Introduction

A trailing stop is a percentage below the most recent high at which you exit a trade. It allows you to lock-in gains while avoiding catastrophic loss. There are lot of opinions about where these should be set. And more importantly, when to re-enter. What follows is a discussion on how different stops and re-entry rules affect trading frequency and returns.

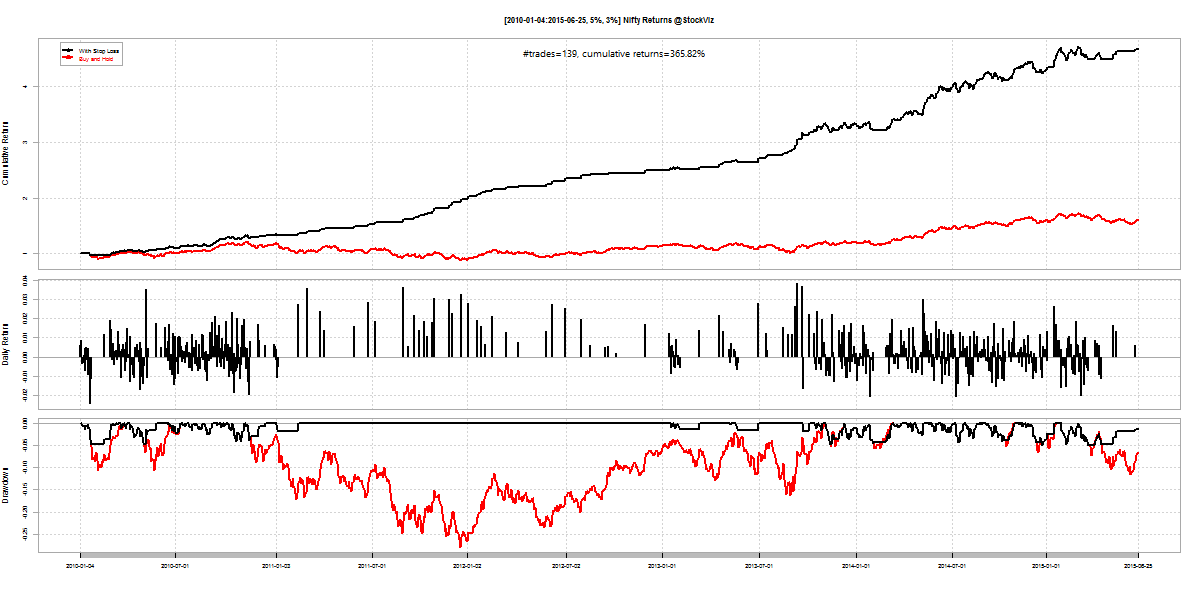

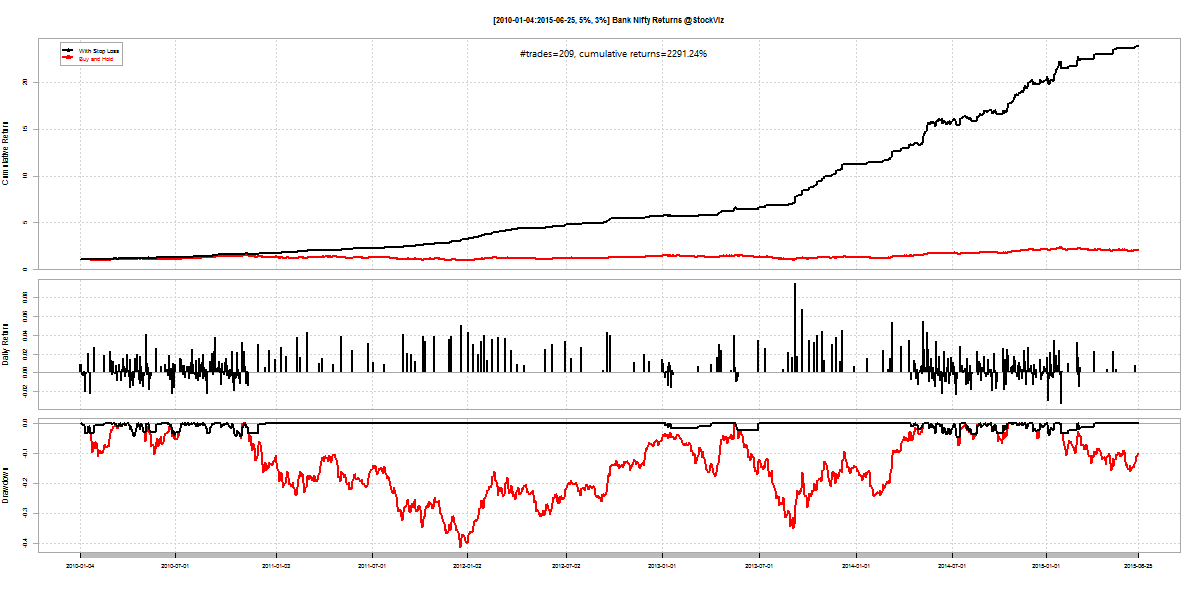

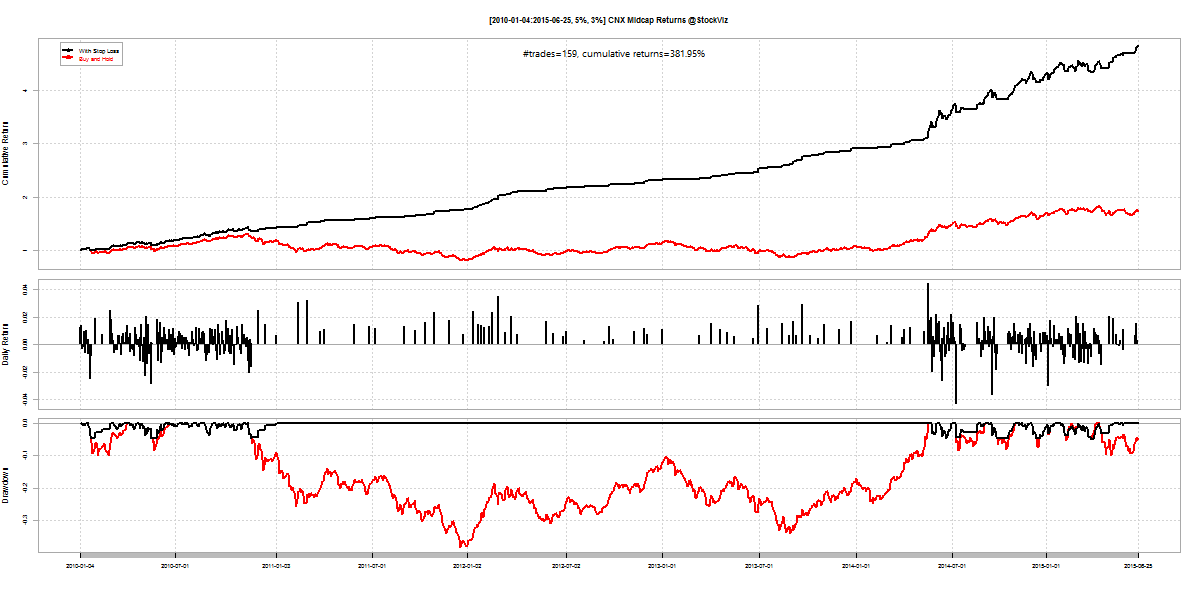

