Equities

Commodities

| Energy |

| Heating Oil |

+15.87% |

| Ethanol |

+4.71% |

| Natural Gas |

+1.65% |

| WTI Crude Oil |

+4.03% |

| Brent Crude Oil |

+19.84% |

| RBOB Gasoline |

+38.27% |

| Metals |

| Silver 5000oz |

-4.07% |

| Palladium |

+6.05% |

| Copper |

+7.54% |

| Gold 100oz |

-4.89% |

| Platinum |

-3.99% |

| Agricultural |

| Coffee (Arabica) |

-15.10% |

| Orange Juice |

-13.76% |

| White Sugar |

-3.00% |

| Cocoa |

+6.99% |

| Lean Hogs |

+0.07% |

| Wheat |

+2.68% |

| Coffee (Robusta) |

-2.39% |

| Corn |

+3.30% |

| Feeder Cattle |

-4.76% |

| Lumber |

-7.83% |

| Cattle |

-1.67% |

| Cotton |

+7.53% |

| Soybean Meal |

+6.62% |

| Soybeans |

+7.05% |

| Sugar #11 |

-6.49% |

Credit Indices

| Index |

Change |

| Markit CDX EM |

+0.80% |

| Markit CDX NA IG |

-6.65% |

| Markit iTraxx Asia ex-Japan IG |

-12.04% |

| Markit iTraxx Australia |

-12.42% |

| Markit iTraxx Europe |

-8.36% |

| Markit iTraxx Europe Crossover |

-53.54% |

| Markit iTraxx Japan |

-4.43% |

| Markit iTraxx SovX Western Europe |

-1.77% |

| Markit LCDX (Loan CDS) |

+0.03% |

| Markit MCDX (Municipal CDS) |

-1.59% |

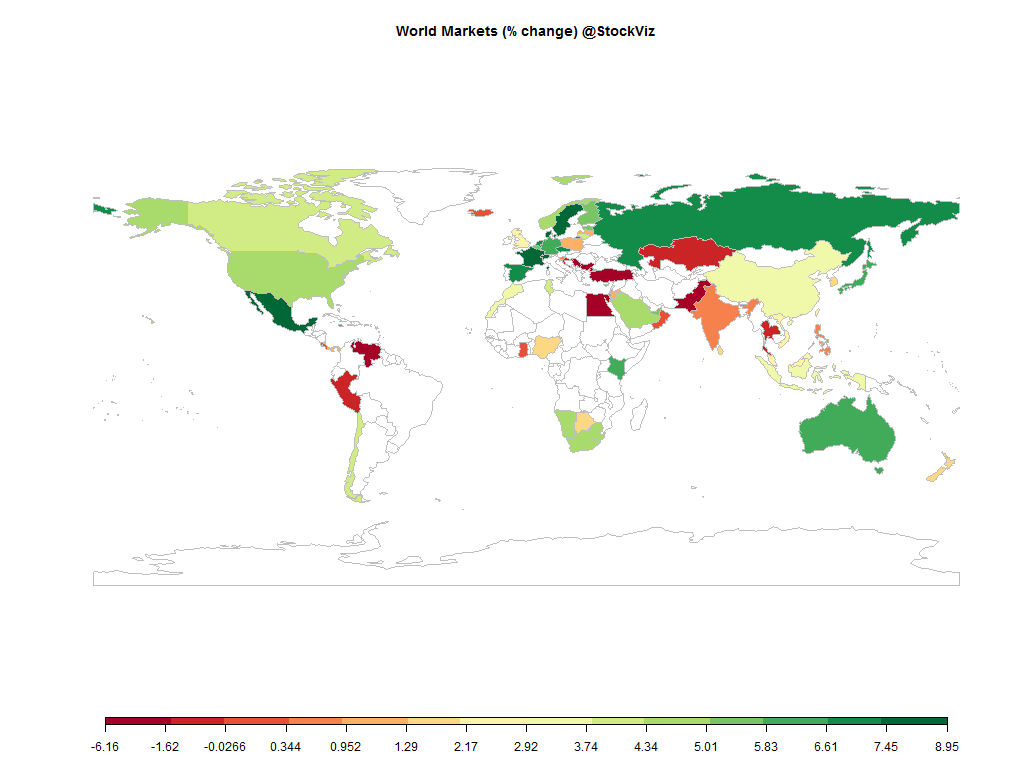

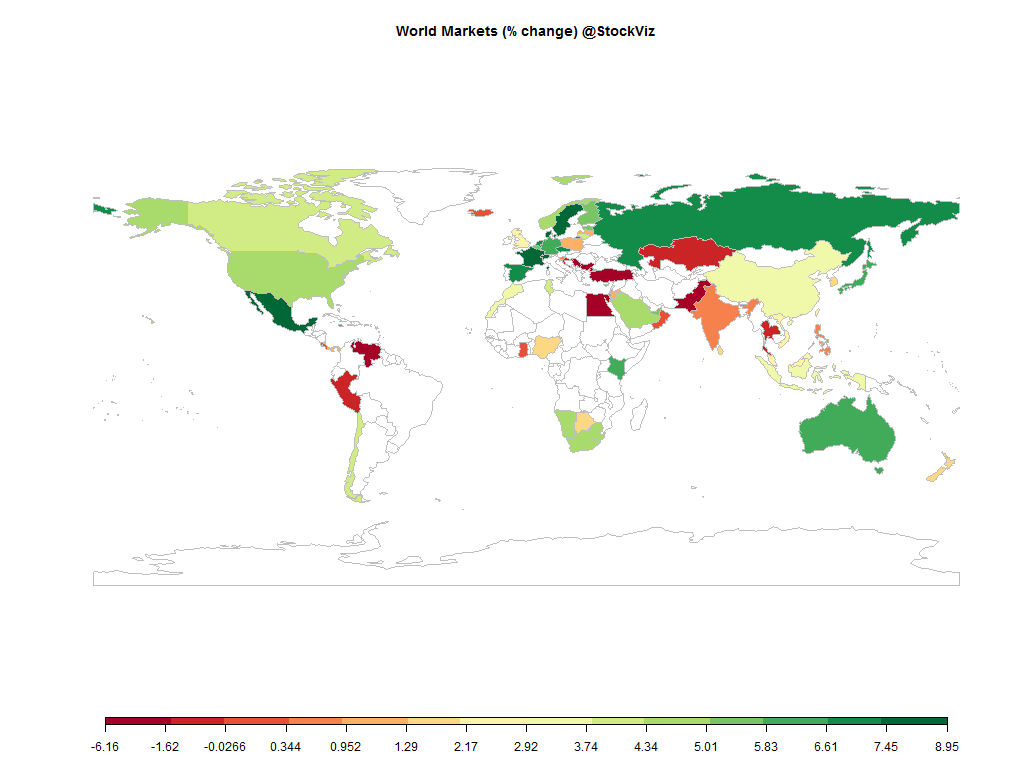

Most world markets ended in the green. The energy complex clocked in some impressive gains as well…

