Equities

Commodities

| Energy |

| Brent Crude Oil |

-18.38% |

| Ethanol |

+14.75% |

| Heating Oil |

-14.43% |

| Natural Gas |

+5.18% |

| RBOB Gasoline |

-16.66% |

| WTI Crude Oil |

-18.16% |

| Metals |

| Copper |

-6.54% |

| Gold 100oz |

-0.26% |

| Palladium |

+2.16% |

| Platinum |

-2.76% |

| Silver 5000oz |

-3.14% |

| Agricultural |

| Coffee (Robusta) |

+2.24% |

| Corn |

+0.20% |

| Lumber |

+1.11% |

| Coffee (Arabica) |

-0.90% |

| Cocoa |

+0.52% |

| Cotton |

-3.33% |

| Feeder Cattle |

-1.22% |

| Orange Juice |

+12.06% |

| Sugar #11 |

-2.62% |

| Cattle |

-0.53% |

| Lean Hogs |

+1.87% |

| Soybean Meal |

+0.85% |

| Soybeans |

-2.50% |

| Wheat |

+8.79% |

| White Sugar |

-3.85% |

Credit Indices

| Index |

Change |

| Markit CDX EM |

-1.23% |

| Markit CDX NA HY |

+0.96% |

| Markit CDX NA IG |

-5.29% |

| Markit iTraxx Asia ex-Japan IG |

-10.87% |

| Markit iTraxx Australia |

-5.75% |

| Markit iTraxx Europe |

-8.46% |

| Markit iTraxx Europe Crossover |

-35.75% |

| Markit iTraxx Japan |

-5.35% |

| Markit iTraxx SovX Western Europe |

-2.32% |

| Markit LCDX (Loan CDS) |

+0.05% |

| Markit MCDX (Municipal CDS) |

-4.85% |

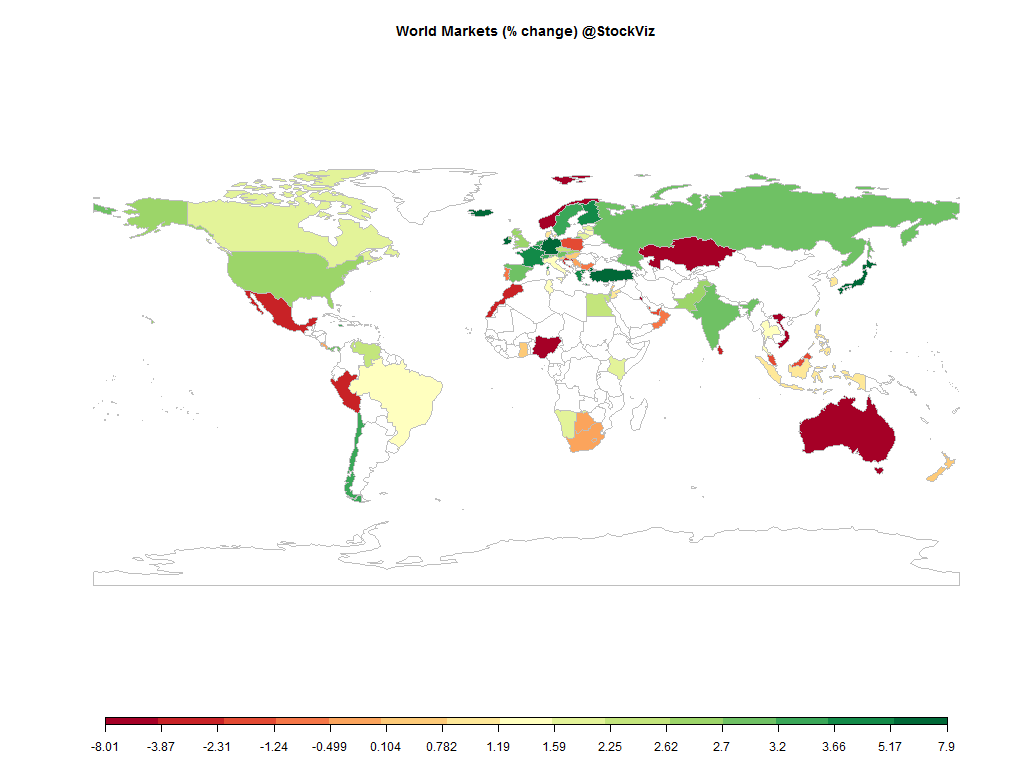

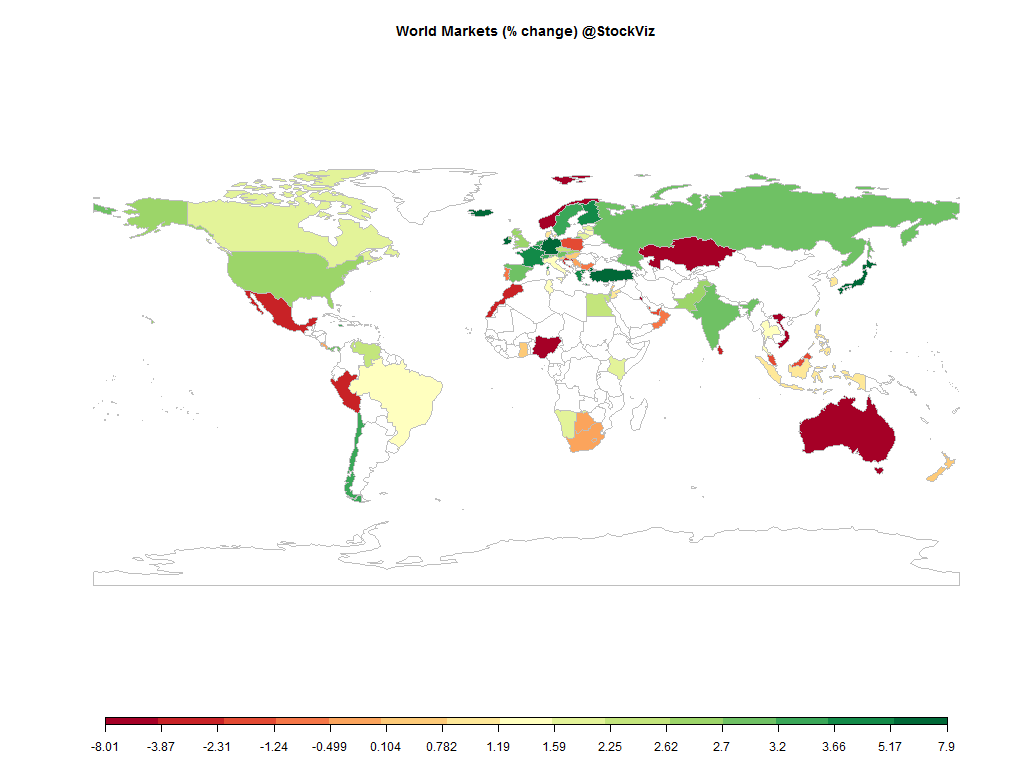

The US dollar rally continued this month. Oil took a giant tumble on the back of OPEC’s non-cut. The race toward zero yield continues. 10-yr yields of Germany, France, Netherlands, Switzerland and Japan are all below 1%