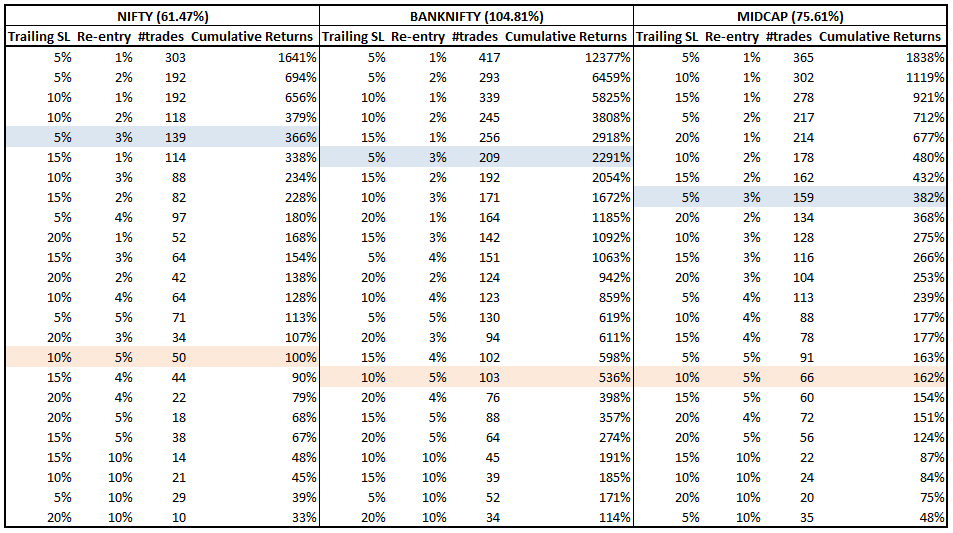

We will consider time-series from 2010 through now on the NIFTY, BANK NIFTY and CNX MIDCAP indices. During this time, the cumulative buy-and-hold returns were 61.47%, 104.81% and 75.61% respectively.

A simple 5-3 Rule

– George S. Patton

To get us started, we propose a trailing-stop loss at 5% and a re-entry rule that triggers when the index covers 3% from the lowest level since exiting the trade. This rule significantly increases returns and reduces draw-downs across all indices.

