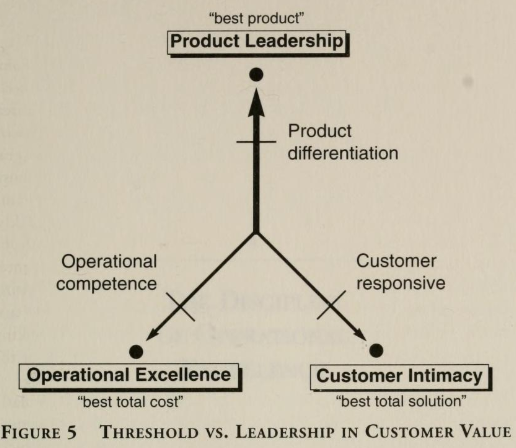

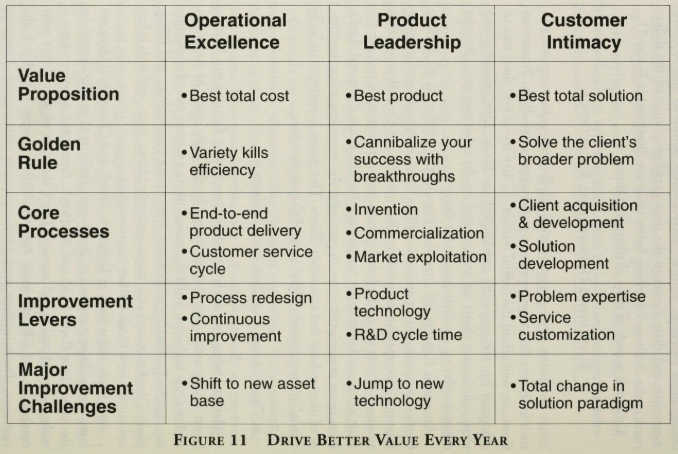

The Discipline of Market Leaders (Amazon,) is about the importance of focusing on either one of cost, innovation, or service.

A company cannot be everything for everybody. It can be a highly efficient low-cost provider of a utility, or it could be a high-cost provider of innovative products, or it could be so close to its customers that they stick with it for its superior service.

The general message of the book could be useful for investors in old-economy stocks. Figuring out how a company scores along these drivers of value could help in evaluating the robustness of the “moat.”

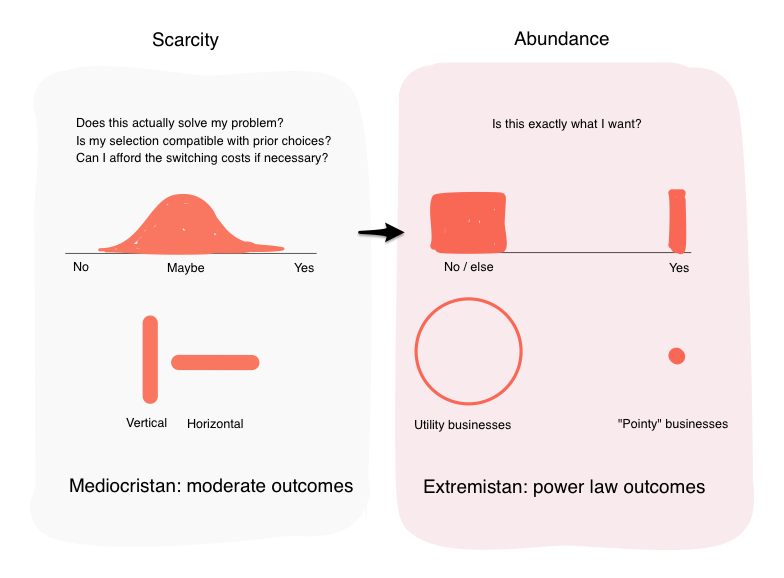

However, things change. Consider this chart from Understanding Abundance:

Along with cost/innovation/service, in the age of abundance, companies need to also choose between being a “utility” business or a “pointy” business. The drivers of value have shifted.

All said, the book was published in the late-90’s and hasn’t aged well. The examples are dated and some of the exemplar companies have gone bankrupt.

Recommendation: Skip it.