The beta of a portfolio is often used to hedge it against the market. We did a brief intro in our post: A Gentle Introduction to Hedging. And previously, we discussed how the Hamming distance can unearth relationships by simplifying the data that we have. Here, we bring the two concepts together.

Linear-payoffs

CAPM Beta is a glorified linear regression between two return streams. It is useful in the context of linear-payoff portfolios.

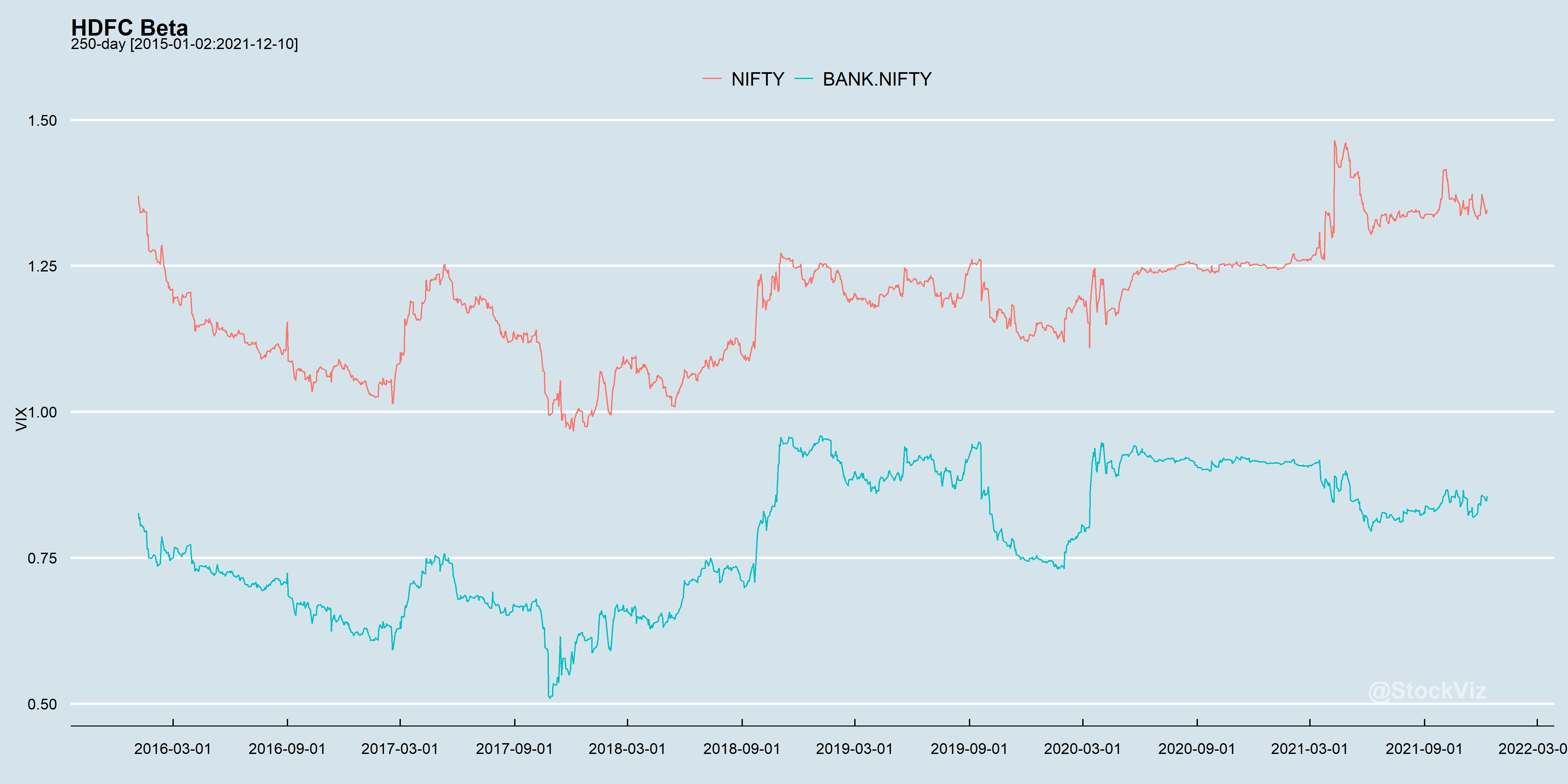

For example, a typical long-only fund can use its portfolio beta to measure sensitivity to the market and to hedge against it. A single-stock portfolio with only HDFC in it will exhibit varying beta wrt different markets.

