Image via Wikipedia

There a mind-boggling number of mutual funds operating in India. According to the AMFI, there are about 42 fund houses, offering more than 4500 funds! They span equities, fixed-income and hybrids with a whole host of options available for pay-outs, tax-planning, etc. With so much on offer, one would think that there must be a solid value proposition that allows so many players in the market.

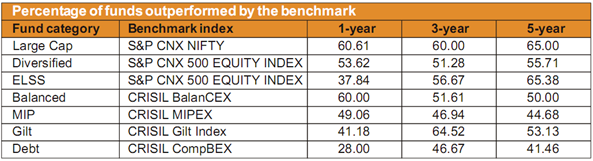

However, it appears that most mutual funds in India underperform their benchmarks! According to a June 2011 study by CRISIL:

Among equity-oriented funds, majority of large cap and diversified equity funds underperformed their benchmark indices, viz, the S&P CNX Nifty and the S&P CNX 500, respectively, in all three time periods of analysis (1, 3 and 5 years).

In case of equity-linked saving schemes (ELSS), majority of funds have underperformed the

benchmark S&P CNX 500 over the 3 and 5 year time frames. The ELSS category (investments are intended for tax saving and typically have a 3-year lock-in) witnessed 57% and 65% of the funds underperforming the benchmark S&P CNX 500 over the 3 and 5 year time frames, respectively.

Here’s a snippet from the report:

So the question remains: why are investors paying asset management fees to fund-managers for under-performing the benchmarks? Why not invest in ETFs where you are at least tracking the market (at a much lower fee)?