Today, we present a very preliminary cut of how a very popular market pundit, who is often on TV and the web, has performed.

The period we looked at was between the November of 2013 and the June of 2014. As a point of reference, during this period, investors would be up 26.14% if they had just held on to the NIFTYBEES etf.

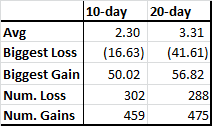

Long Calls

On an average, his long calls gave a 10-day return of +2.30% and a 20-day return of +3.31%. Out of 761 long-calls, 302 resulted in losses and 459 in gains over a 10-day period. Not bad at all.

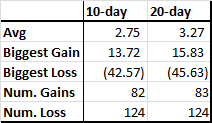

Short Calls

Its tough to come out with a short call when the market is moving up. On an average, his short calls gave a 10-day return of -2.75% and a 20-day return of -3.27%. Out of 206 short-calls, 124 resulted in losses and 82 in gains over a 10-day period.

You can download the spreadsheet and run your analysis here. Just let us know what you find!

Related articles

- IPOs – Are they Worth It? (stockviz.biz)

- CNX 100 50-Day Tactical Theme (stockviz.biz)

- IPOs Revisited (stockviz.biz)