The following are excerpts from a recent JP Morgan special report titled “India: elections, markets & the tyranny of economic reality.”

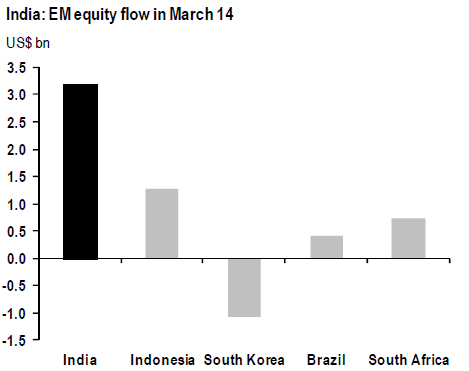

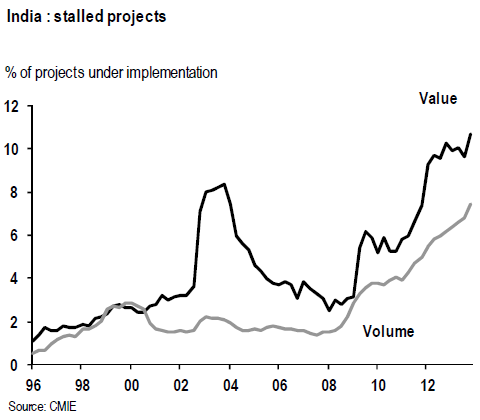

The equity market exuberance, however, appears based on opinion polls increasingly pointing to a stable government post election, and the presumption of a dramatic economic pivot post election that jump starts a new capex cycle.

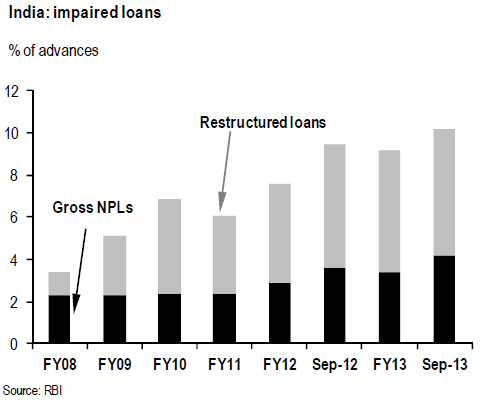

The broad hope is that a positive cycle can be unleashed if projects get unclogged, increasing cash flow for infra companies (which account for 30% of stressed loans), enabling loan repayments, and healing bank balance sheets, which can allow a fresh lending cycle to start.

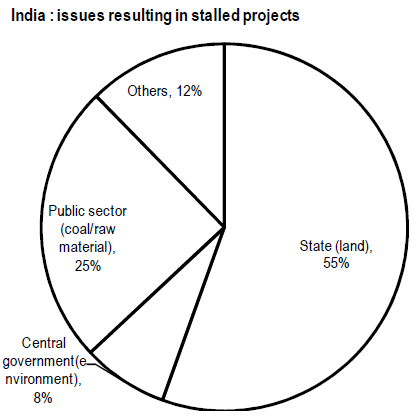

But the problem is that the vast majority of projects are currently stuck because of issues that are under the purview of state governments, over which the central government has little jurisdiction.

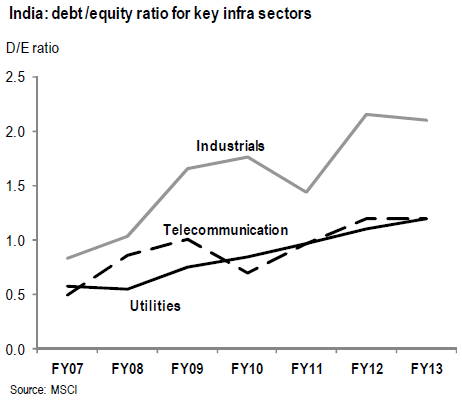

And even if these problems were magically resolved, where is the money going to come from? Among the BSE-200 non-financials, 17% have operating incomes (before depreciation, interest and taxes) that are less than the perilous threshold of 1.5 times their debt service obligations. So a significant deleveraging would need to be undertaken before these infrastructure companies have the balance sheet strength to finance another investment cycle. This is a multi-quarter process.

Banks are not in a position to lend. Public sector banks – which account for 70% of banking sector assets – are saddled with the overwhelming majority of impaired loans, and would need a significant quantum of capital injection by the government – far in excess of what has been budgeted – to finance any large pick-up in credit growth.

Given the economic reality on the ground, the translation from political stability to economic performance is likely to be far more lagged, incomplete and uncertain than the current market euphoria may be betraying.