| Index | #trades | cum. returns |

|---|---|---|

| Nifty | 139 | 366% |

| Bank Nifty | 209 | 2291% |

| Midcap | 159 | 382% |

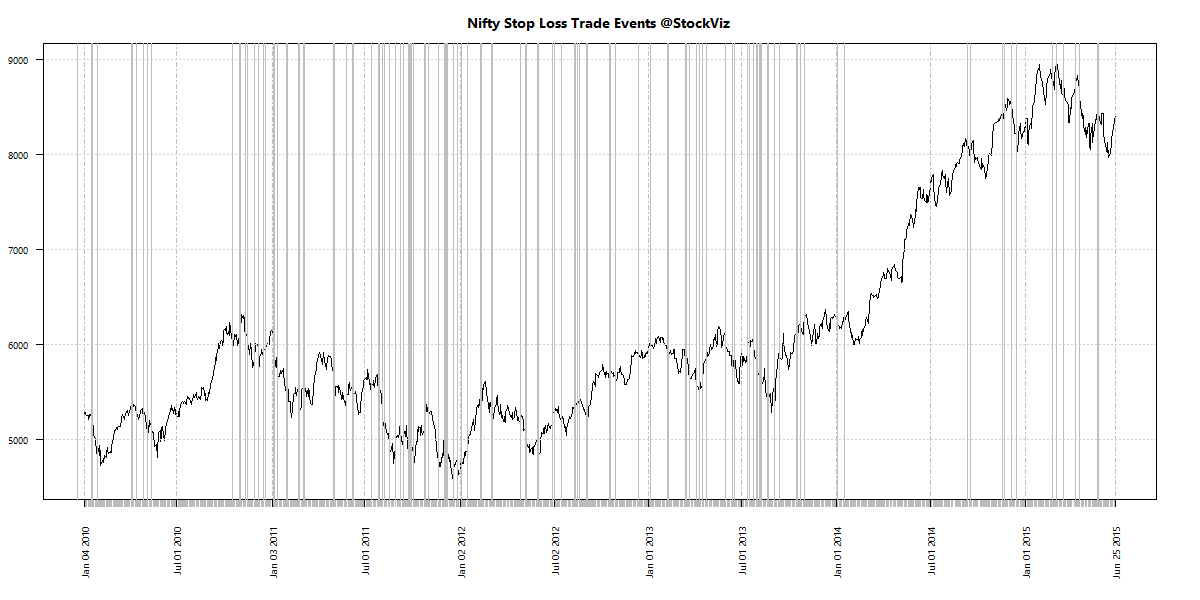

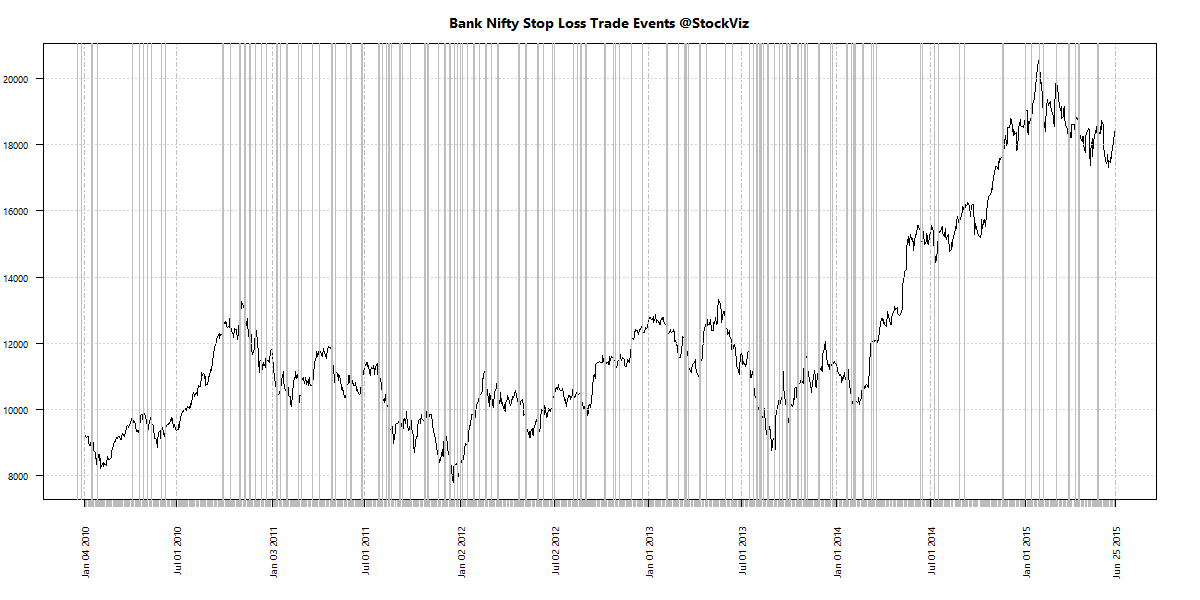

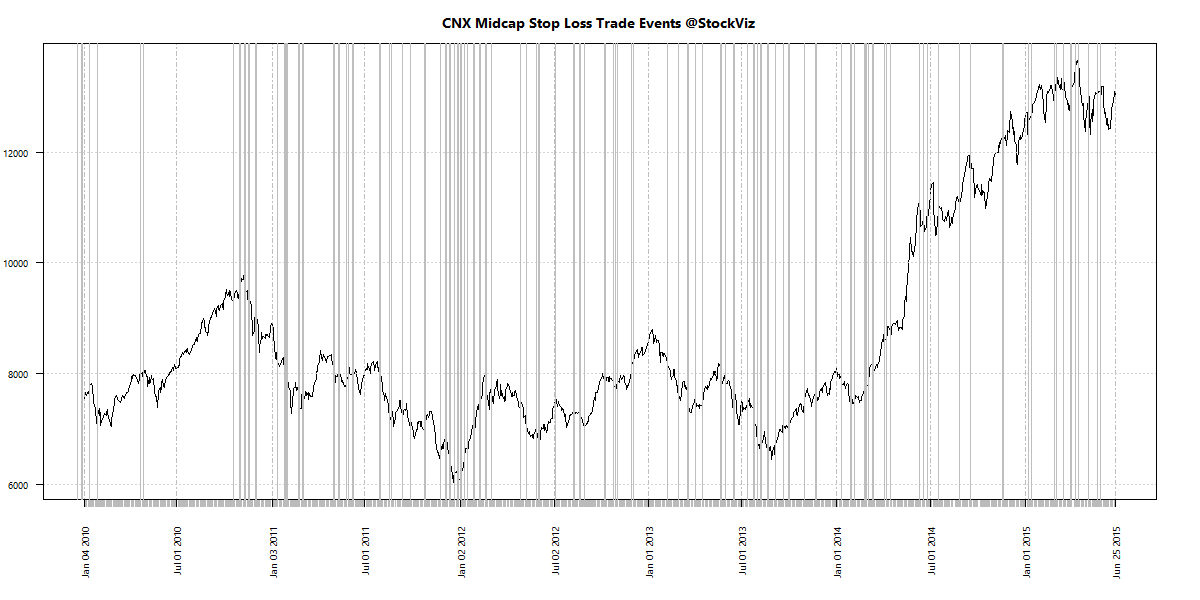