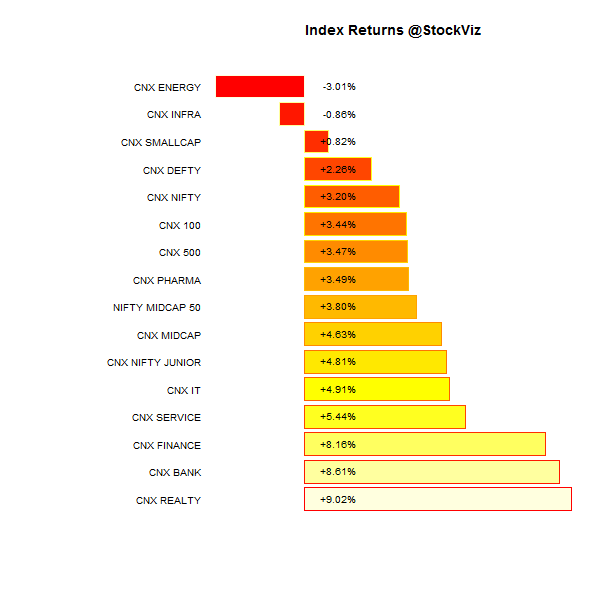

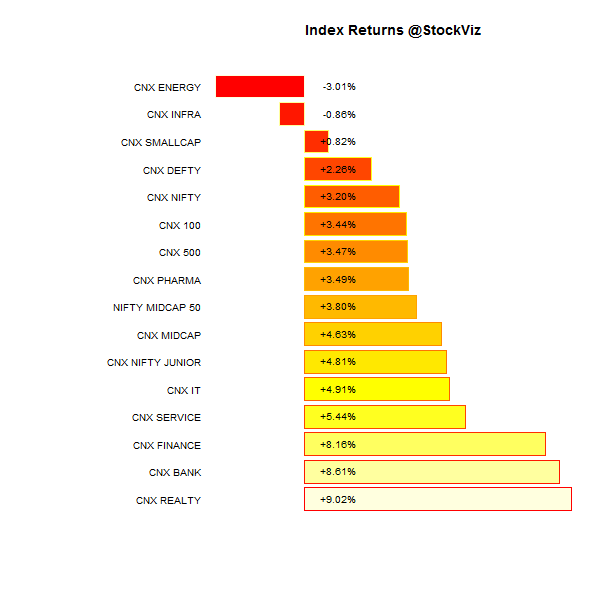

Index Performance

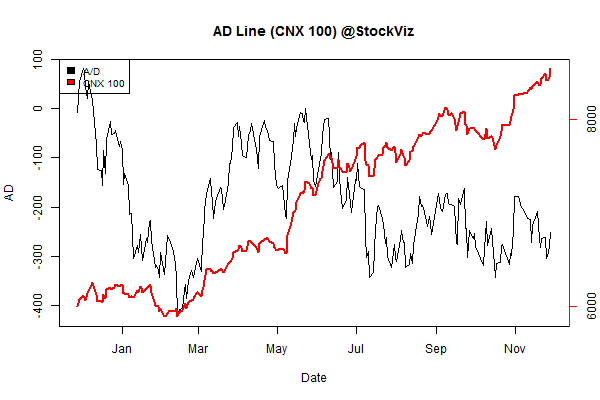

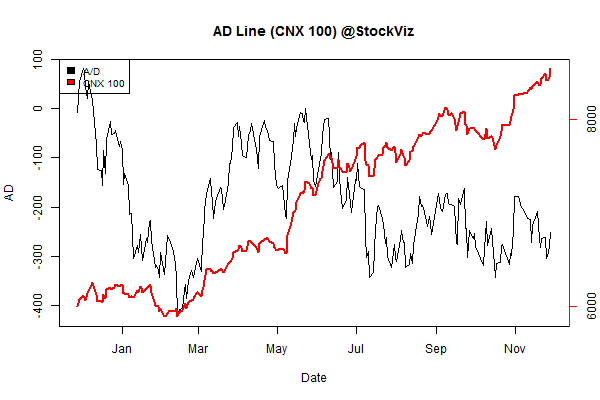

Advance Decline

Market cap decile performance

| Decile |

Mkt. Cap. |

Adv/Decl |

| 1 (micro) |

-0.47% |

72/68 |

| 2 |

+4.92% |

81/58 |

| 3 |

+3.91% |

74/65 |

| 4 |

+1.61% |

68/71 |

| 5 |

+1.26% |

70/70 |

| 6 |

+3.29% |

76/63 |

| 7 |

+5.43% |

83/57 |

| 8 |

+1.94% |

74/65 |

| 9 |

+5.05% |

77/63 |

| 10 (mega) |

+4.03% |

71/69 |

An across the board rally on macro events…

Top Winners and Losers

BOSCH put in a rally for the record books. And apparently, DLF is going to pay its CCI fine in EMIs…

ETF Performance