If you are after a linear-payoff (long stocks or futures outright,) beta can be a useful metric to track.

Convex-payoffs

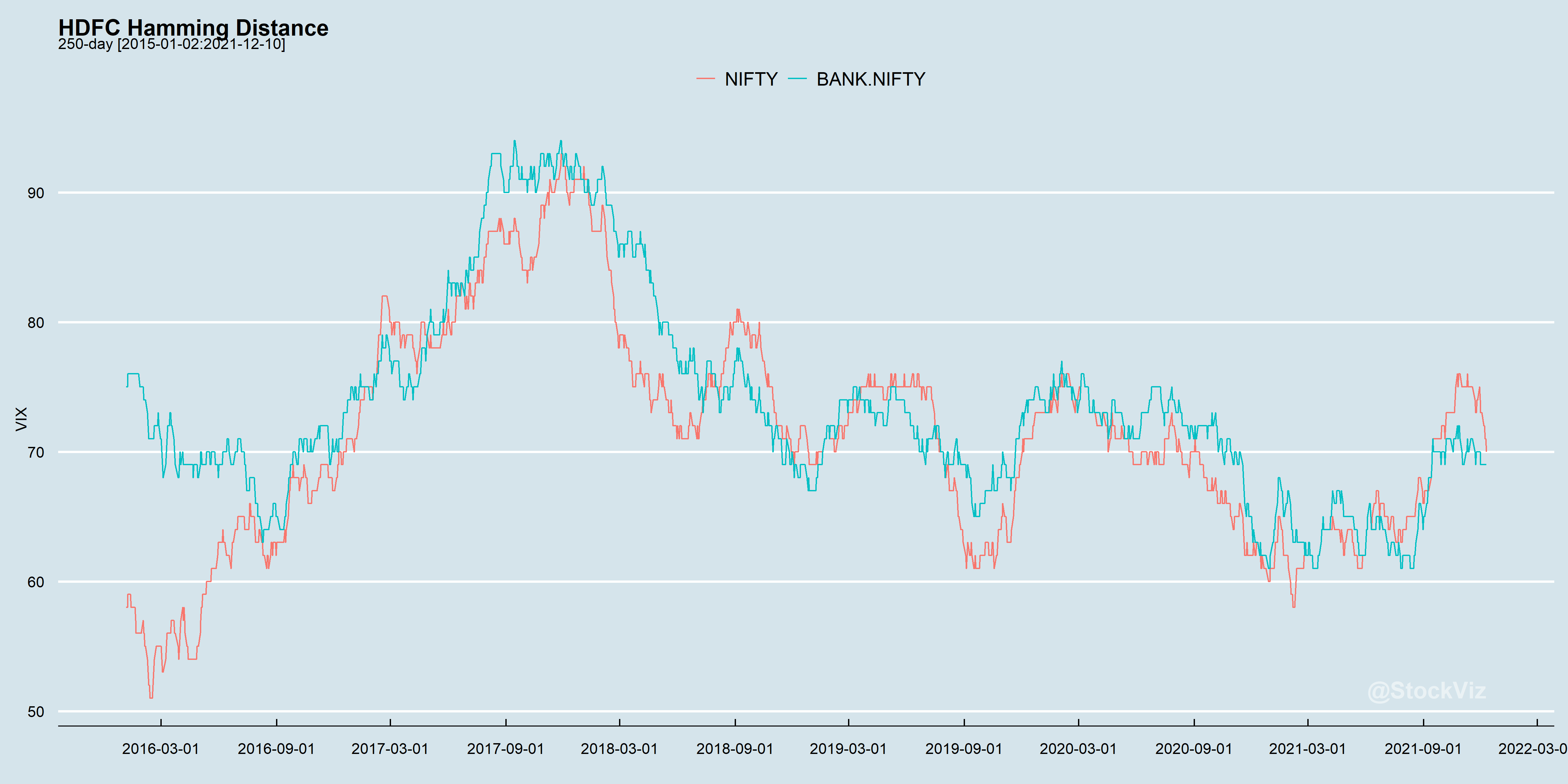

Betas are useless if you are trying to hedge or analyze a portfolio with convex payoffs. Like, say, an options portfolio. Here, you care more about up/down days over an index. This is where Hamming distances are useful.

A Hamming distance of 70 over a 250-day return stream means that by flipping the direction of just a third of the sample, the up/down series will equalize.

In our HDFC-only single-stock portfolio example above, we see that its beta over NIFTY/BANK-NIFTY is vastly different whereas its Hamming distances closely track each other. This behavior can be used to construct trades that go beyond being long-only equity.