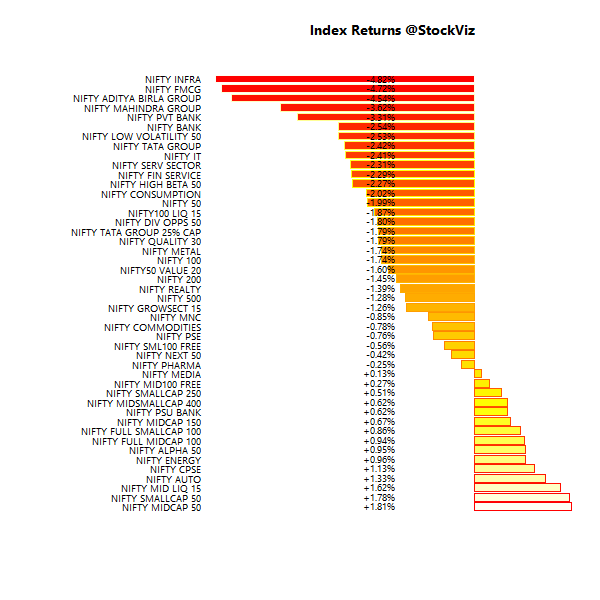

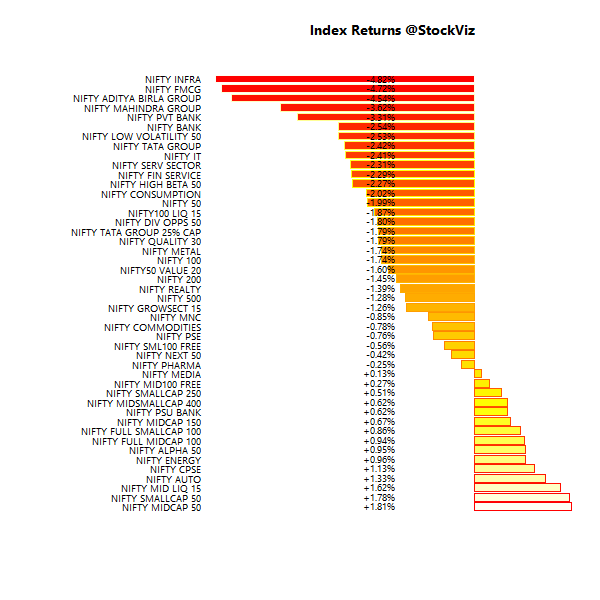

Index Returns

More: Sector Dashboard

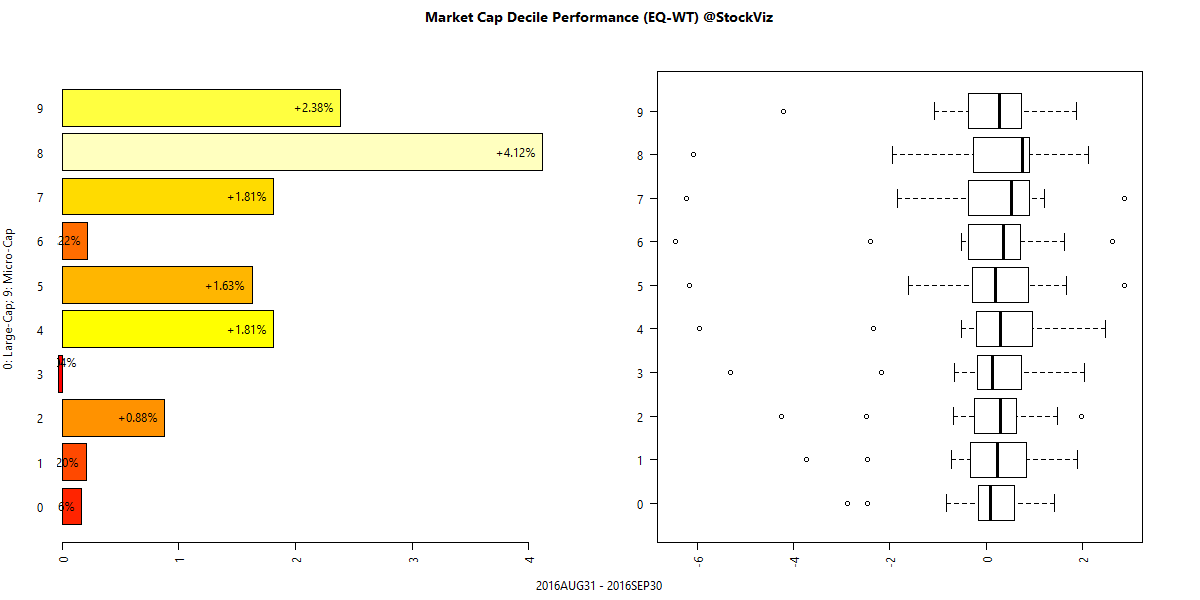

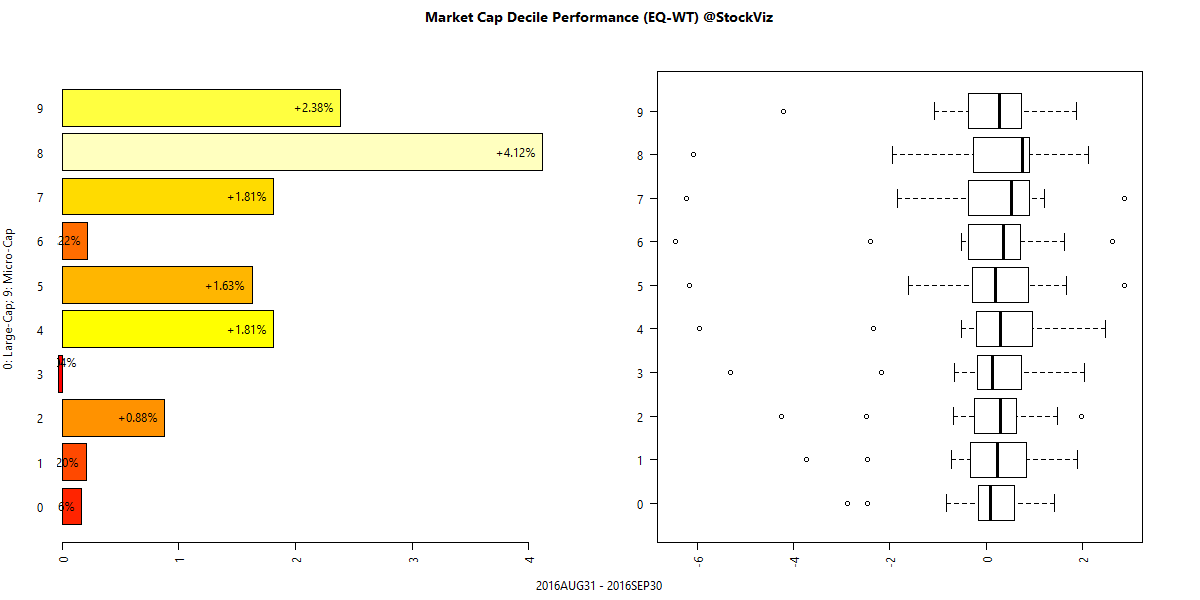

Market Cap Decile Performance

More: Equal-Weight Deciles, Cap-Weight Deciles

ETF Performance

PSU Banks… because all is well!

