Equities

Commodities

| Energy |

| Brent Crude Oil |

-1.74% |

| Ethanol |

-2.63% |

| WTI Crude Oil |

-2.99% |

| RBOB Gasoline |

-9.46% |

| Heating Oil |

-4.41% |

| Natural Gas |

+2.79% |

| Metals |

| Platinum |

-0.92% |

| Copper |

-2.26% |

| Silver 5000oz |

-5.52% |

| Palladium |

+3.04% |

| Gold 100oz |

+1.11% |

| Agricultural |

| Coffee (Robusta) |

-10.25% |

| Feeder Cattle |

+11.81% |

| Lumber |

-0.68% |

| Sugar #11 |

-4.27% |

| Coffee (Arabica) |

-5.52% |

| Soybean Meal |

+1.17% |

| White Sugar |

-4.05% |

| Cattle |

+3.42% |

| Cotton |

+3.72% |

| Lean Hogs |

+2.18% |

| Wheat |

+0.18% |

| Cocoa |

-16.04% |

| Corn |

-0.75% |

| Orange Juice |

+2.10% |

| Soybeans |

+0.58% |

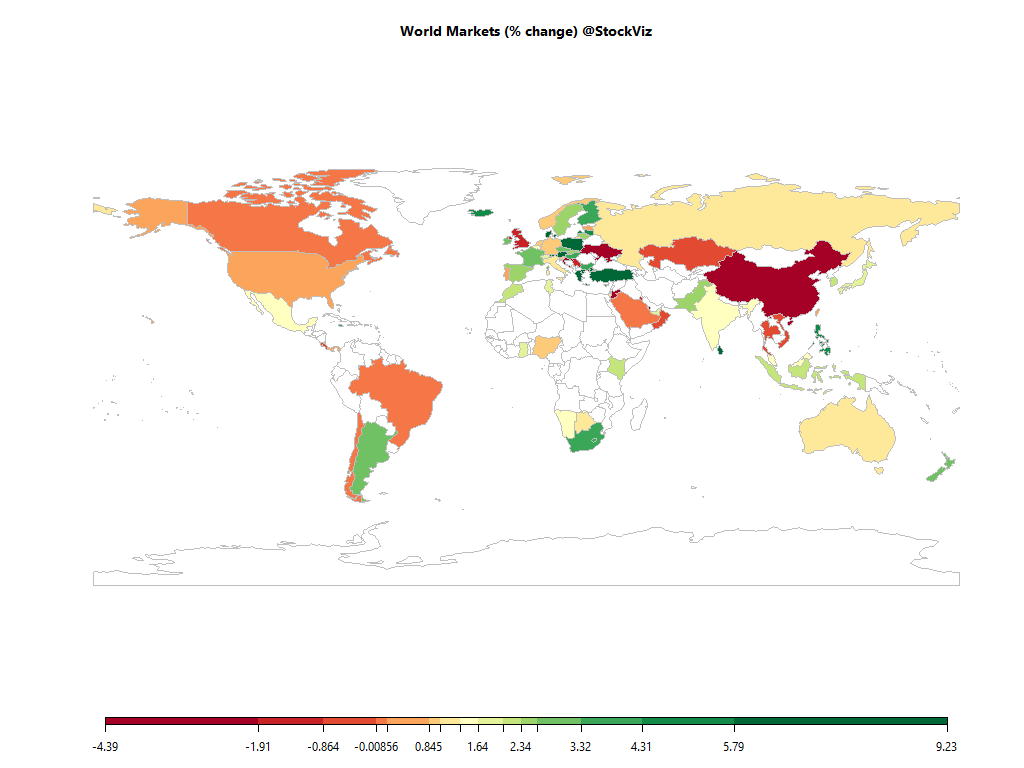

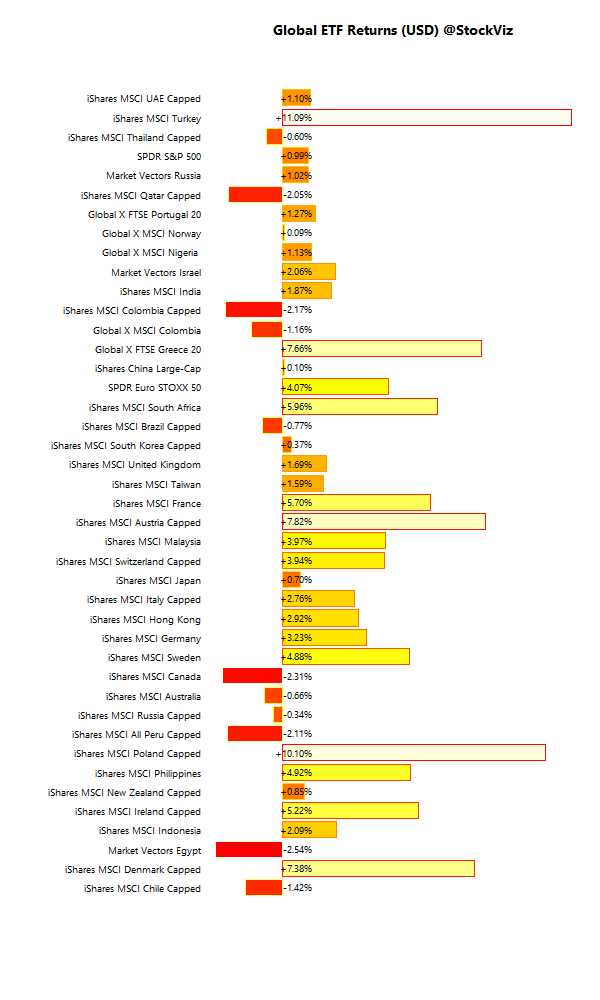

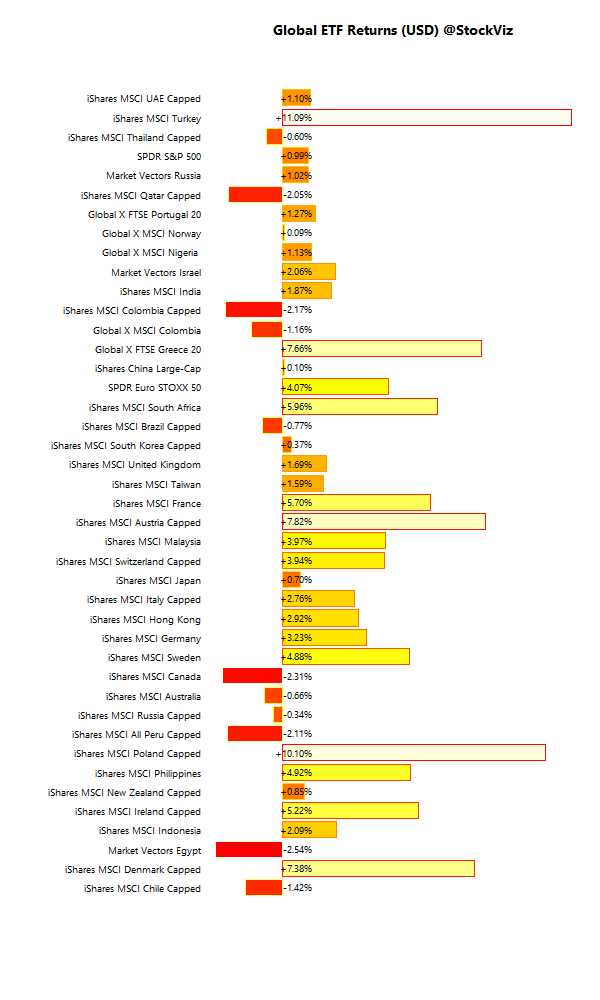

International ETFs (USD)

