This is a review of the fifth chapter of John J. Murphy’s Technical Analysis of the Financial Markets.

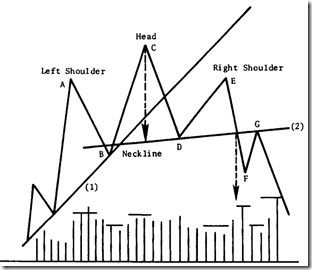

The Head & Shoulders Reversal Pattern

The basic ingredients are:

- A prior uptrend

- A left shoulder (A) followed by a corrective dip (B)

- A rally into a high on light volume (C)

- A decline (D) that moves below (A)

- A third rally (E) that fails to reach (C)

- A close below the neckline (F)

- A return move back to the neckline (G) followed by new lows.

Once prices move through a neckline and completed the h&s pattern, they should not re-cross the neckline again. A decisive penetration of the neckline might indicate a false alarm.

The inverse head & shoulders is pretty much the inverse of the image above.

Next up: Triple Tops & Bottoms