This post is a continuation of our exploration of trying to use macro market indicators to time the NIFTY 50. See World Markets and the NIFTY 50 and India VIX vs. SPX VIX.

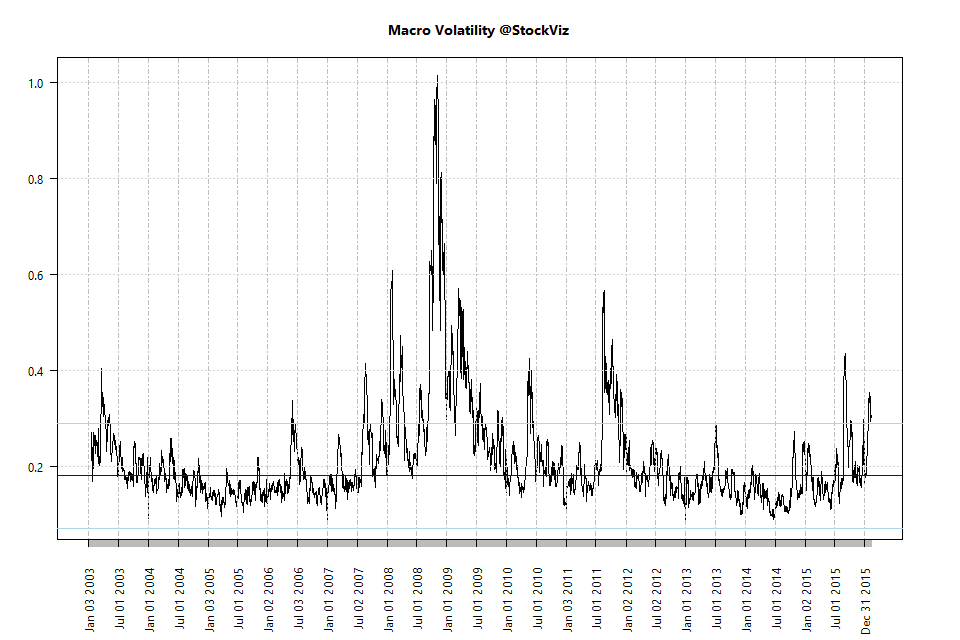

Perhaps the problem with using price moving averages was that the major moves were already done before we could short the NIFTY. What if we used volatility instead? Here is how the median of 10-day volatility of major world indices looks like:

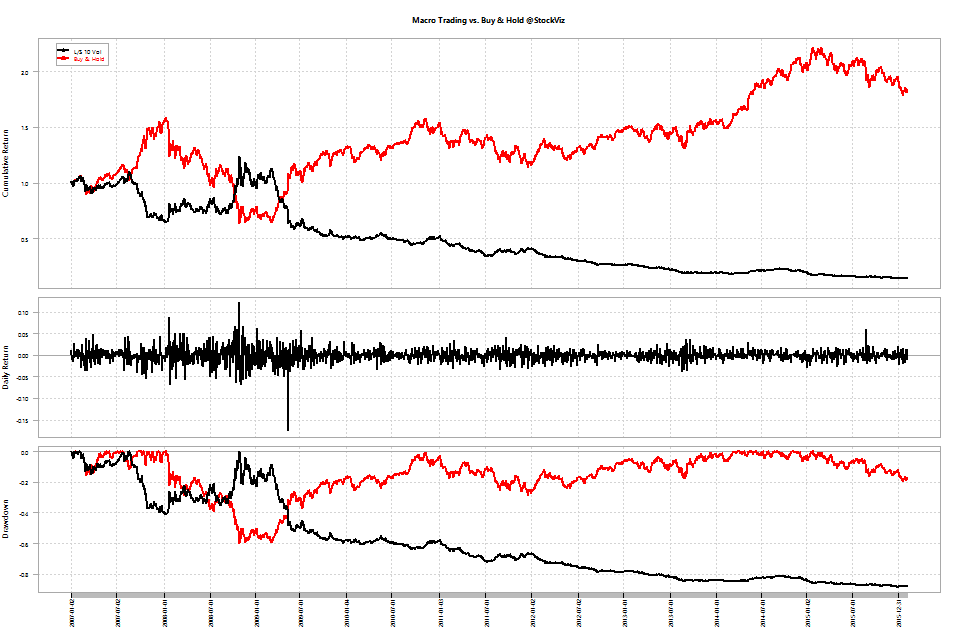

What if we went long only when volatility was below the median and went short otherwise?

Looks like the strategy works only in avoiding the 2008 crash. Using observed volatility to time trades doesn’t work. One more to the reject pile.