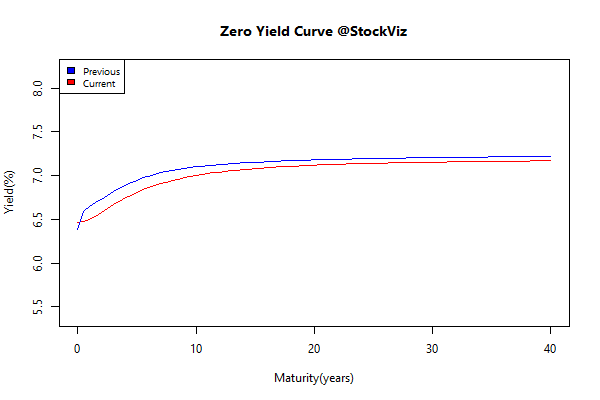

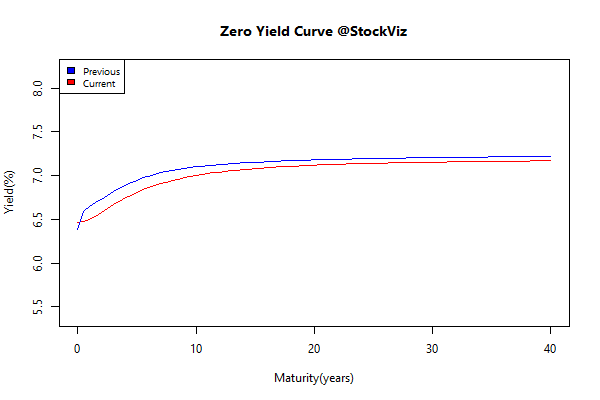

Yield Curve

Bond Indices

| Sub Index |

Change in YTM |

Total Return(%) |

| 0 5 |

-0.17 |

+1.01% |

| 5 10 |

-0.14 |

+1.30% |

| 10 15 |

-0.11 |

+1.35% |

| 15 20 |

-0.09 |

+1.44% |

| 20 30 |

-0.06 |

+1.22% |

Bonds FTW!!!

