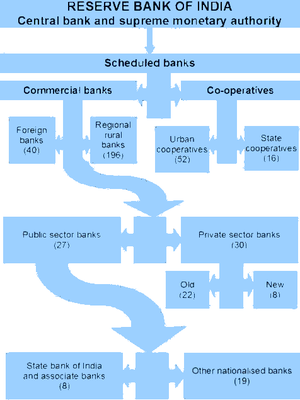

Image via Wikipedia

The corporate debt market (even for the highest rated corporates) has failed to take off. And The reason has very little to do with the availability of capital or the existence of securities and market instruments. It has more to do with the strength of the legal system in India and the existence of strong bankruptcy, insolvency and receivership laws and the effectiveness of their speedy and smooth implementation. What happens when things go bad, and a company or a special purpose entity is unable to meet all its payment obligations, holds the key to the development of a vibrant debt market.

The usury by the Indian banking system exacts a huge toll on Indian companies (borrowers) and significantly reduces the efficiency of the Indian economy. Unless the government is able to put in place the structural changes required to its legal and regulatory systems and ensure their effective implementation, its debt markets will remain underdeveloped, placing its corporations at a disadvantage