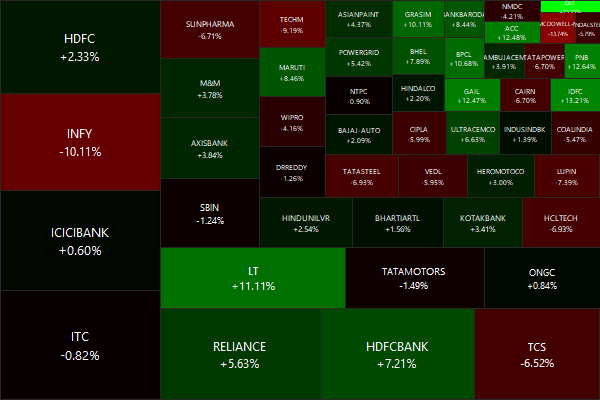

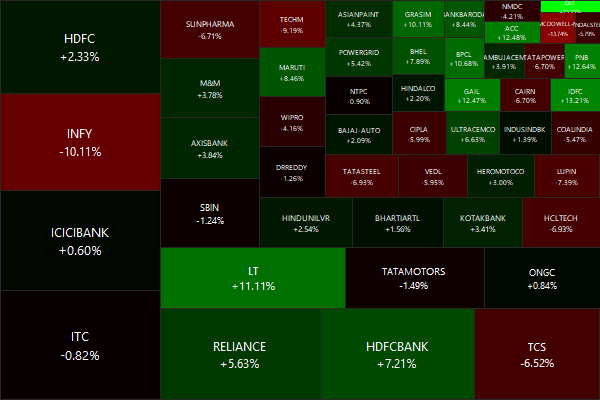

Nifty Heatmap

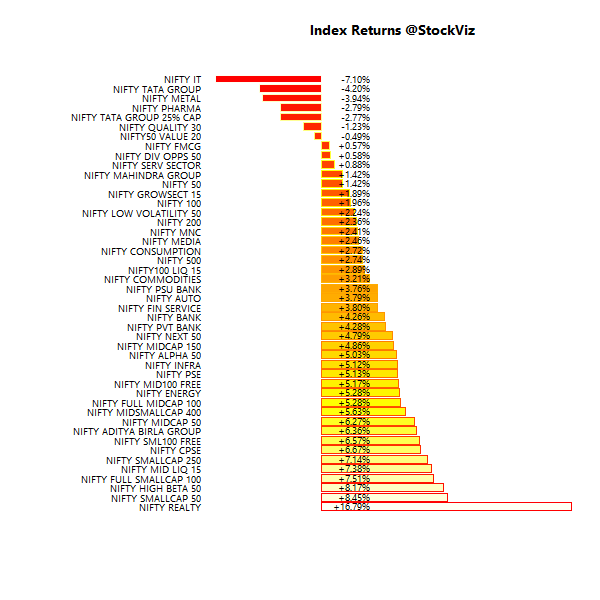

