Last part of the review of the 4th chapter of John J. Murphy’s Technical Analysis of the Financial Markets.

Reversal Days

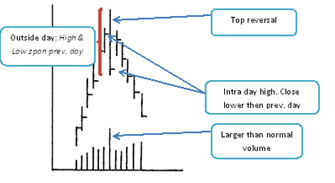

A reversal day happens either at the top of an uptrend (top reversal day) or at the bottom of a downtrend (bottom reversal day). A top reversal day is the setting of an intraday high for the uptrend followed by a close below the previous day’s close. A bottom reversal day is the setting of an intraday low for the downtrend followed by a close above the previous day’s close. The wider the intraday range, the higher the probability of a near term trend reversal.

A reversal day happens either at the top of an uptrend (top reversal day) or at the bottom of a downtrend (bottom reversal day). A top reversal day is the setting of an intraday high for the uptrend followed by a close below the previous day’s close. A bottom reversal day is the setting of an intraday low for the downtrend followed by a close above the previous day’s close. The wider the intraday range, the higher the probability of a near term trend reversal.

A reversal pattern can form on monthly and weekly charts and usually bears greater significance compared a reversal day.

Price Gaps

Price gaps are areas in the chart where no trading has taken place. There are three types of gaps:

- Breakaway: the penetration of a resistance level usually occurs through a Breakaway Gap and signifies a major move. It occurs on heavy volume and upside gaps usually act as support levels. Its important that prices do not fall below these gaps during an uptrend.

- Runaway: formed after a trend is in play for a while (usually the halfway point), these are prices leaping upward on moderate volume. If these gaps are filled, then its usually a sign of weakness.

- Exhaustion: as the name suggests, it usually occurs at the end of a trend. After the identification of both the Breakaway and Runaway gaps, one should start expecting the Exhaustion gap. The filling of this gap during an uptrend is a bearish signal.

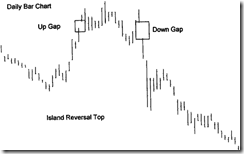

The Island Reversal Pattern

Sometimes, after an upward exhaustion gap, prices trade within a narrow range before gapping to the downside. This leaves the few days of price action looking like an “island” and indicates a trend reversal that needs to be confirmed with the overall trend structure.

Up Next: Chapter 5: Reversal Patterns