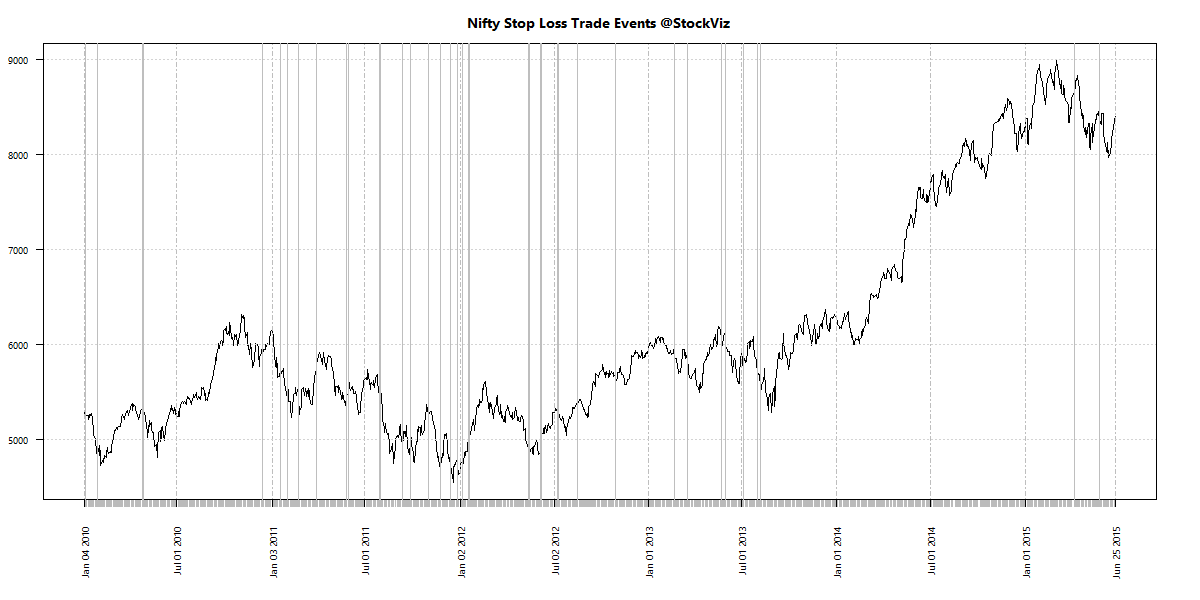

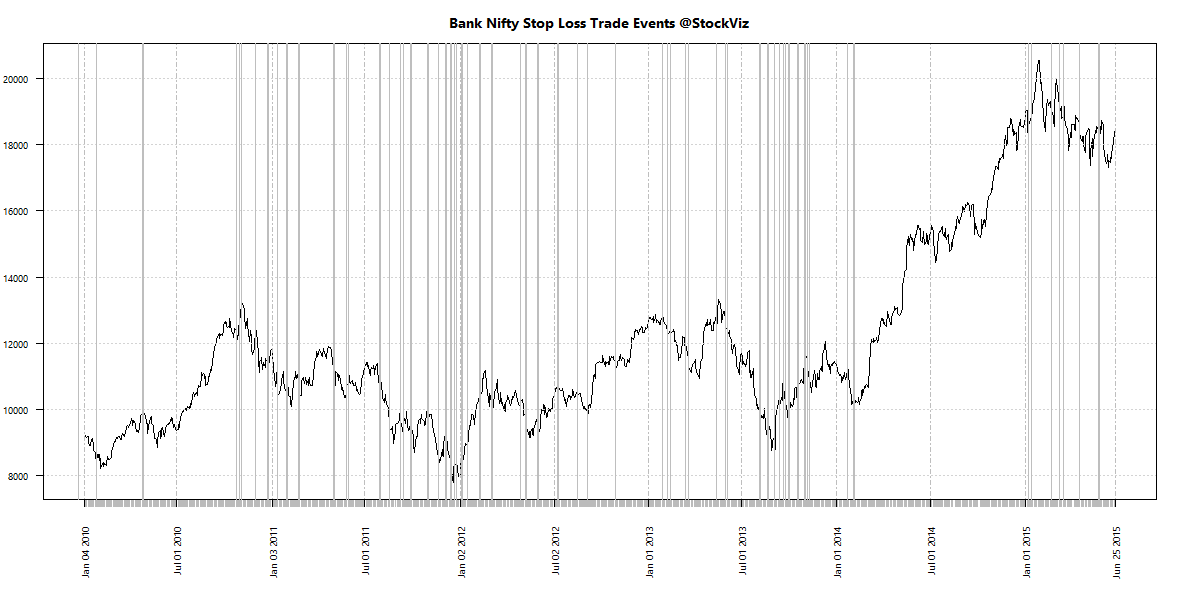

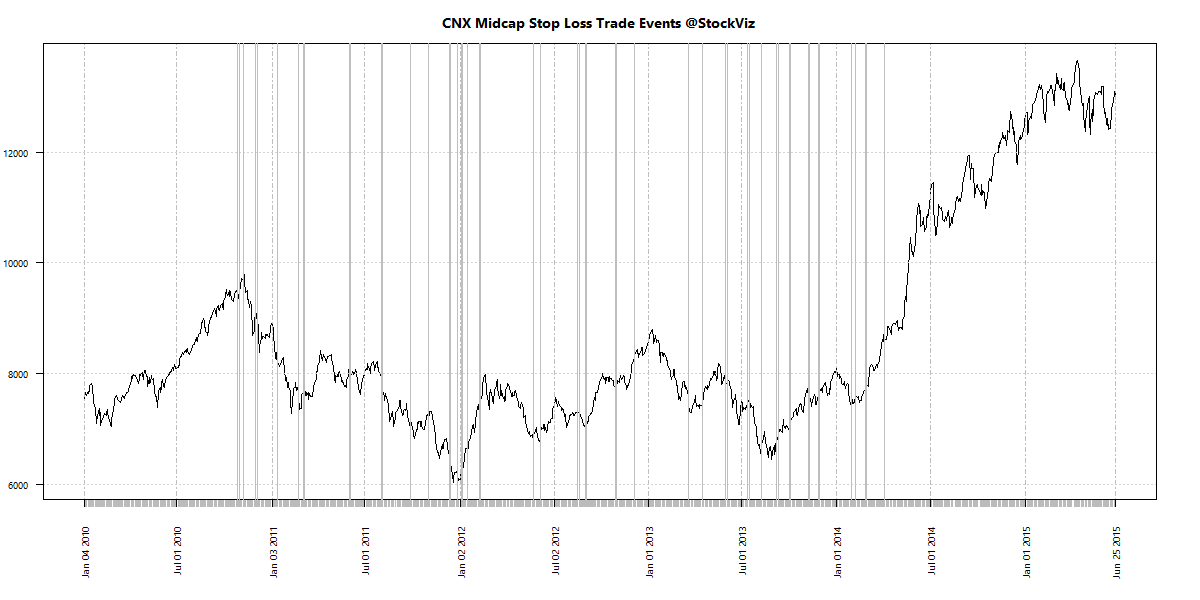

The 5-3 Trading frequency

Let’s plot the days on which this rule triggers (both buys and sells.)

By the looks of it, the stop-loss and re-entry bands are too narrow.

