Equities

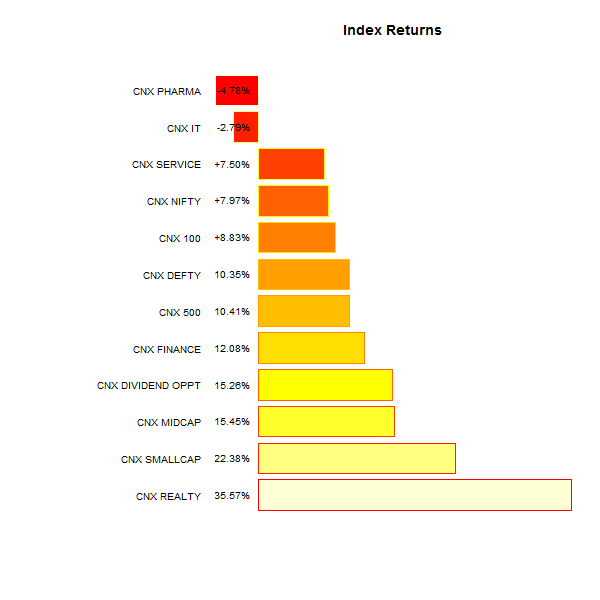

The Nifty pitched in with a +7.97% bump (+10.35% in USD terms)

