Image via Wikipedia

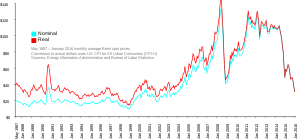

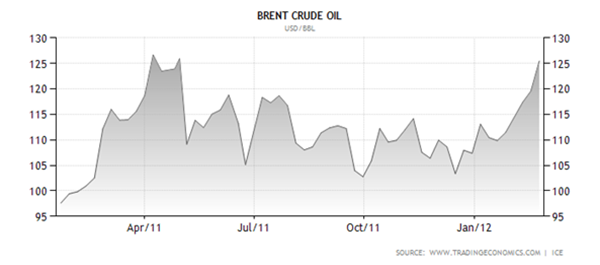

Crude oil, Indian economy’s biggest nemesis, is heading northwards again and further complicating the already battered macroeconomic picture. With the benchmark Indian crude oil basket flirting close to the $125/ barrel mark due to the Iran nuclear standoff, Finance Minister Pranab Mukherjee is sure to spend ‘sleepless nights’ fretting over the burgeoning subsidy bill.

In January, ratings agency Crisil noted that under recoveries on sale of regulated fuels would touch an all-time high of Rs 1.4 trillion (Rs 1, 40,000 crore ) in 2011-12 due to high crude oil prices and a weak rupee.

Since then, crude has surged even higher, from around $112/ barrel to the present level. A dollar increase in global crude oil price widens the industry’s under-recovery by Rs 4,000 crore annually and about Rs. 8,000 crore on account of every Re.1 depreciation.

The turnaround in Indian currency has cushioned the impact to some extent as the rupee has risen from 53/ dollar to around 49/ dollar presently.

But the damage has already been done. Under-recoveries on the sale of price-controlled fuels for FY-12 have skyrocketed to Rs 97,313 crore for the nine months ended December.

![clip_image002[10]](http://stockviz.biz/wp-content/uploads/2012/02/clip_image00210_thumb.png) The under-recoveries of oil marketing companies (OMC) as on February 16, 2012 on sale of diesel is Rs 12.31 per litre, Kerosene Rs 28.77 per litre and domestic LPG Rs 378 per cylinder, data from the Petroleum Planning and Analysis Cell showed. At these levels, daily under-recovery stands at Rs 465 crore.

The under-recoveries of oil marketing companies (OMC) as on February 16, 2012 on sale of diesel is Rs 12.31 per litre, Kerosene Rs 28.77 per litre and domestic LPG Rs 378 per cylinder, data from the Petroleum Planning and Analysis Cell showed. At these levels, daily under-recovery stands at Rs 465 crore.

The last time this (subsidy bill breaching Rs 100,000 crore) happened was in FY ’09 when crude oil touched an all-time high of above $145/ barrel.

The share of subsidy burden for upstream oil companies has been hiked to 37.91 per cent for the first nine months (April-December) of this fiscal (FY 12), compared with 33% in the year-earlier period.

The soaring under-recoveries has a double whammy effect- while it would adversely affect the profitability of OMCs, it would also inflate the country’s subsidy bill which is bound to expand the fiscal deficit apart from fuelling inflationary pressures.

Fiscal deficit is expected to surpass the budgeted target of 4.6% by over 1% driven largely by bloating oil subsidies.

The Centre spent Rs 38,386 crore in petroleum subsidies in 2010-11 and estimated this fiscal year’s bill at 23,640 crore.

Even as plummeting economic growth and deteriorating business conditions have severely hit its fiscal calculations, Pranabda and his battery of economic experts will have to contend with a high import and subsidy bill unless it raises retail prices as is widely expected.

![clip_image002[8]](http://stockviz.biz/wp-content/uploads/2012/02/clip_image0028_thumb.png)