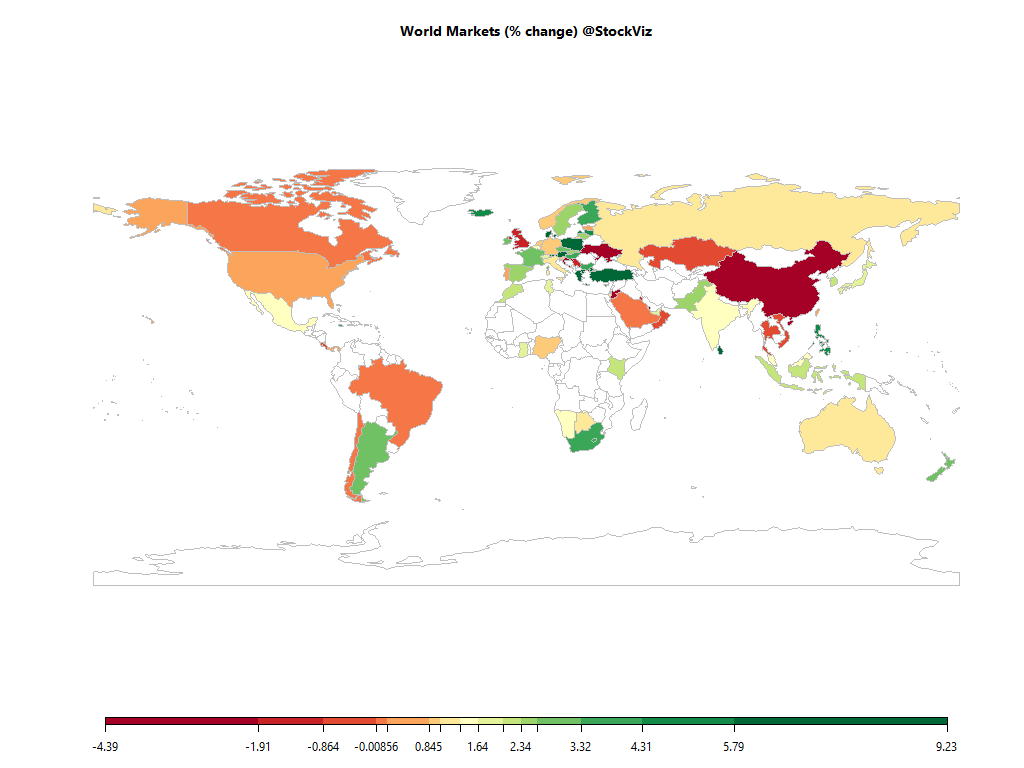

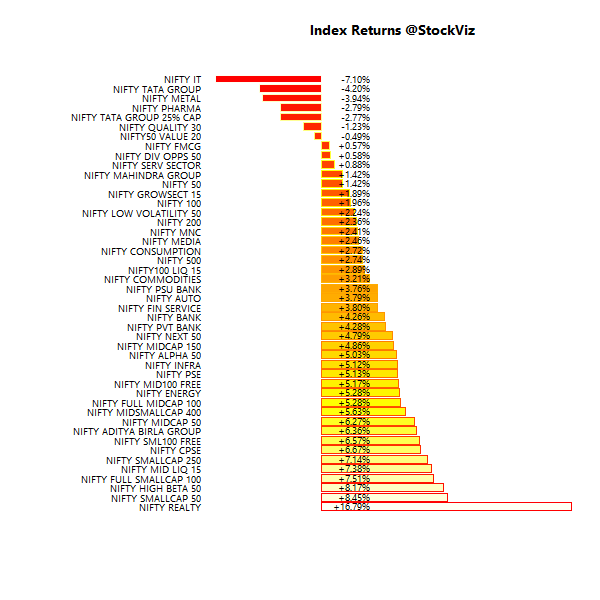

Index Returns

More: Sector Dashboard

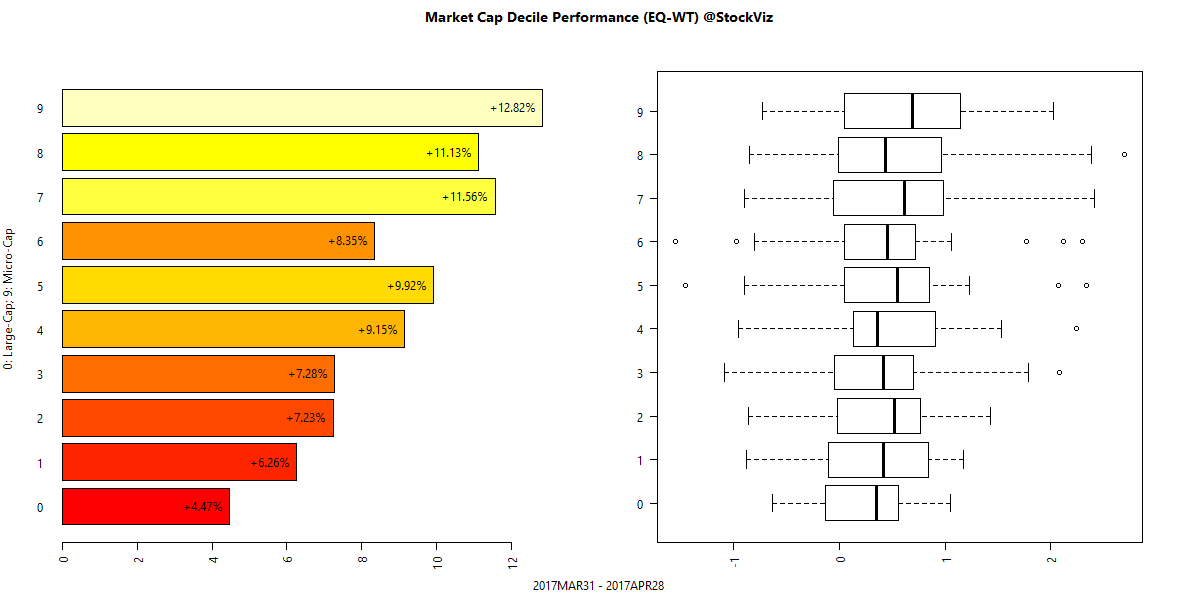

