Equities

Commodities

| Energy |

| Heating Oil |

-9.59% |

| Brent Crude Oil |

-6.64% |

| Ethanol |

-15.22% |

| WTI Crude Oil |

-9.49% |

| Natural Gas |

-9.44% |

| RBOB Gasoline |

+2.30% |

| Metals |

| Copper |

-10.92% |

| Gold 100oz |

+7.99% |

| Platinum |

+2.27% |

| Palladium |

-3.38% |

| Silver 5000oz |

+9.55% |

| Agricultural |

| Cocoa |

-3.55% |

| Coffee (Robusta) |

+1.53% |

| Lumber |

-2.74% |

| Soybean Meal |

-9.07% |

| White Sugar |

-2.07% |

| Soybeans |

-5.88% |

| Coffee (Arabica) |

-4.31% |

| Corn |

-7.56% |

| Feeder Cattle |

-6.25% |

| Wheat |

-14.73% |

| Cattle |

-6.55% |

| Cotton |

-2.45% |

| Lean Hogs |

-17.35% |

| Orange Juice |

+0.07% |

| Sugar #11 |

+1.44% |

Credit Indices

| Index |

Change |

| Markit CDX EM |

-2.75% |

| Markit CDX NA HY |

-0.52% |

| Markit CDX NA IG |

+2.54% |

| Markit iTraxx Asia ex-Japan IG |

+5.51% |

| Markit iTraxx Australia |

+2.89% |

| Markit iTraxx Europe |

-7.13% |

| Markit iTraxx Europe Crossover |

-36.06% |

| Markit iTraxx Japan |

-2.64% |

| Markit iTraxx SovX Western Europe |

-2.88% |

| Markit LCDX (Loan CDS) |

+0.24% |

| Markit MCDX (Municipal CDS) |

+3.87% |

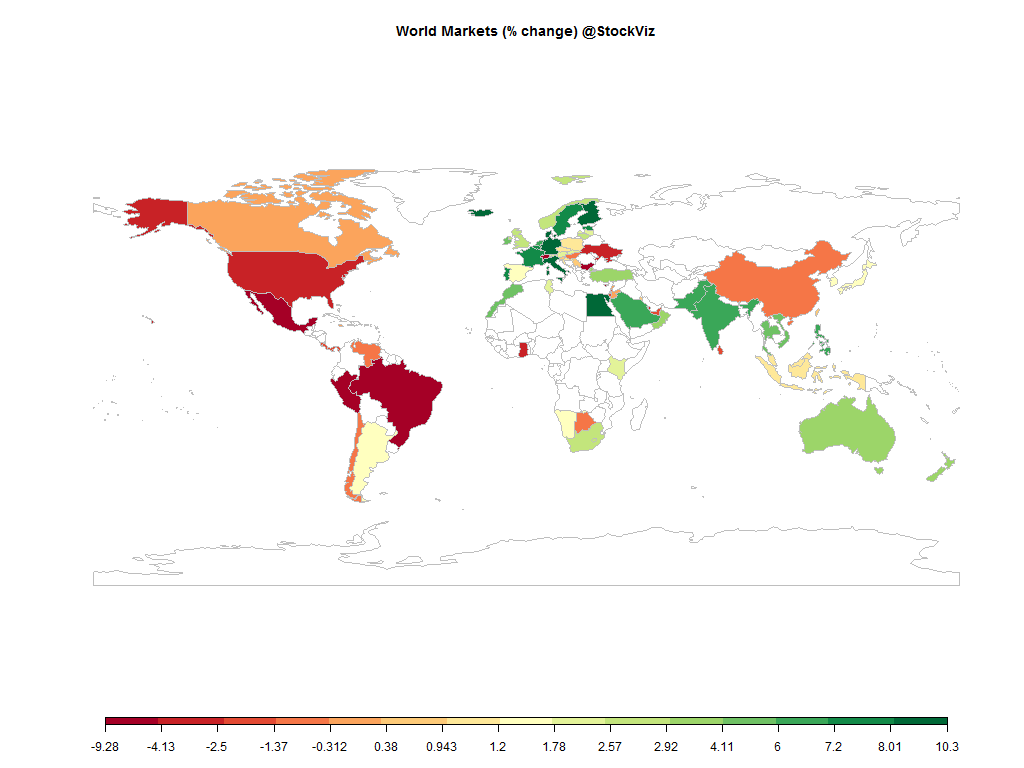

We certainly started the party with a bang: Euro QE, Swiss abandon, Rajan rate-cut… Oh my!

