Previously, we discussed how applying a trend filter to a midcap momentum index could make sense. Then, we extended that to our homegrown momentum models. In both cases, there are certain situations where trended momentum side-steps deep drawdowns. However, if you are only looking at “raw” returns, you would be better off with monthly rebalanced momentum versions.

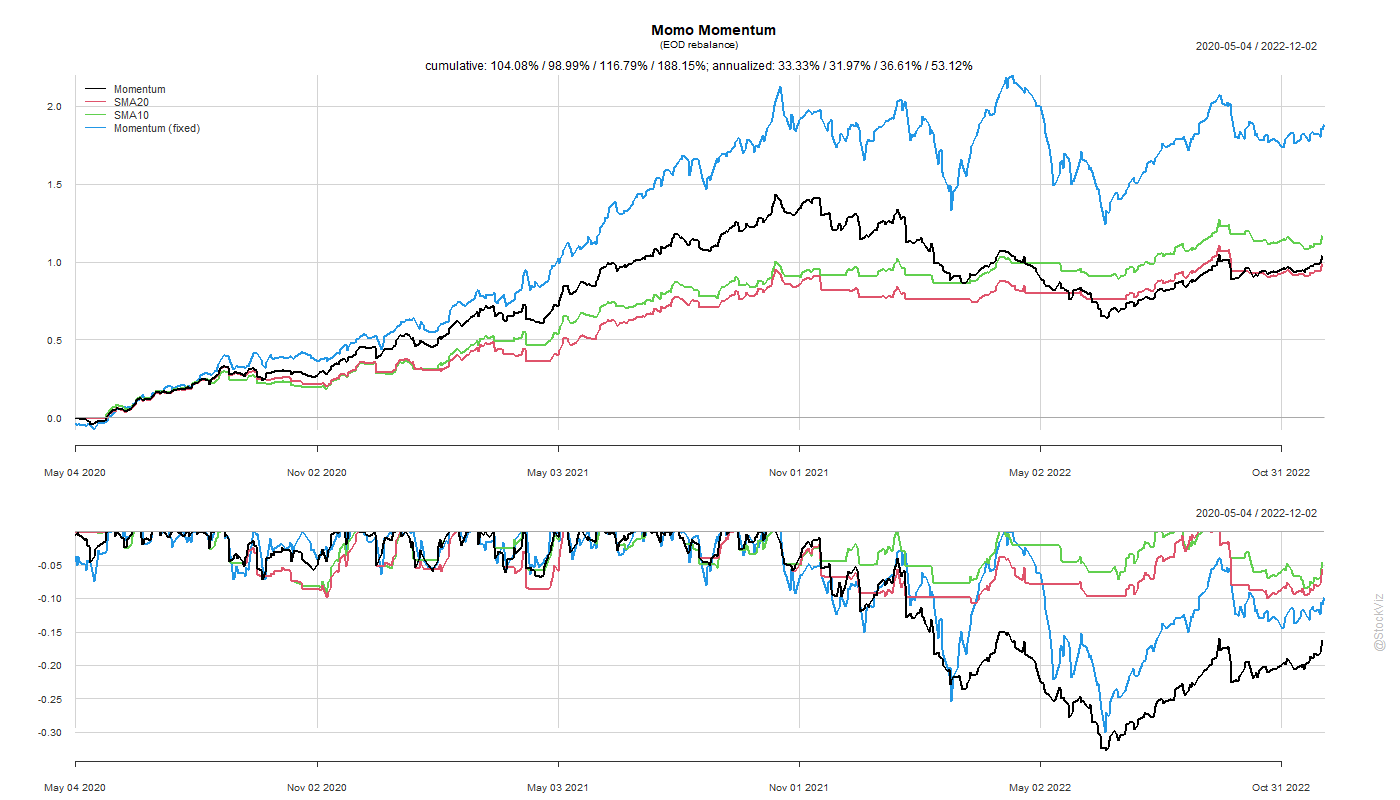

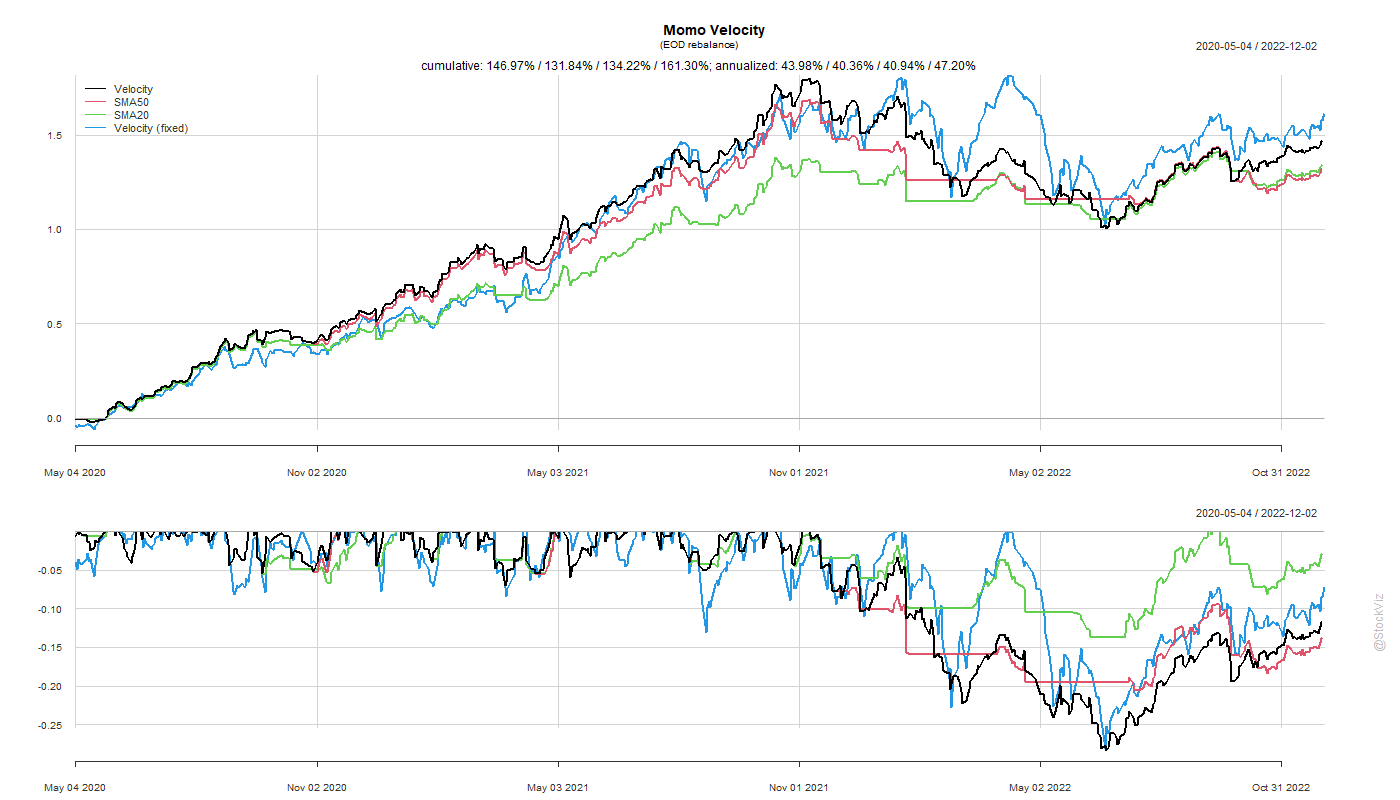

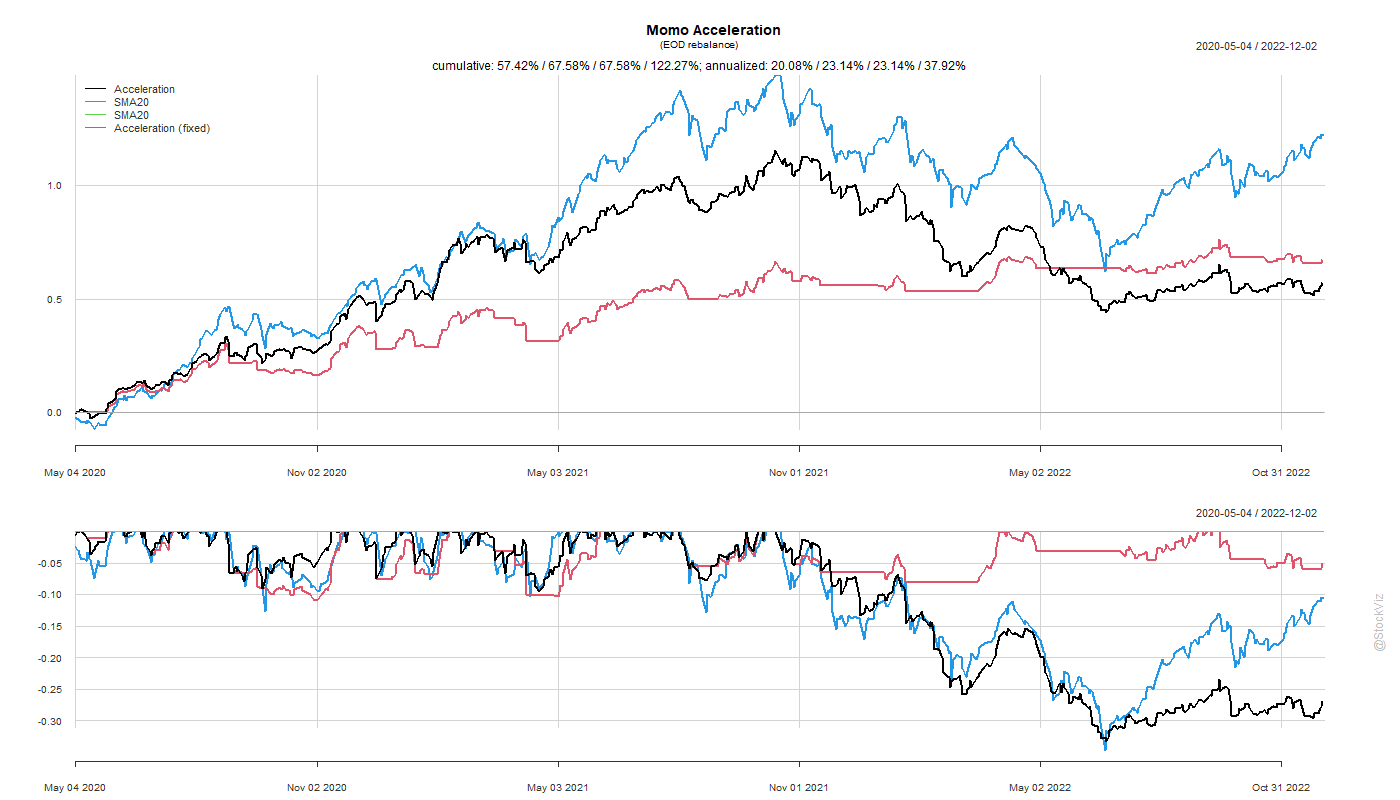

In this post, we run a similar test on the Momo versions of our homegrown momentum models.

The problem with high turnover strategies, beyond transaction costs, is the higher operational risk it entails. You could probably get away with postponing trades by a day or two in the monthly rebalance strategies but with these, you need automated trading systems.

You can track these strategies here: Tactical Momo (Momentum), Tactical Momo (Velocity) and Tactical Momo (Acceleration).

Code and charts: github