Image via Wikipedia

Quite often, the reasons that investors give to be bullish on Indian stocks are: millions of people are rising above poverty and are experiencing the joys of consumerism for the first time. Almost all of India is connected via mobile phones and cable TV is making inroads in the remotest of towns. So in effect, what they are saying is that the stock-market is going to rise with India’s GDP. Is that really the case? Are stock-market returns correlated with GDP growth?

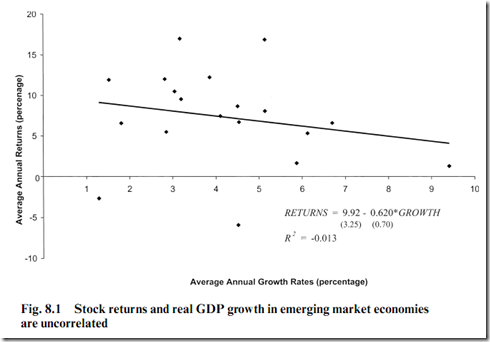

A study by Peter Henry and Prakash Kannan seems to indicate not:

This only reconfirms the theory that stock-markets are leading indicators of the economy, not the other way around. And somewhat counter-intuitively, investing in low growth countries actually yielded higher returns!

So what does this mean for Indian investors? The key take-away is to not get swayed by all the “India Shining” callouts and focus on the fundamentals of individual stocks. A rising tide lifts all boats but you only find out who is swimming naked when the tide goes out (–Warren Buffett).