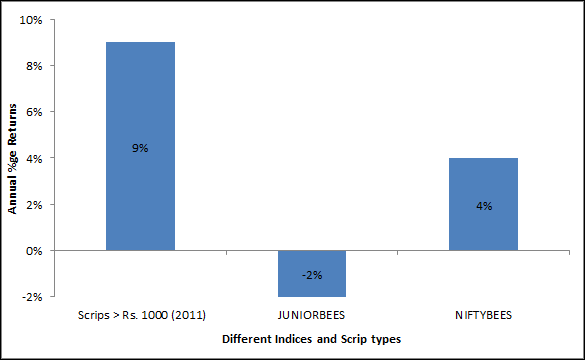

Stocks worth more than Rs.1000 a year ago show an average yearly return of 9%, versus the 4% and –2% of [stockquote]NIFTYBEES[/stockquote] and [stockquote]JUNIORBEES[/stockquote].

Is the 4 digit price tag a psychological barrier that stops you from buying them?

Average returns of the top 5 performers for the last year [stockquote]ULTRACEMCO[/stockquote] ,[stockquote]OFSS[/stockquote], [stockquote]DPSCLTD[/stockquote], [stockquote]EICHERMOT[/stockquote], and [stockquote]MRF[/stockquote] is about 50%.

Higher ticker prices do not necessarily mean “expensive”. Investors who can tune themselves to ignore the price and focus on valuation will profit from trades that typical retail investors stay out of.