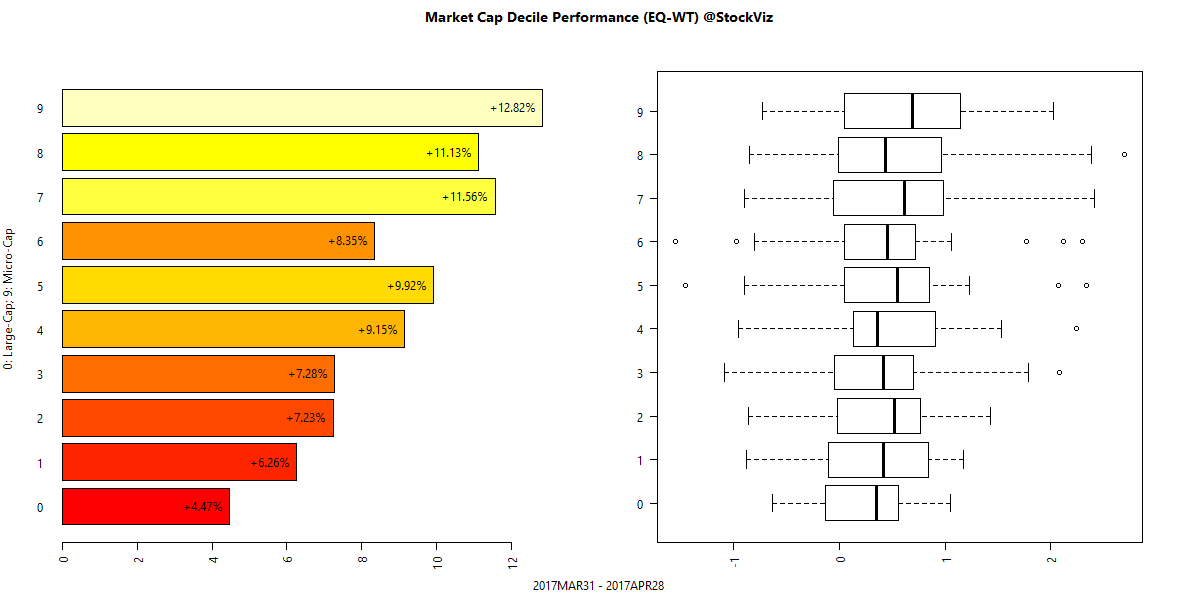

Market Cap Decile Performance

More: Equal-Weight Deciles, Cap-Weight Deciles

ETF Performance

PSEs… because this time its different.