PSU Banks’ fund raising plans and the consequent dilution is not in the investors’ radar right now…

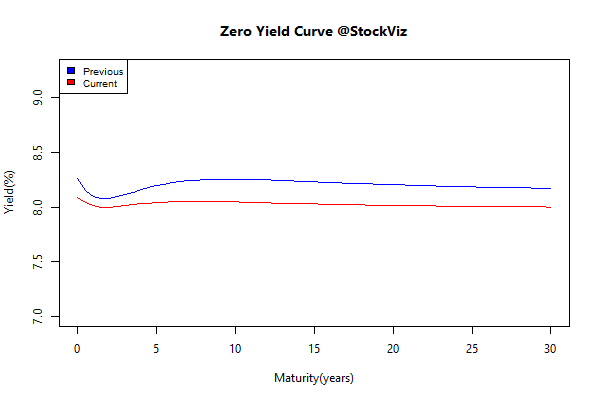

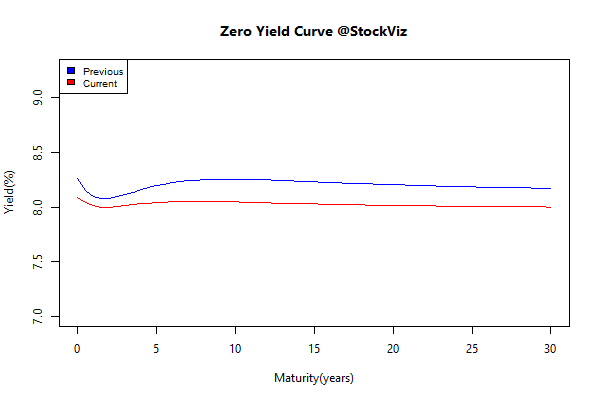

Yield Curve

Bond Indices

| Sub Index |

Change in YTM |

Total Return(%) |

| GSEC TB |

-0.24 |

+0.70% |

| GSEC SUB 1-3 |

+0.10 |

+1.08% |

| GSEC SUB 3-8 |

-0.33 |

+1.30% |

| GSEC SUB 8 |

-0.20 |

+2.26% |

Flat, flatter, flattest…

Investment Theme Performance

Momentum eclipsed value by far…

Thought to sum up the month

Workers from the red-blooded bit of banking — traders and the like — were more dishonest than those in ancillary jobs. Nearly a tenth of them lied blatantly.

Source: Talking about their work makes bankers more dishonest. (Economist)