Commodities

| Energy |

| Brent Crude Oil |

+1.35% |

| Ethanol |

+4.87% |

| Heating Oil |

-1.51% |

| Natural Gas |

-5.54% |

| RBOB Gasoline |

-1.18% |

| WTI Crude Oil |

+3.40% |

| Metals |

| Copper |

+3.96% |

| Gold 100oz |

-3.39% |

| Palladium |

+3.27% |

| Platinum |

+1.79% |

| Silver 5000oz |

-2.08% |

| Agricultural |

| Cattle |

-5.59% |

| Cocoa |

+6.21% |

| Coffee (Arabica) |

-13.98% |

| Coffee (Robusta) |

-10.70% |

| Corn |

-9.49% |

| Cotton |

-9.02% |

| Feeder Cattle |

+8.98% |

| Lean Hogs |

-3.53% |

| Lumber |

-7.36% |

| Orange Juice |

+2.80% |

| Soybean Meal |

-0.75% |

| Soybeans |

-2.53% |

| Sugar #11 |

+0.58% |

| Wheat |

-11.99% |

| White Sugar |

-1.45% |

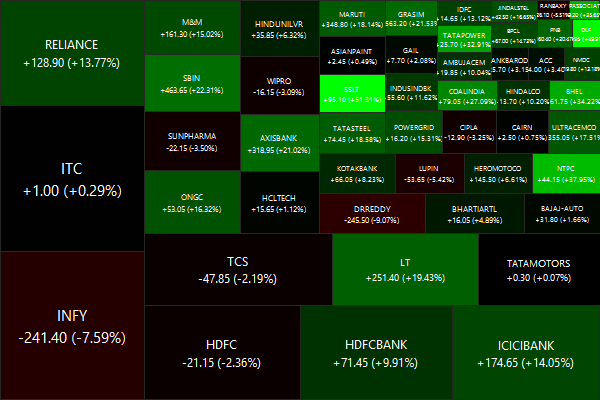

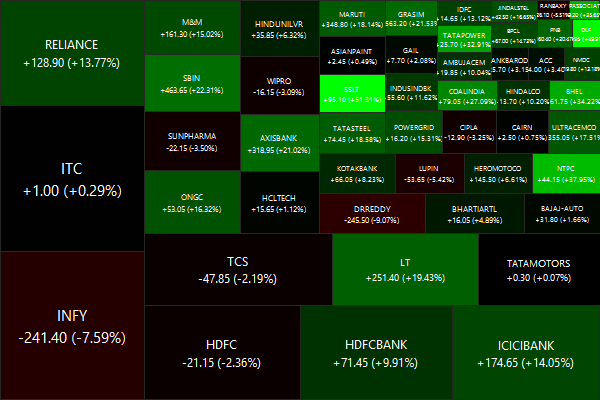

Nifty Heatmap

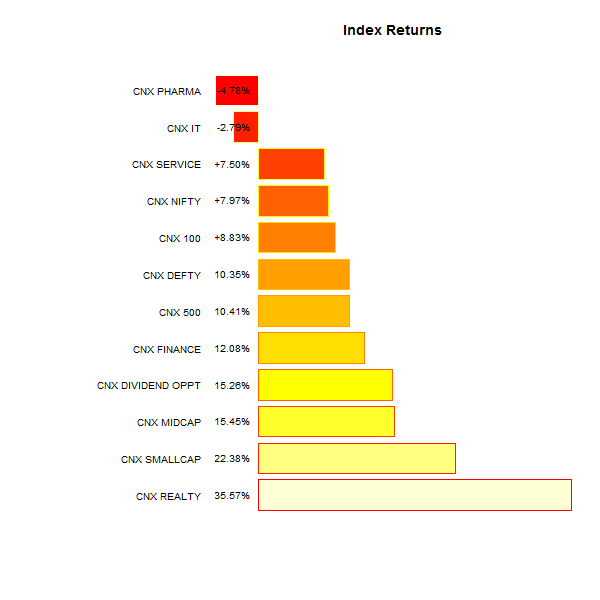

Index Performance

Top Winners and Losers

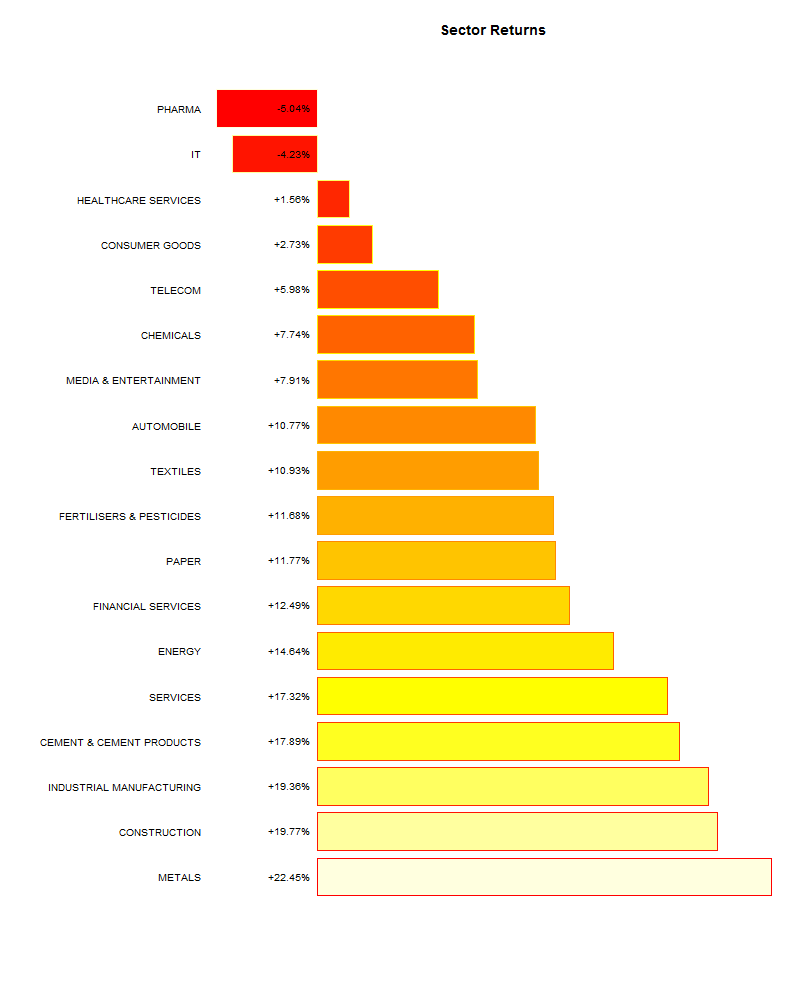

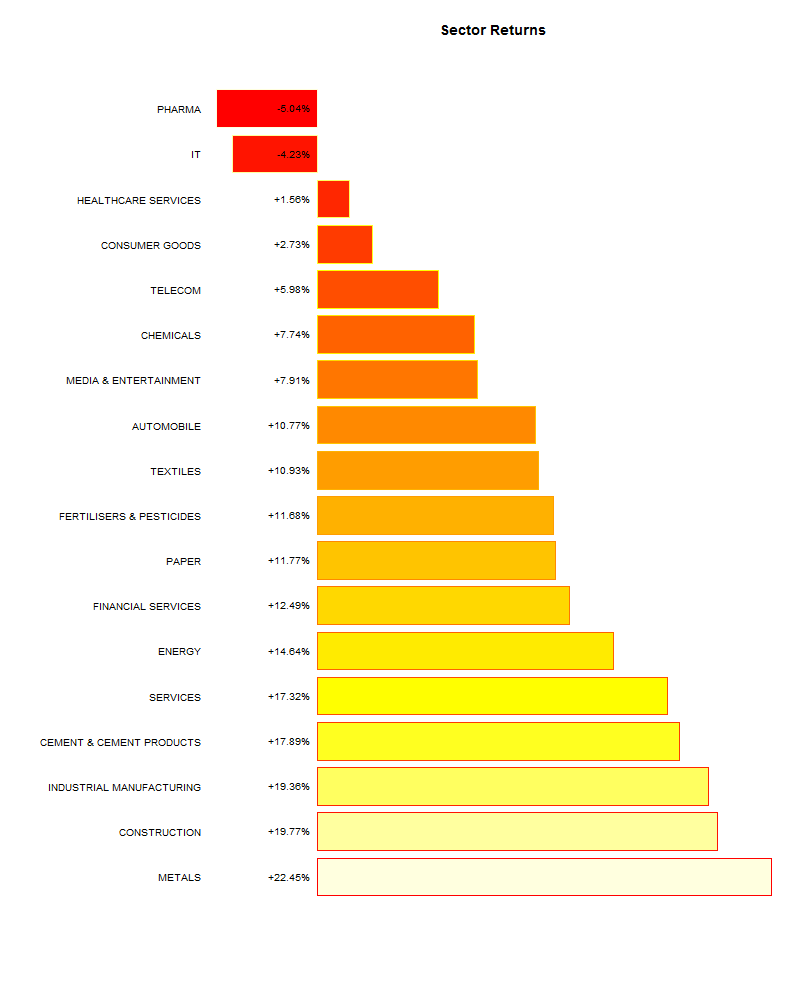

Pharma got whacked badly… it was a real estate and industrial show…

ETFs

Investment Theme Performance

