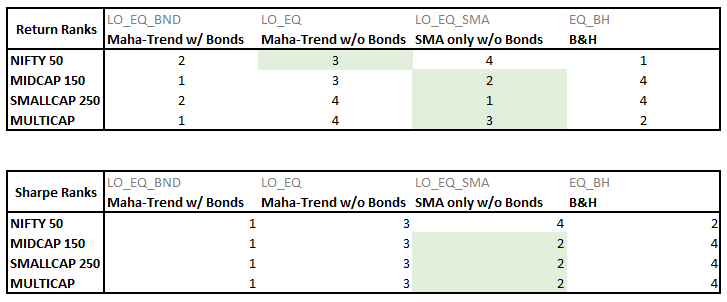

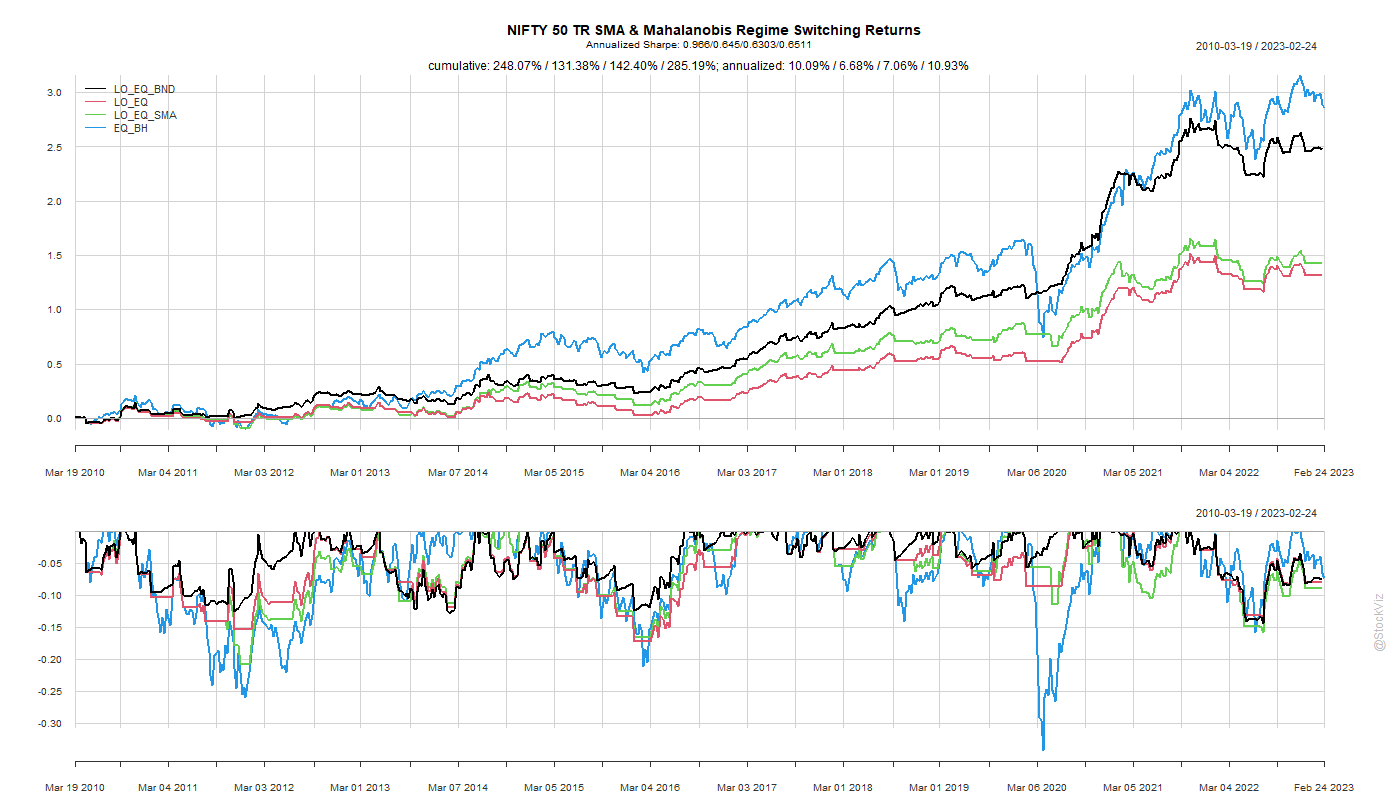

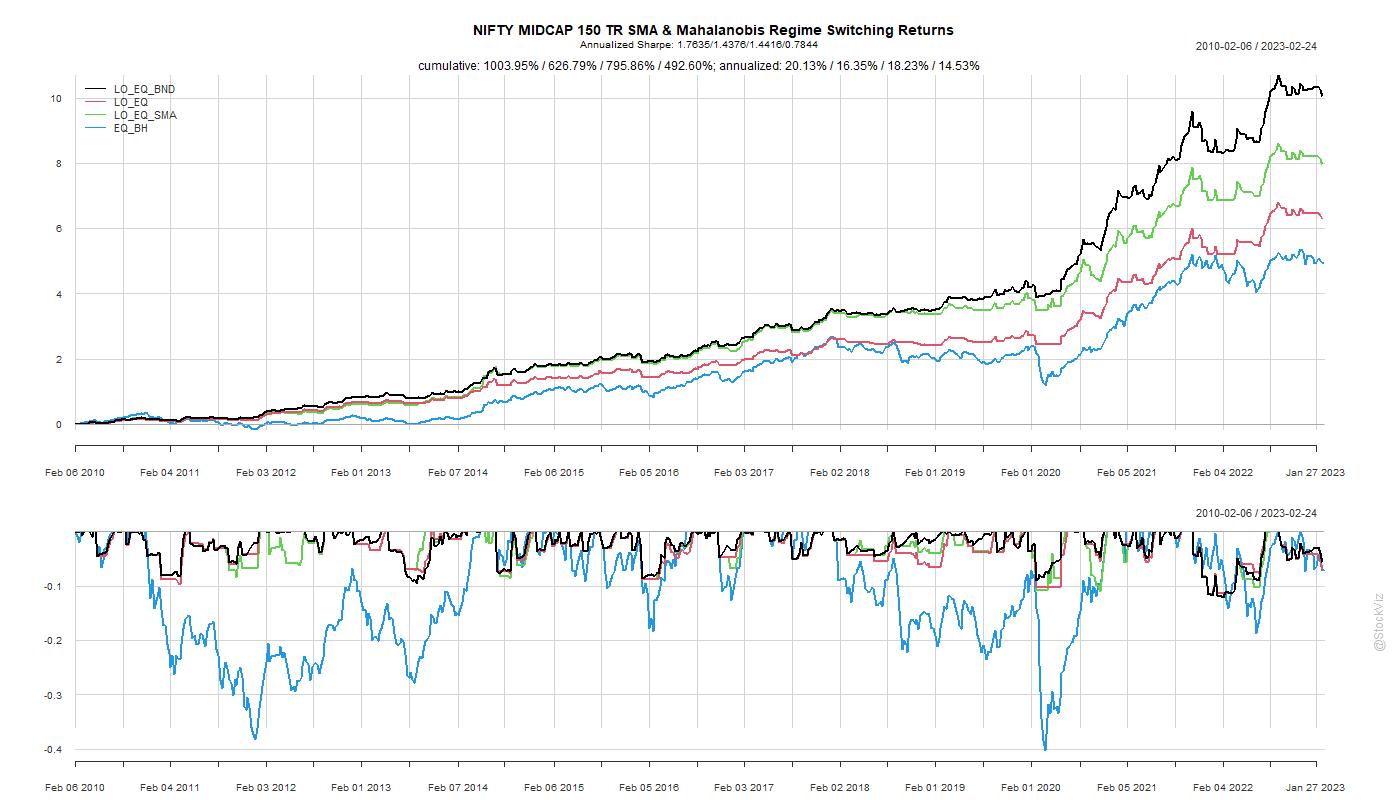

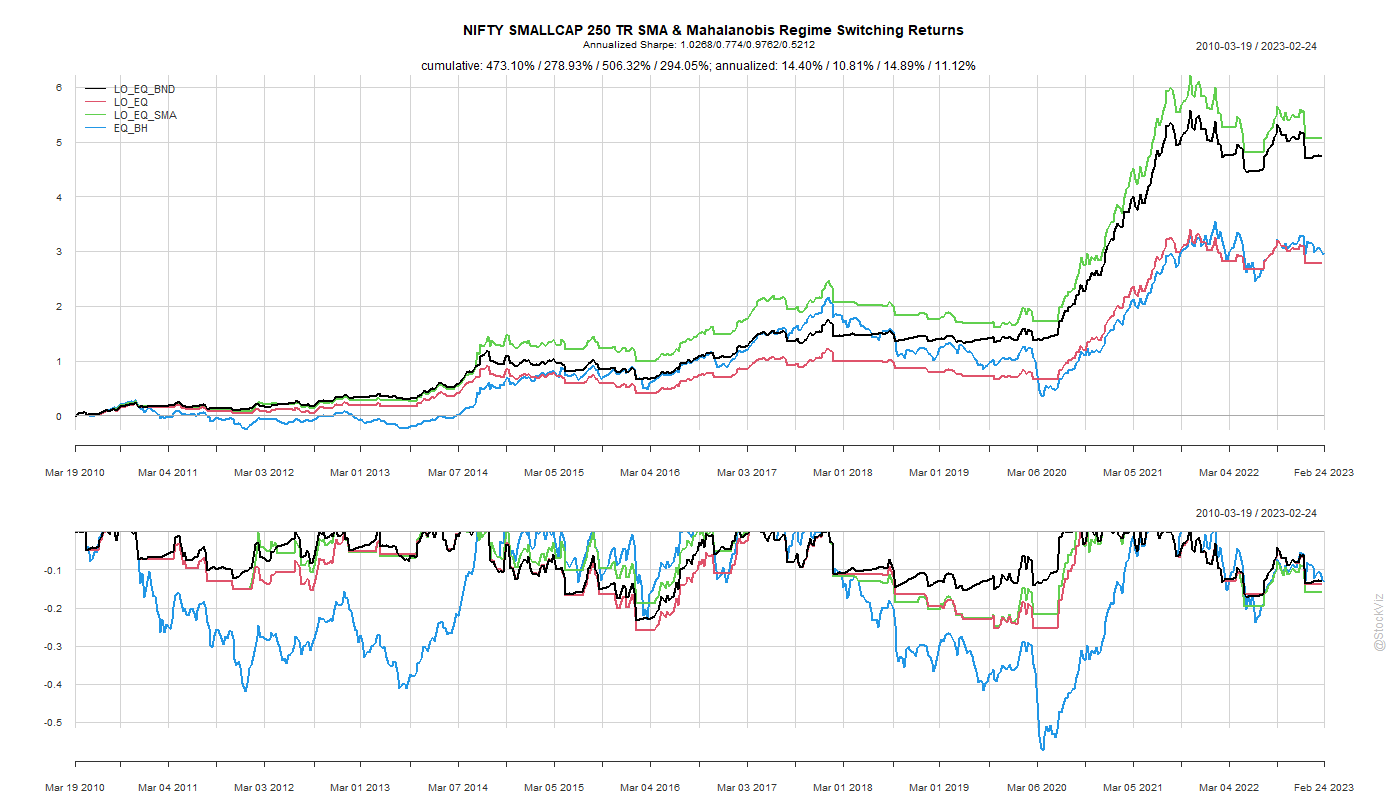

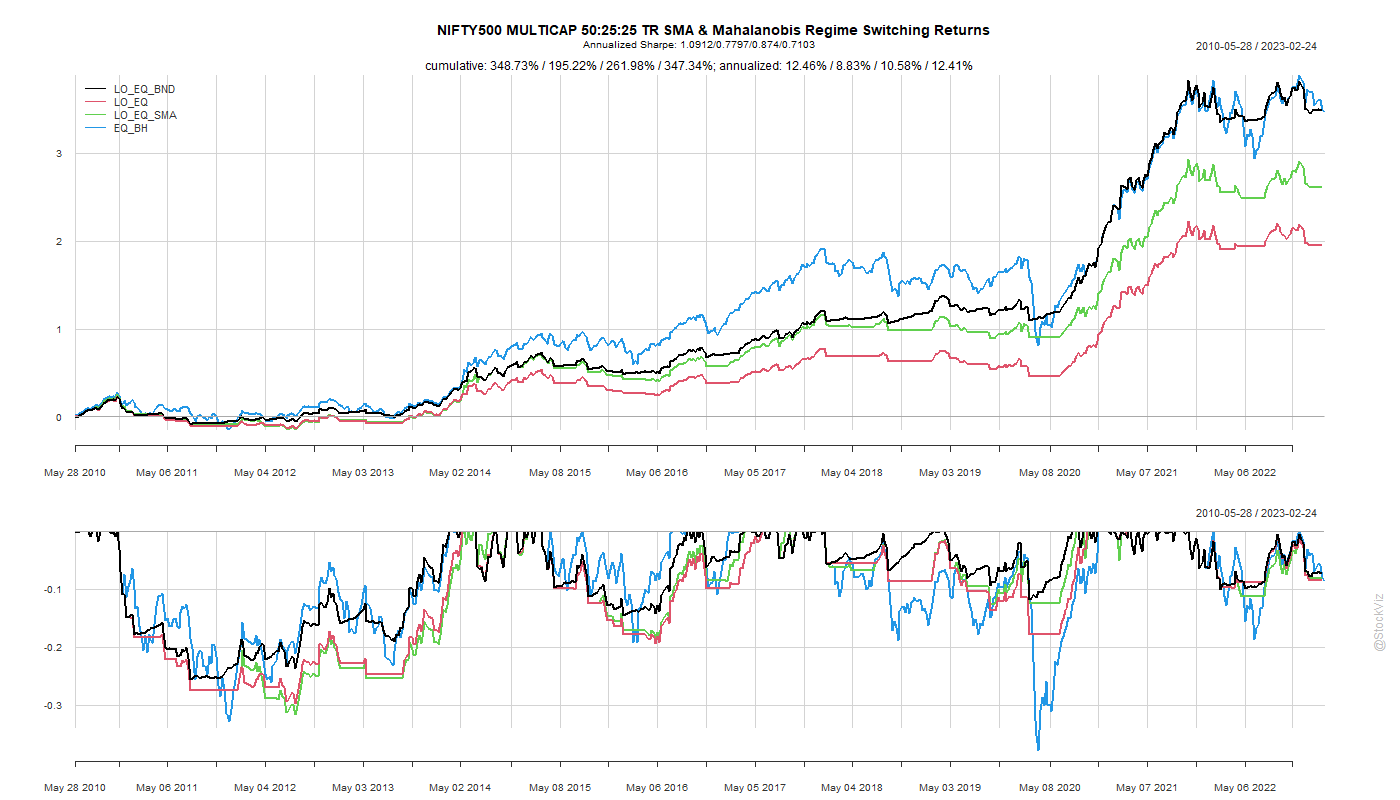

Previously, we constructed a portfolio that switches between equities and bonds based on the Mahalanobis distance between them. Here, keeping everything else the same, we add a trend filter to the same set of indices.

The composite regime-switching model ends up with superior Sharpe Ratios. However, if you don’t switch to bonds (and stay in cash, earning zero), then you maybe better off with a simple trend model.

The alpha seems to be in earning the risk-free rate when things are “bad” and getting long equities only when things are “favorable.”

Code and charts are on github.