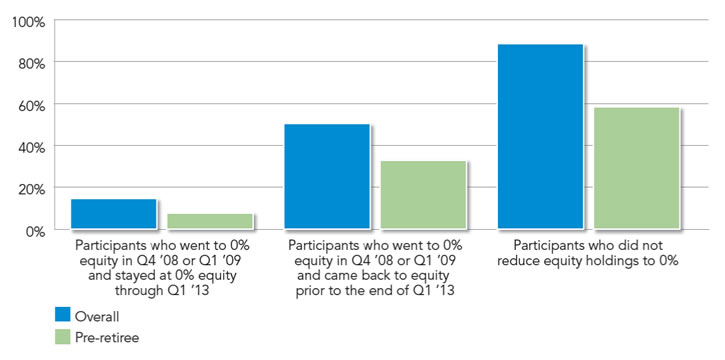

Fidelity has an interesting study out. The whole thing is worth a full read here.

While the only predictable thing about market behavior is its unpredictability, history has shown repeatedly that continued plan contribution and diversified, age-based asset allocation has delivered better results over time. During turbulent times, a steady course is most often the best one. A reactionary approach, including a focus on short-term market activity and related attempts to time the market, typically leads to poorer outcomes in the long term.

Besides, how you diversify matters greatly. BlackRock:

The fact is that in times of stress, correlations of stocks and bonds rises greatly. And a traditionally diversified portfolio contains a high degree of equity risk.

Read the whole thing here.