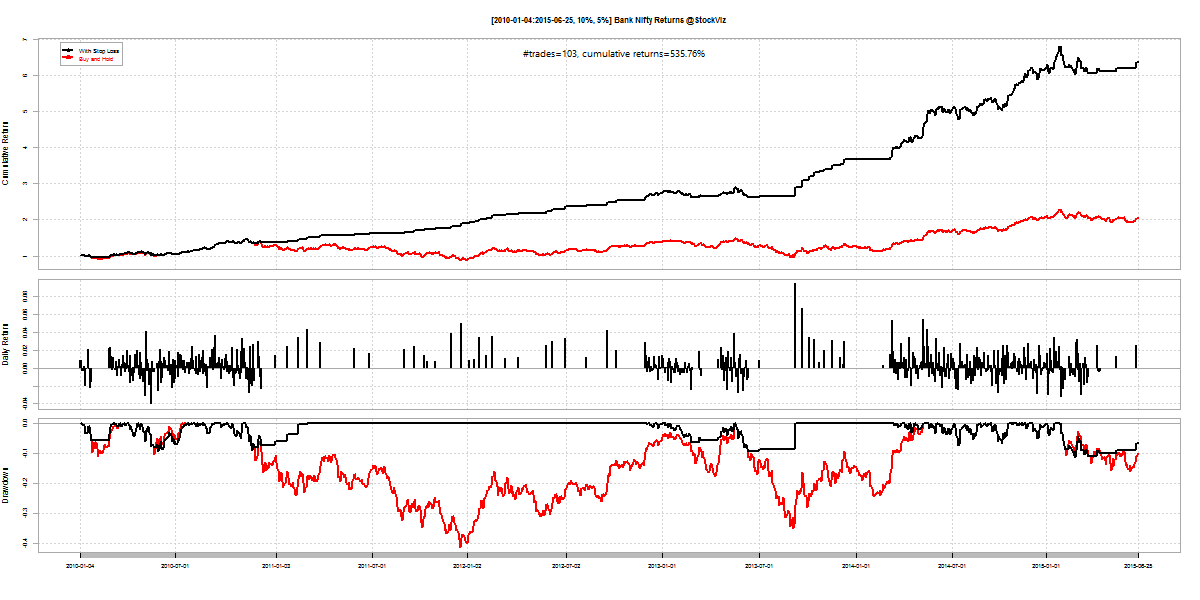

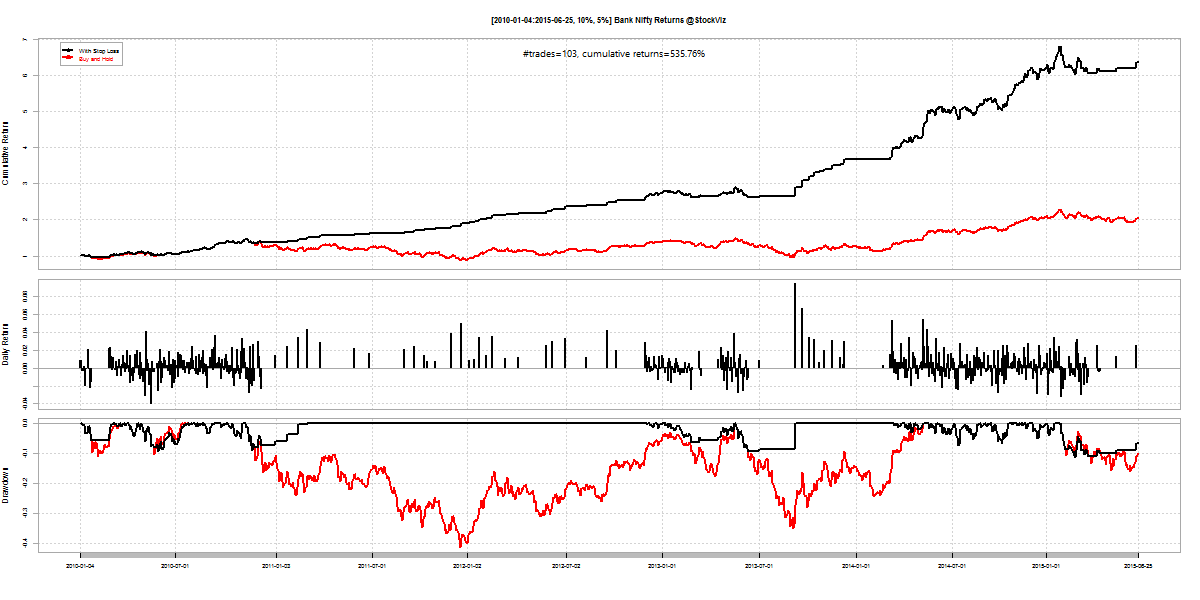

The 10-5 Rule

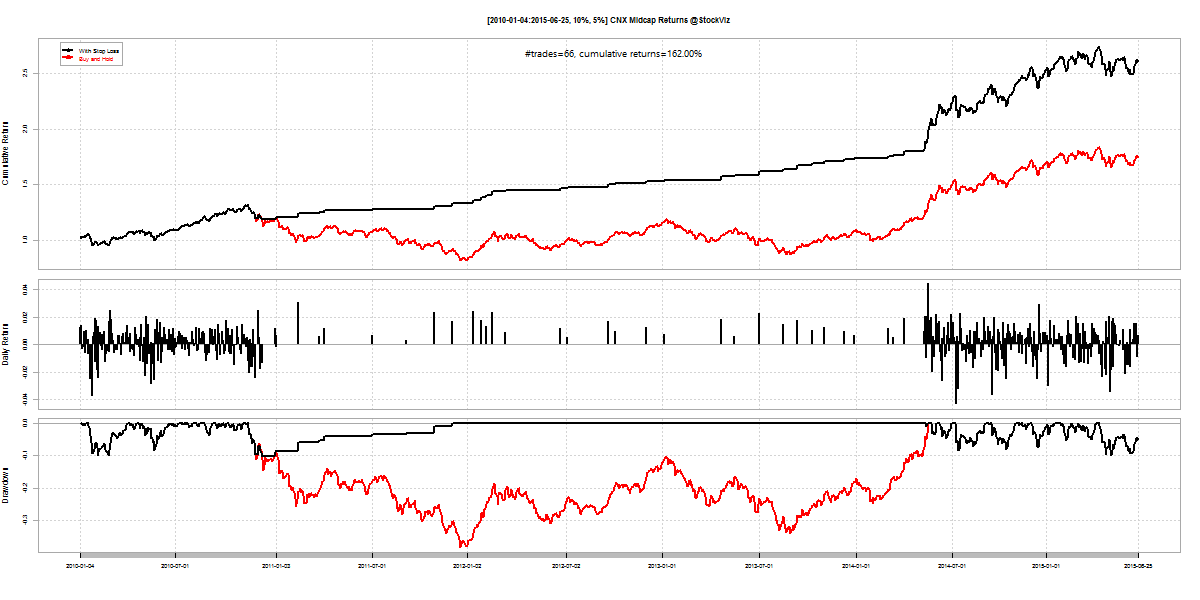

Suppose we set the trailing-stop loss at 10% and re-enter when the index covers 5%, we end up with a strategy with lower number of trades and yet, better returns and buy-and-hold.

| Index | #trades | cum. returns |

|---|---|---|

| Nifty | 50 | 100% |

| Bank Nifty | 103 | 536% |

| Midcap | 66 | 162% |

Returns:

Trading Events:

Trailing stop-loss and re-entry scenarios

The master list of different strategies, their trading frequencies and cumulative returns.

Conclusion

Having a trailing stop-loss and re-entry strategy enhances returns but at the price of increased trading frequency. No combination of strategies can escape the doldrums – where the index is basically flat and you are getting whipsawed.

With a 15% tax on short-term gains, over the 5-year period, you should handicap strategy returns by 75% to do an apples-to-apples comparison on the tax-free buy-and-hold returns. If you use the 10-5 rule, it means you will only come-out ahead trading the Bank Nifty. So you are better off with the 5-3 rule given where trading costs stand.