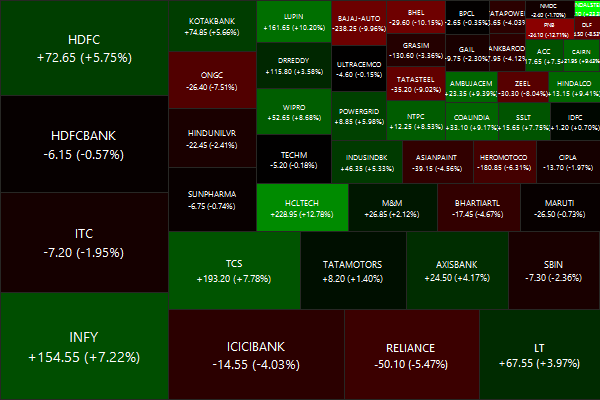

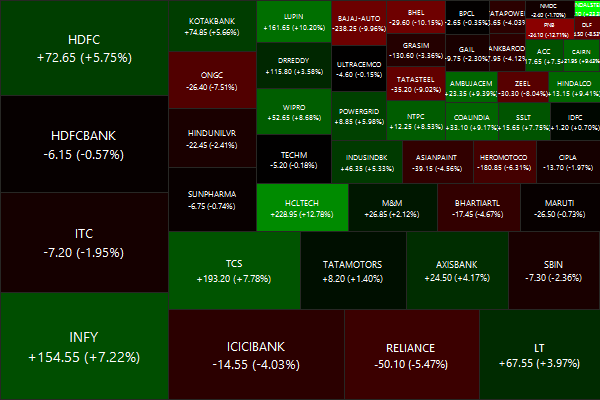

Nifty Heatmap

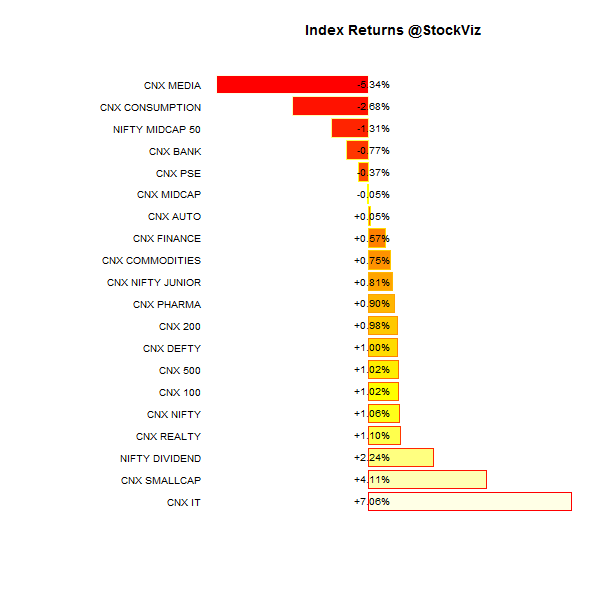

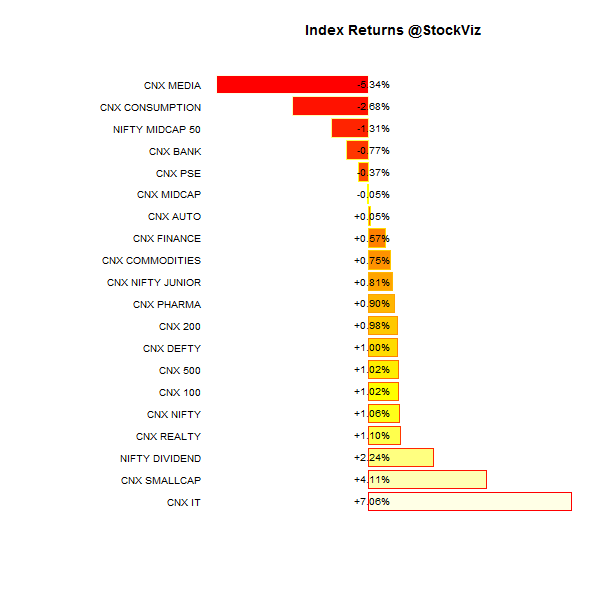

Index Returns

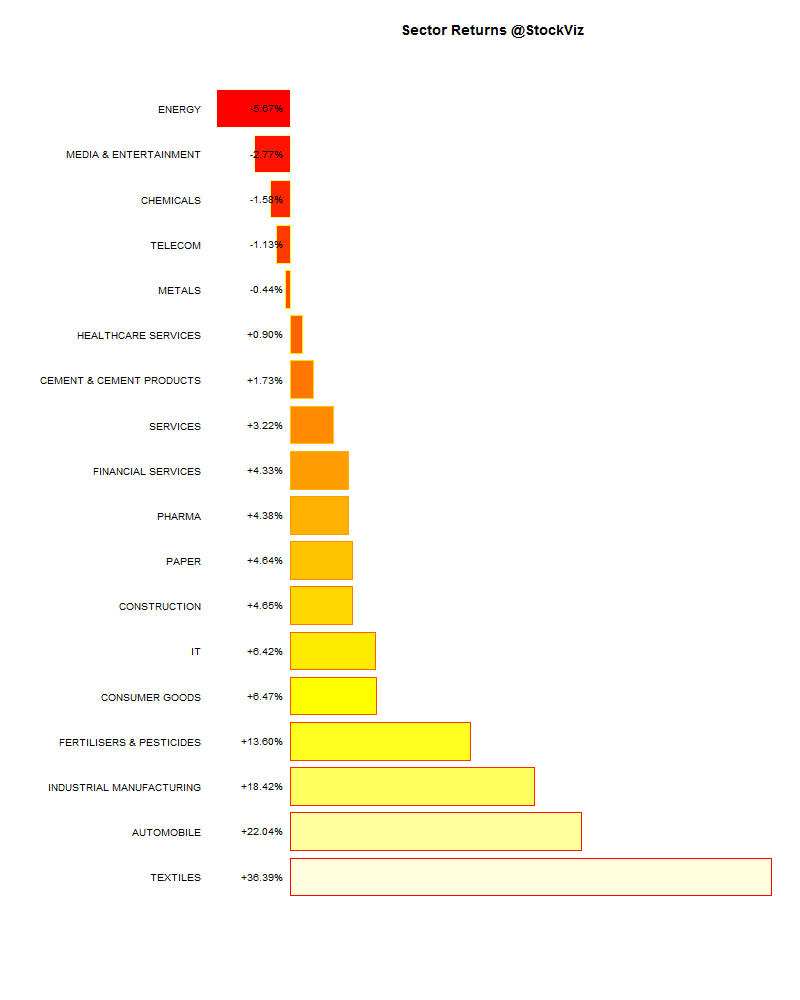

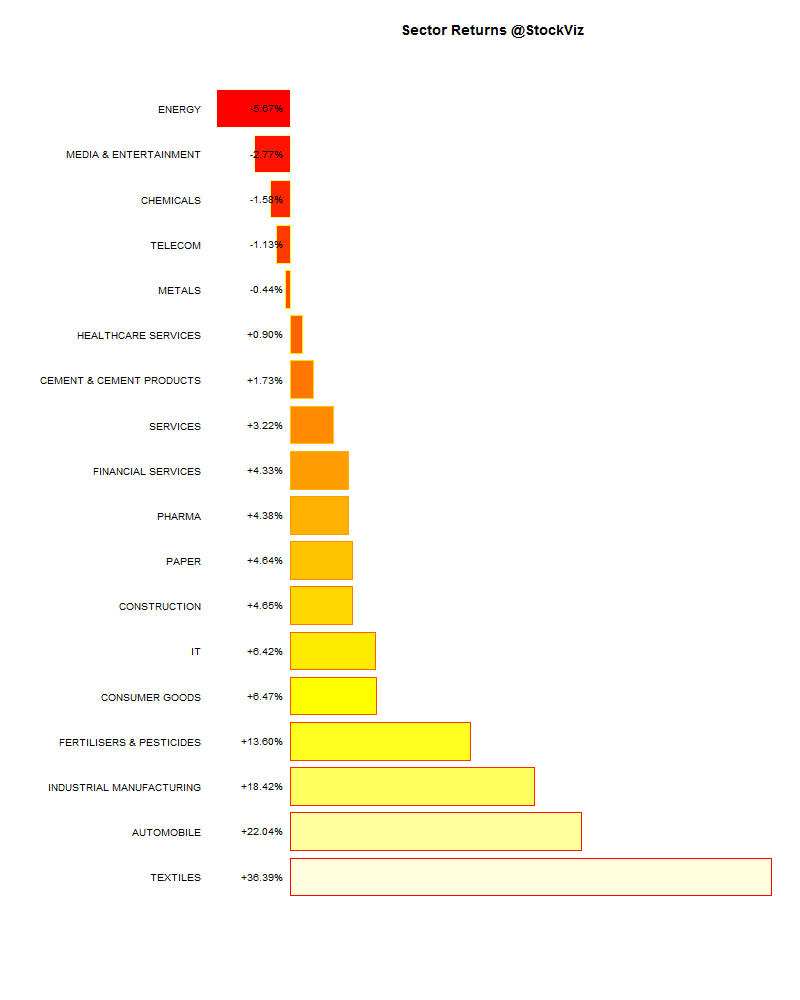

Sector Performance

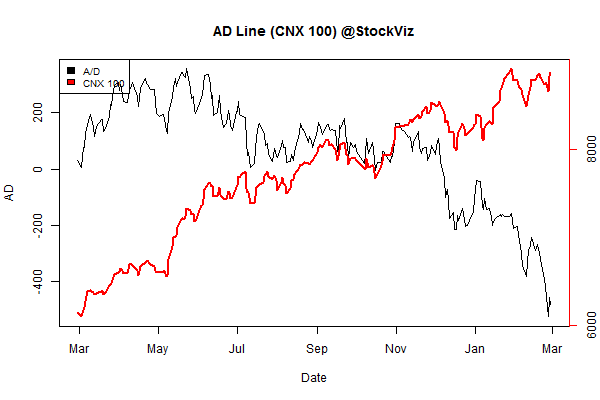

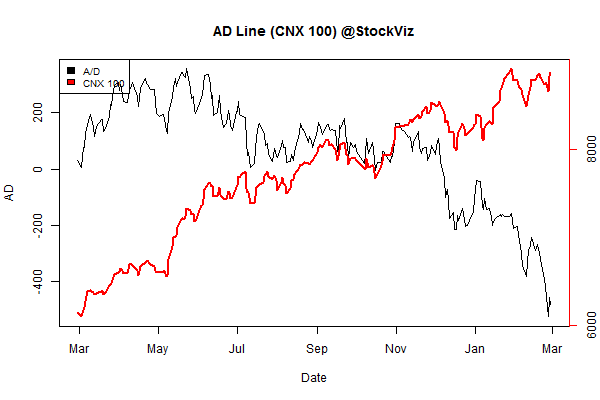

Advance Decline

Market Cap Decile Performance

| Decile |

Mkt. Cap. |

Adv/Decl |

