Image via Wikipedia

I recently posted a link to an FT.com article that said that volume in the cash market has been dropping. I decided to do some digging myself to see how the trends are in the NSE.

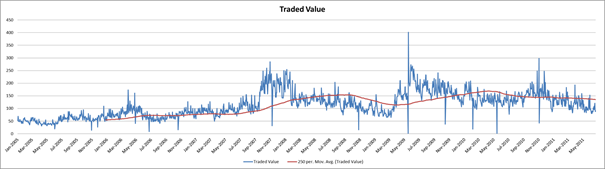

Turns out, there is some truth to it. If you look at the value traded since 1995, it does look its flat lined.

You see the crash of 2000 and the recovery in this chart:

However, post-2005, it looks like there’s been a very tepid bounce back in value traded (volume x price) and it has been dipping lately.

Doesn’t bode well for the capital markets in general if everybody wants to be a derivatives trader. Ask the CDO bankers at Merrill Lynch!

Source: StockViz @ Microsoft Azure