Yield Curve

Bond Indices

| Sub Index |

Change in YTM |

Total Return(%) |

| 0 5 |

+0.23 |

-0.11% |

| 5 10 |

+0.16 |

-0.31% |

| 10 15 |

+0.11 |

-0.40% |

| 15 20 |

+0.06 |

+0.07% |

| 20 30 |

+0.10 |

-0.45% |

Bonds down in spite of increased FII flows…

Investment Theme Performance

Value themes out-performed momentum…

Equity Mutual Funds

Bond Mutual Funds

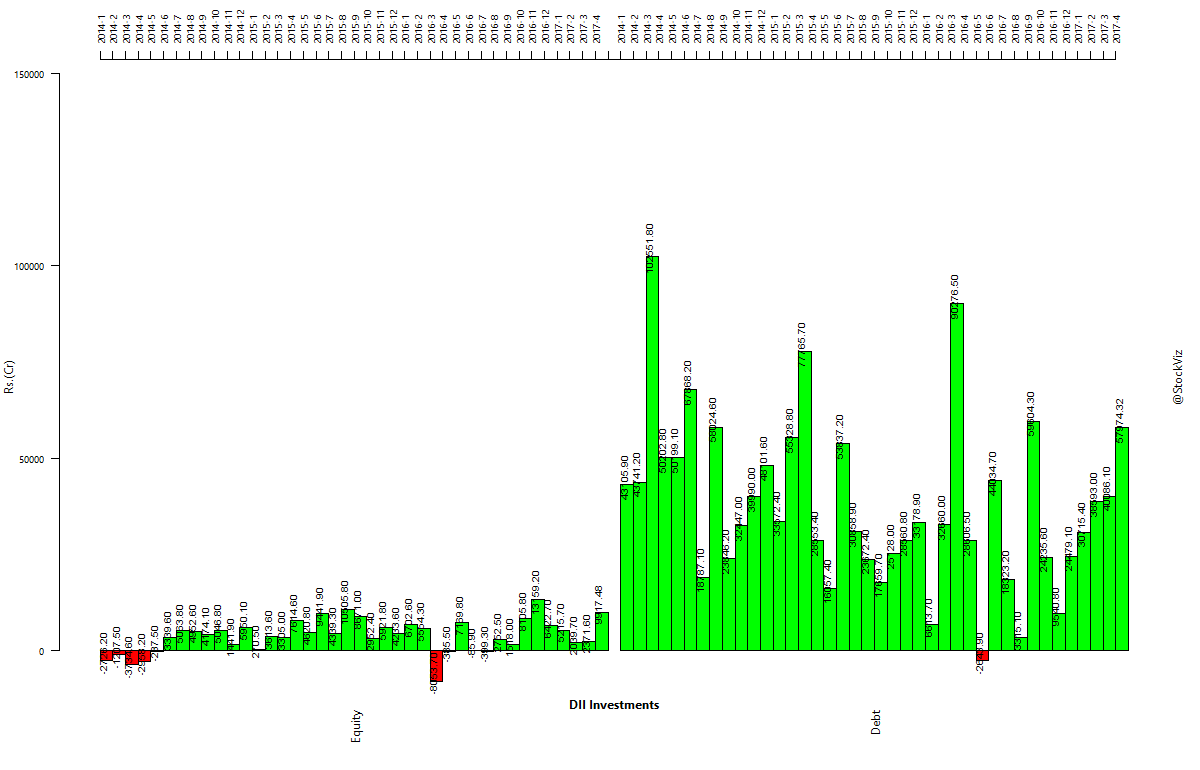

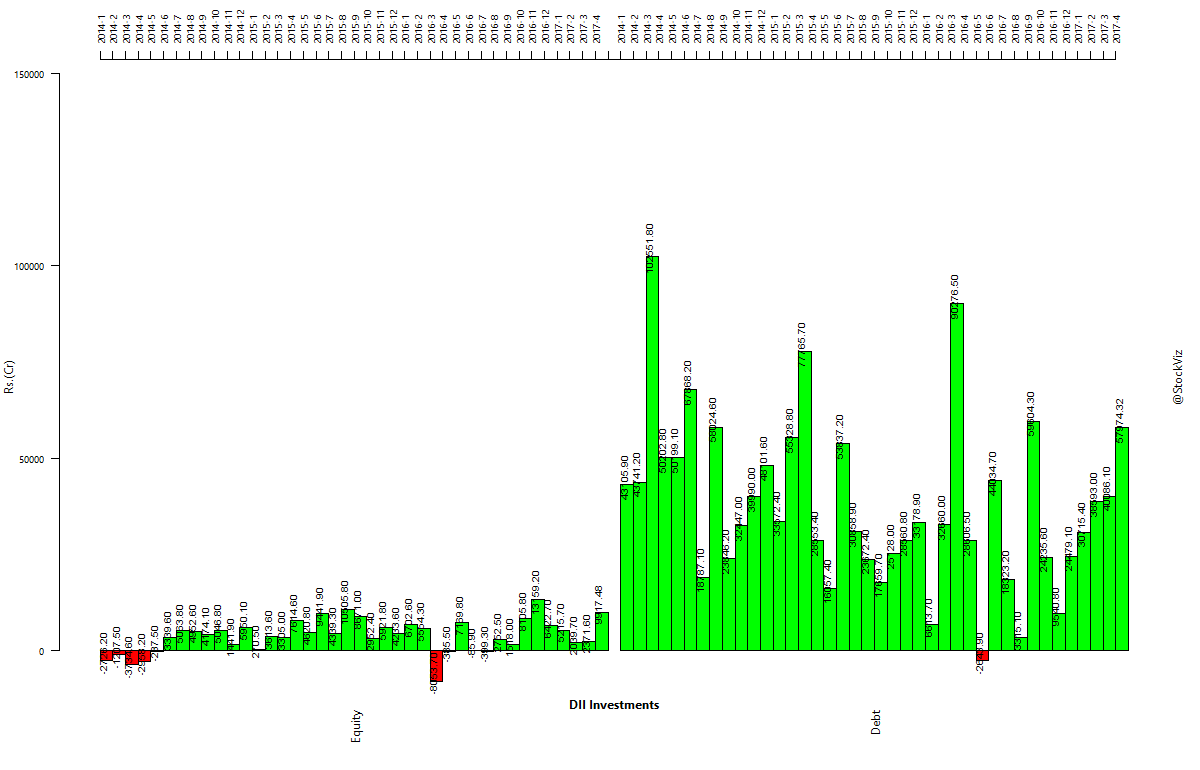

Institutional flows