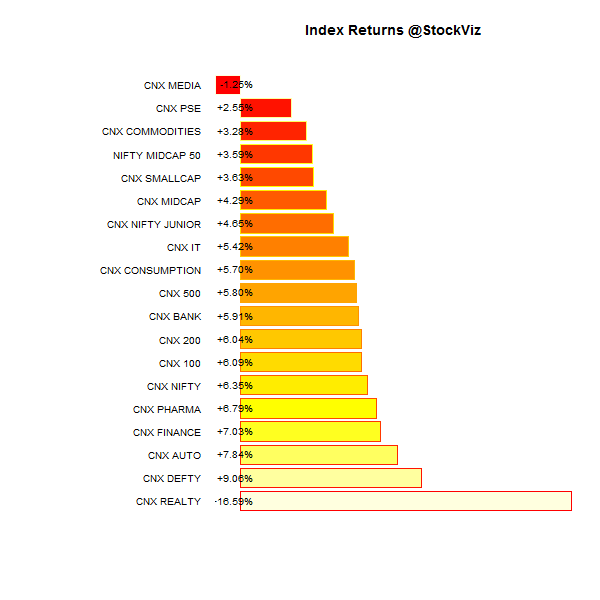

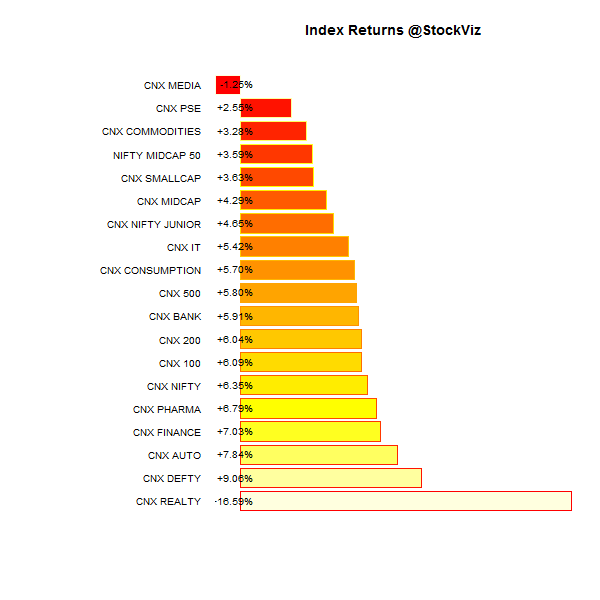

Index Returns

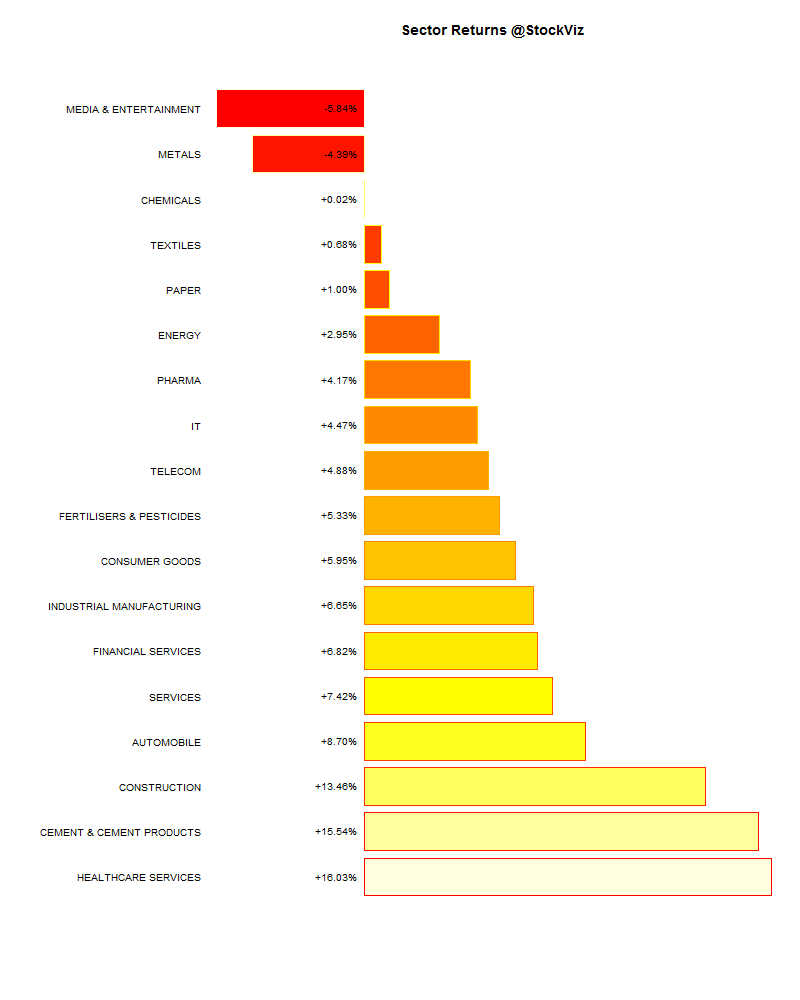

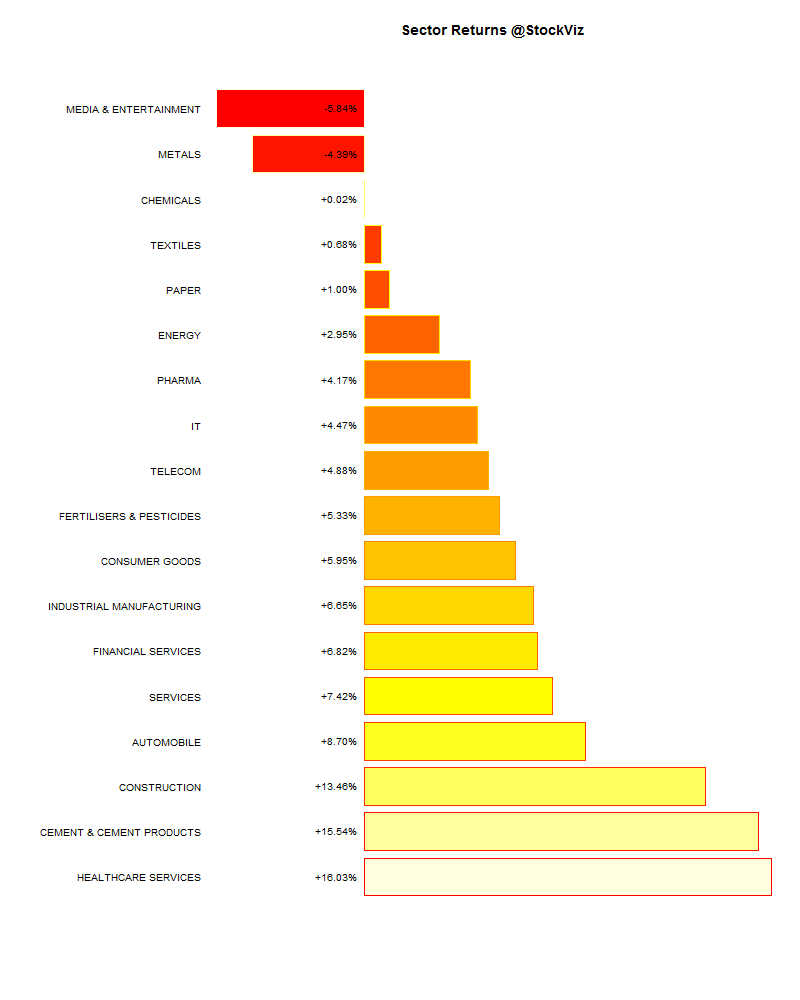

Sector Performance

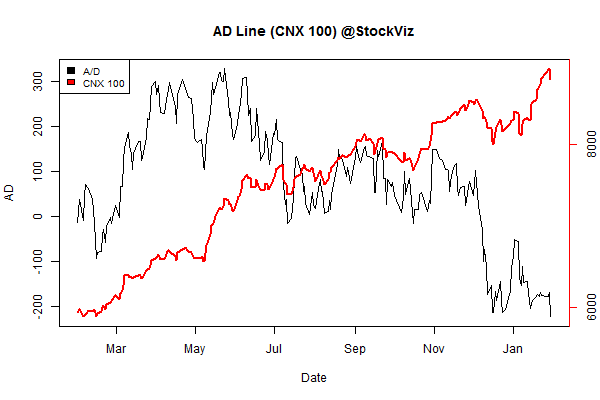

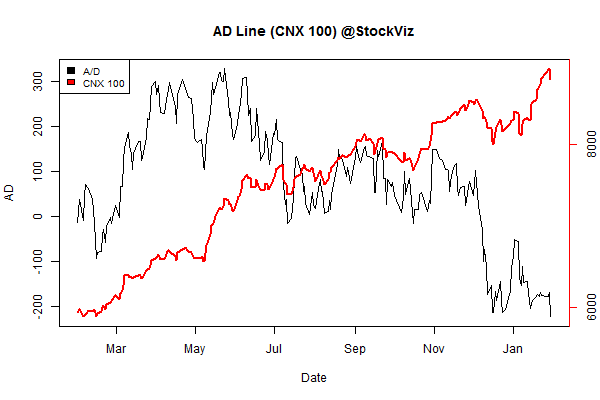

Advance Decline

Market Cap Decile Performance

| Decile |

Mkt. Cap. |

Adv/Decl |

| 1 (micro) |

-3.90% |

68/66 |

| 2 |

+2.62% |

79/54 |

| 3 |

+0.33% |

73/60 |

| 4 |

+2.82% |

81/52 |

| 5 |

+4.56% |

72/61 |

| 6 |

+3.52% |

81/52 |

| 7 |

+7.85% |

77/56 |

| 8 |

+5.76% |

76/57 |

| 9 |

+5.68% |

69/64 |