Every single investment strategy ended in the green…

Sector Performance

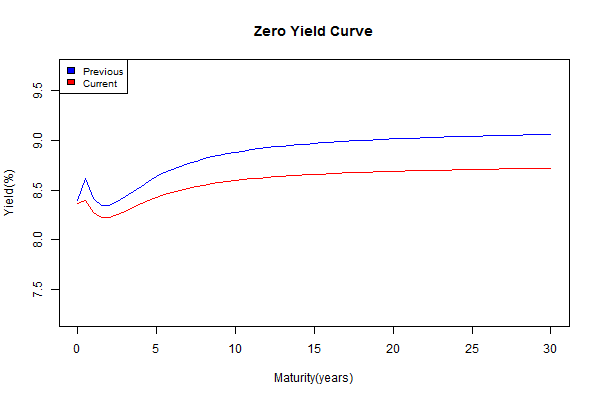

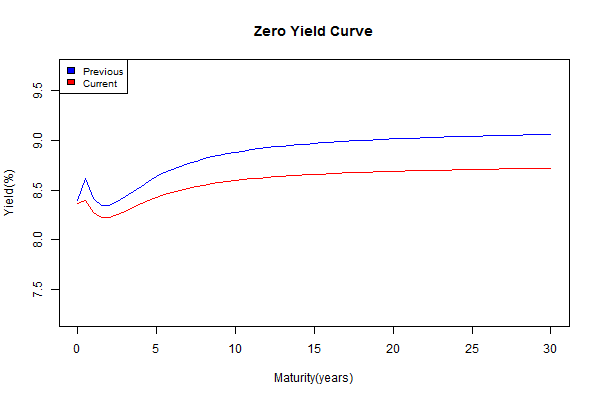

Yield Curve

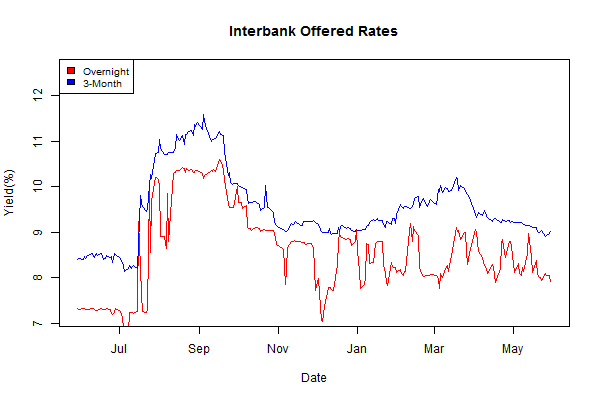

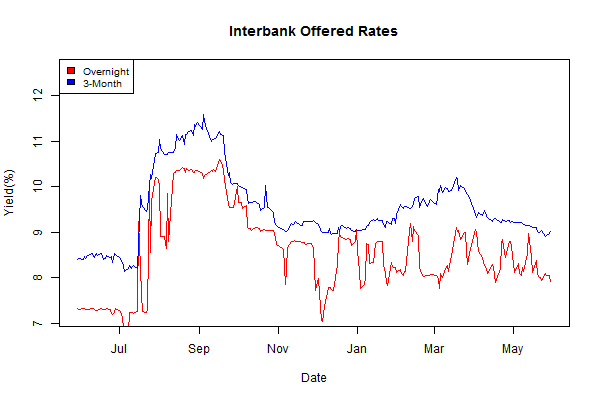

Interbank lending rates

Thought to sum up the month

Warren Buffett:

My most surprising discovery: the overwhelming importance in business of an unseen force that we might call “the institutional imperative.”

For example:

- As if governed by Newton’s First Law of Motion, an institution will resist any change in its current direction;

- Just as work expands to fill available time, corporate projects or acquisitions will materialize to soak up available funds;

- Any business craving of the leader, however foolish, will be quickly supported by detailed rate-of-return and strategic studies prepared by his troops; and

- the behavior of peer companies, whether they are expanding, acquiring, setting executive compensation or whatever, will be mindlessly imitated.

Source: Warren Buffett: These were my biggest early mistakes