Introduction

There is a common belief that option implied volatility, which is high before earnings announcements, quickly dissipates after the event. So sell options before the event to profit from the fall in IV. We decided to put this theory to test by observing at-the-money IVs 5-days before earnings announcements and their subsequent behavior.

It is not what you expect.

ATM IVs

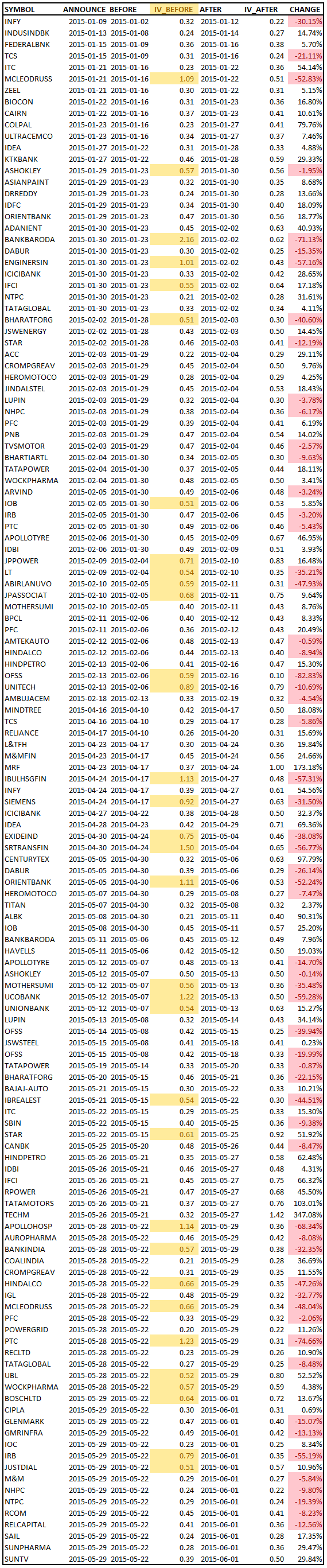

Here are the at-the-money implied vols 5-days before and the day after announcements:

In our study, IV falls only 44% of the time. So the blanket statement fails. IV dissipation is not guaranteed. There are a lot of other things that affect IV and earnings alone is not sufficient to predict the outcome.

However, if the IV was more the 50, then IV dissipates 70% of the time. However, these odds could be similar to those without earnings announcements as well (all things equal.) So further research is required.

Conclusion

Don’t go around selling options thinking that IV will dissipate after earnings announcements. Know your odds.