| 10 (mega) |

+8.38% |

69/65 |

Large caps did good. Midcaps not so much.

Top Winners and Losers

DLF – looks like the market likes the EMI scheme. M&MFIN and PNB got shellacked because of poor shows at earnings parade. The Adanis continued to entertain…

ETF Performance

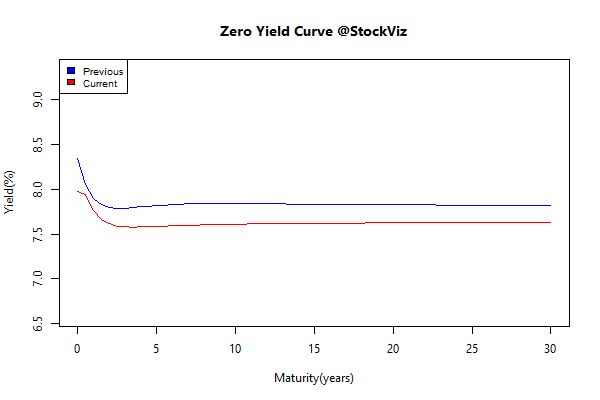

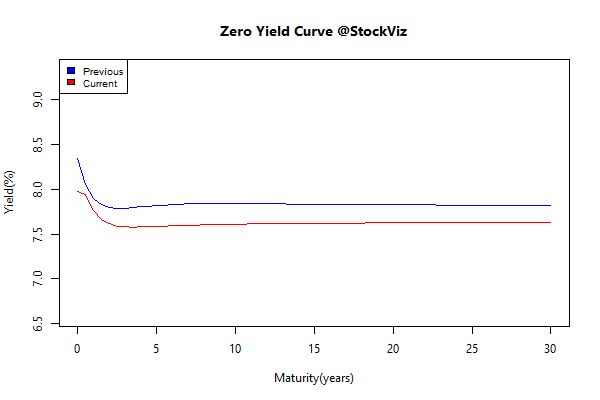

Yield Curve

Bond Indices

| Sub Index |

Change in YTM |

Total Return(%) |

| GSEC TB |

-0.33 |

+0.74% |

| GSEC SUB 1-3 |

-0.92 |

+0.94% |

| GSEC SUB 3-8 |

-0.18 |

+1.48% |

| GSEC SUB 8 |

-0.14 |

+1.91% |

The long bond was a rock-star.

Investment Theme Performance

Equity Mutual Funds

Bond Mutual Funds

Thought to sum up the month

Is there such a thing as a “perfect” value investor? Bob Goldfarb, chief executive of the legendary Sequoia Fund, was asked by Columbia University professor Louis Lowenstein “to select ten dyed-in-the-wool value investors who all followed the essential edicts of Graham and Dodd.”

Goldfarb came up with nine. For a nine-year period from 2006 through 2014, the average return of the eight funds that survived to the end was 6.70% vs. the S&P 500 Index’s 7.99%.

Source: Looking Back at James Montier’s “Perfect” Value Investors