There are two kinds of moves in the market: defined and undefined. The defined moves have a reason attached to them. It can be a news about the company, a new product launch, a good earning postings or a good news for the industry itself. The undefined moves are… well.. they are just undefined.These undefined moves happen usually because of their momentum. A series of up-days keep pushing the stock up everyday.

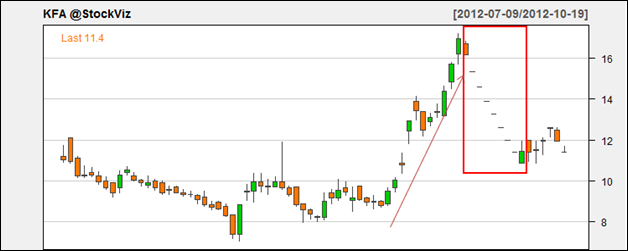

The stock rises until it has the momentum going on its side, and once it stops, this is how it falls.

The trend can be your friend… until the momentum ends.

When you go chasing momentum, don’t forget your faithful friend: the trailing stop loss. Unlike the usual stop-loss that you might set while placing your trades, these stop losses are calculated using highs and lows of a defined period and keep your losses at a minimum based on the recent highs.These are best suited for momentum scrips since they are not set to a particular price, unlike the normal stop losses, and automatically locks-in a profit once the momentum fades.

So, next time you want to trade with a momentum stock, be sure to have a trailing stop loss in place. This will be useful not only in minimizing your losses, but also in securing the profits that you have made over the holding period if used properly.