Investment Theme Performance

Our full automated Momentum strategies (Momos) seem to be out performing their artisanal peers!

Equity Mutual Funds

Bond Mutual Funds

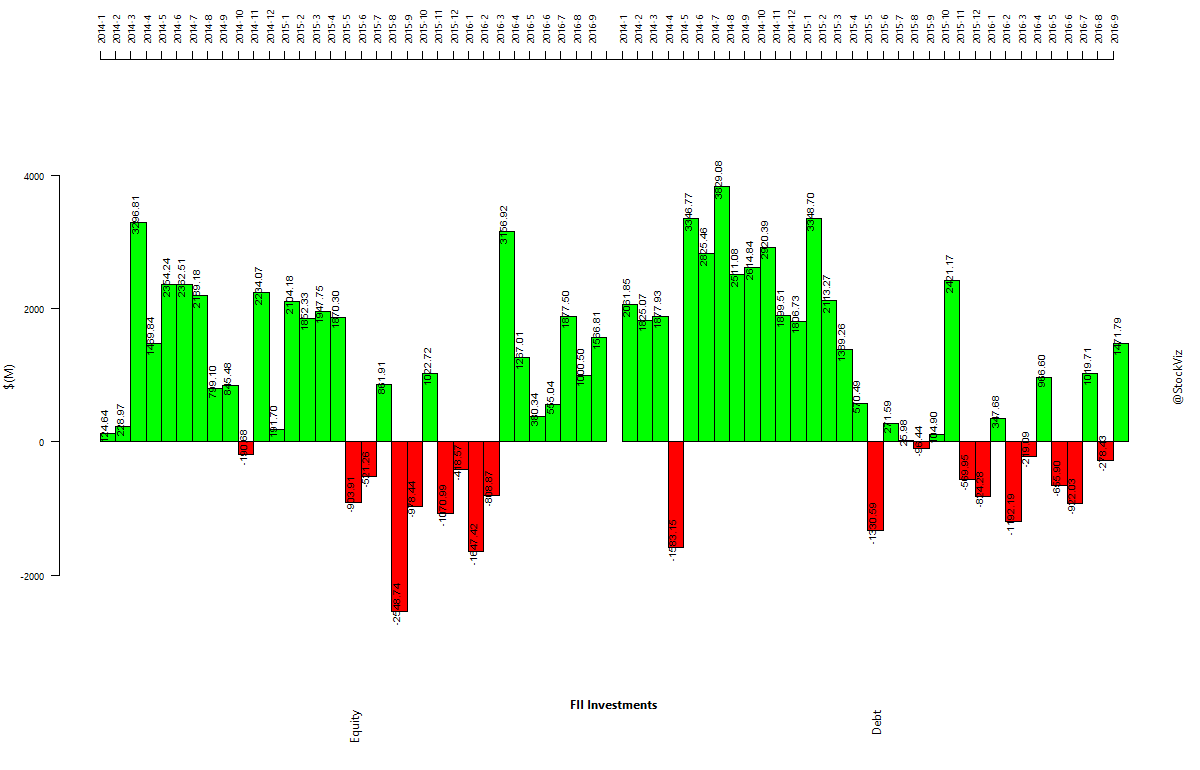

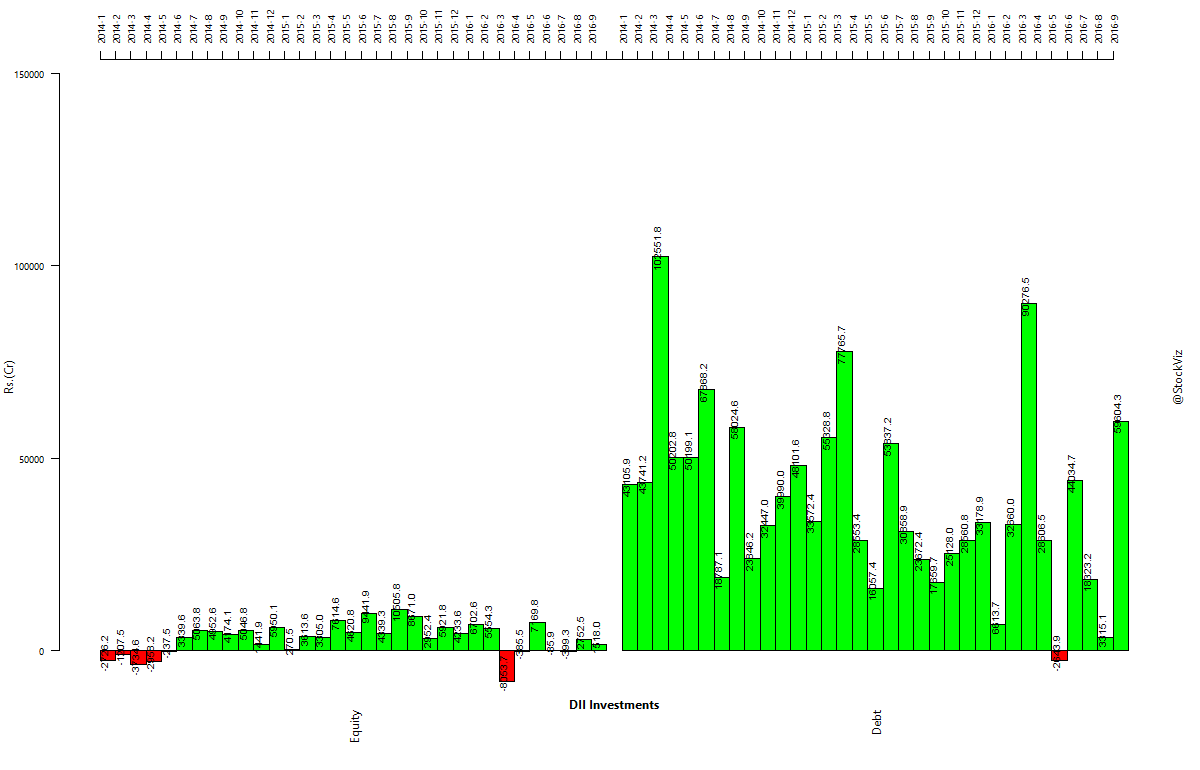

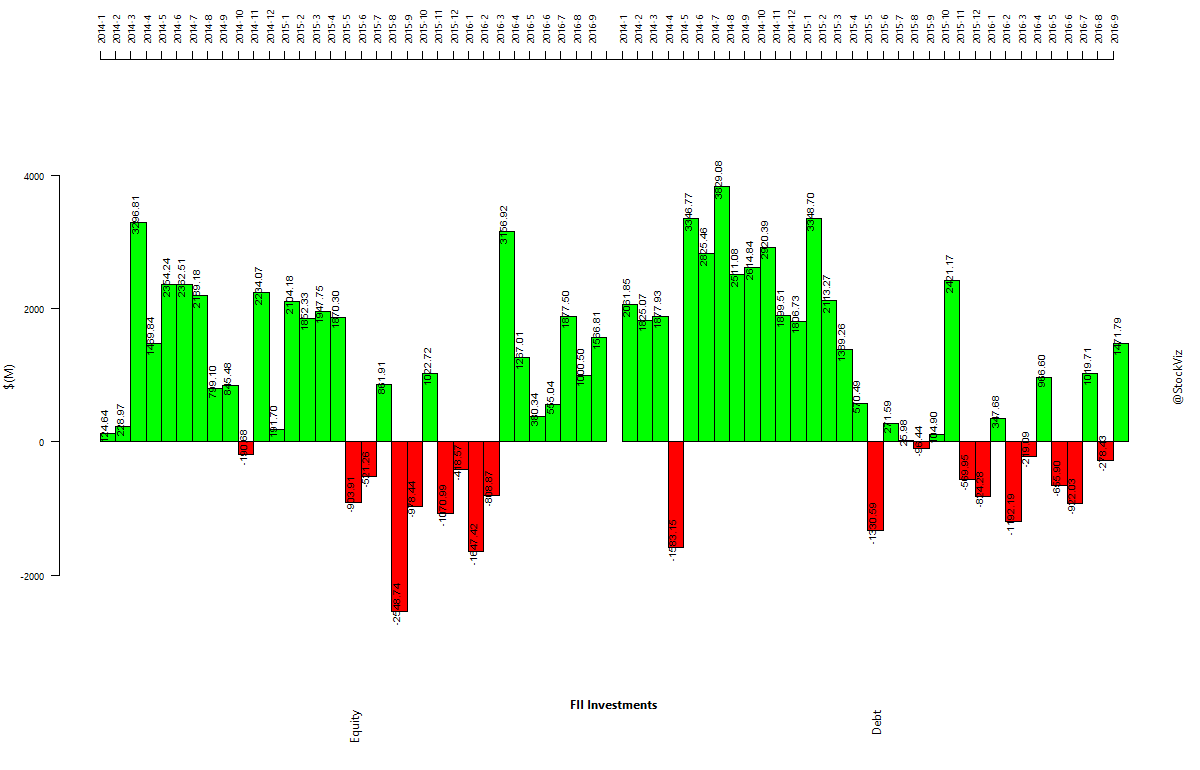

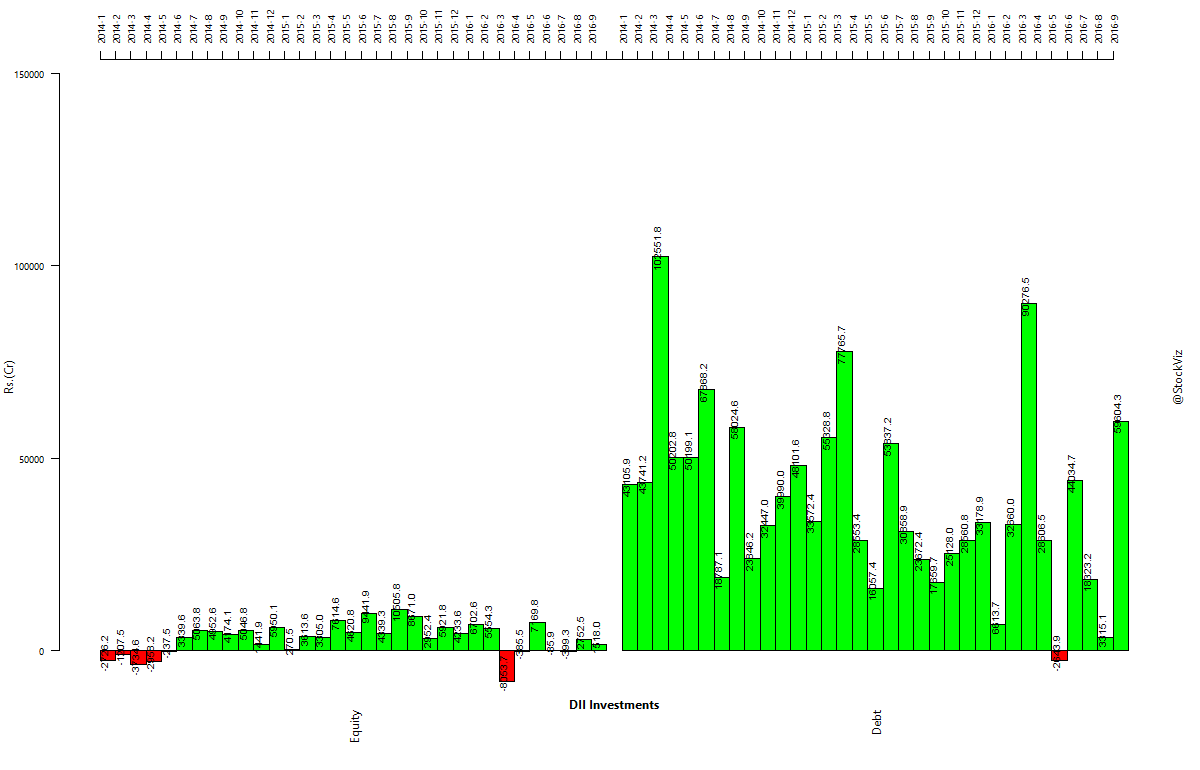

Institutional fund flows

FII’s continue to binge on Indian equities. When will the tide turn?

Book I read this month

The Most Important Thing – Uncommon Sense for the Thoughtful Investor by Howard Marks (Amazon)

Flamboyant and charismatic investors often get more press than the introverted ones. Howard Marks is one of those under-appreciated value investors who’s work we would do well to assimilate. I have been a fan of his “memos” for the longest time. The book adds historical context to his memos and provides a peek into his thought process. If you see some of Marks’ videos, he comes across as a droning, bitter, professor who keeps telling you that you are not smart enough to make it as a professional investor. If you can get past that vibe, there is a wealth of information you can tap into.

My notes on the book are on OneNote.