| 1 (micro) |

-0.87% |

66/66 |

| 2 |

-3.59% |

63/68 |

| 3 |

+3.03% |

62/70 |

| 4 |

-1.24% |

54/77 |

| 5 |

+1.86% |

67/65 |

| 6 |

+1.88% |

68/64 |

| 7 |

-0.26% |

59/72 |

| 8 |

+3.20% |

74/58 |

| 9 |

+1.42% |

67/65 |

| 10 (mega) |

-0.02% |

66/66 |

Mid-caps caught a bid but large-caps were mostly in the red…

Top Winners and Losers

Make defense stuff in India…

ETF Performance

Not takers for PSU banks and their bag of worries…

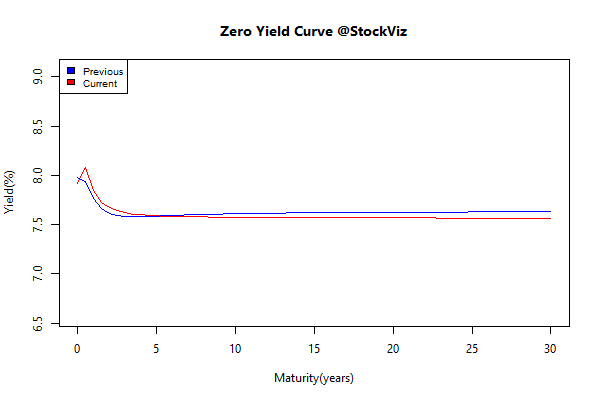

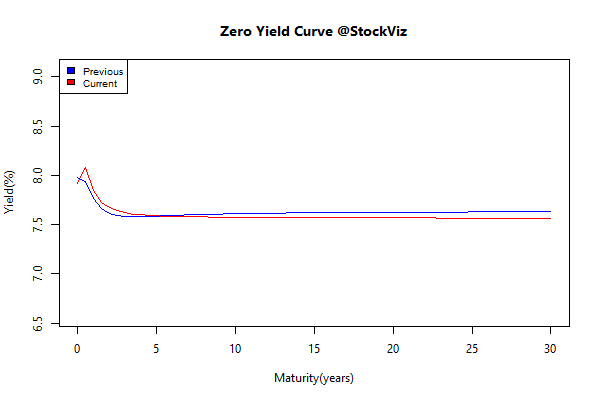

Yield Curve

Bond Indices

| Sub Index |

Change in YTM |

Total Return(%) |

| GSEC TB |

+0.19 |

+0.55% |

| GSEC SUB 1-3 |

+0.34 |

+0.01% |

| GSEC SUB 3-8 |

+0.08 |

+0.09% |

| GSEC SUB 8 |

-0.04 |

+0.07% |

A flat yield curve means you only get to clip the coupon…

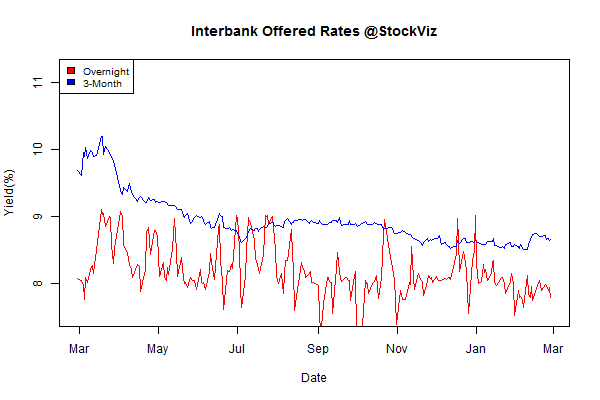

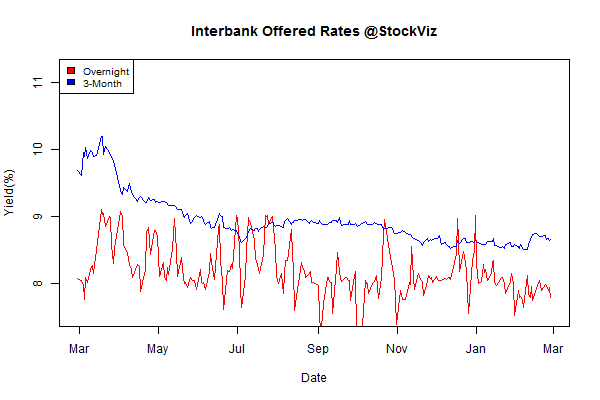

Interbank lending rates

Investment Theme Performance

Momentum beat most of the value strategies out…

Equity Mutual Funds

Bond Mutual Funds

Thoughts to sum up the month

A business with terrific economics can be a bad investment if it is bought for too high a price. In other words, a sound investment can morph into a rash speculation if it is bought at an elevated price.

Source: A Dozen Things Taught by Warren Buffett in his 50th Anniversary Letter that will Benefit Ordinary Investors