In MSCI Country Index Correlations, we looked at country index correlations through time. Here is a quick update that “flattens” out the rolling correlation of the momentum versions of these indices with the MSCI INDIA MOMENTUM Index.

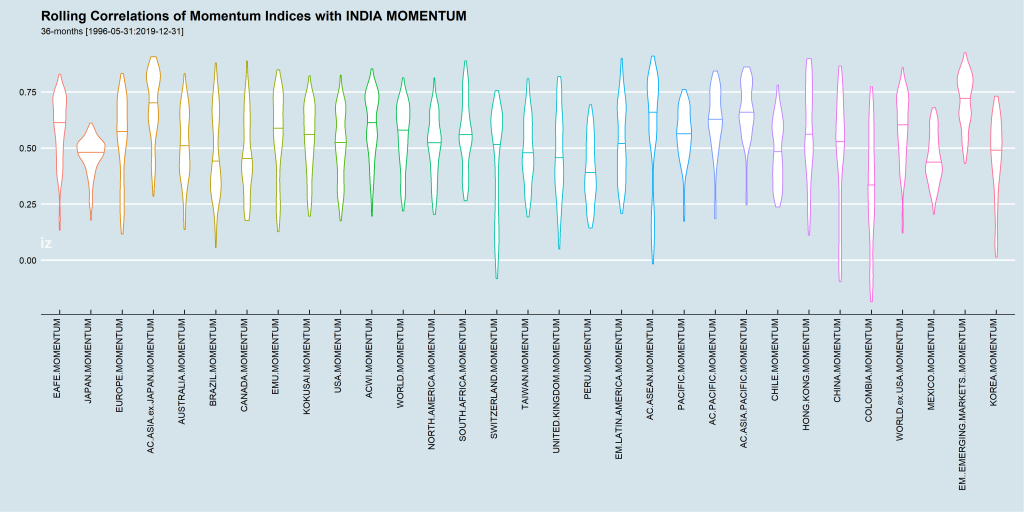

Three-year Rolling Correlations

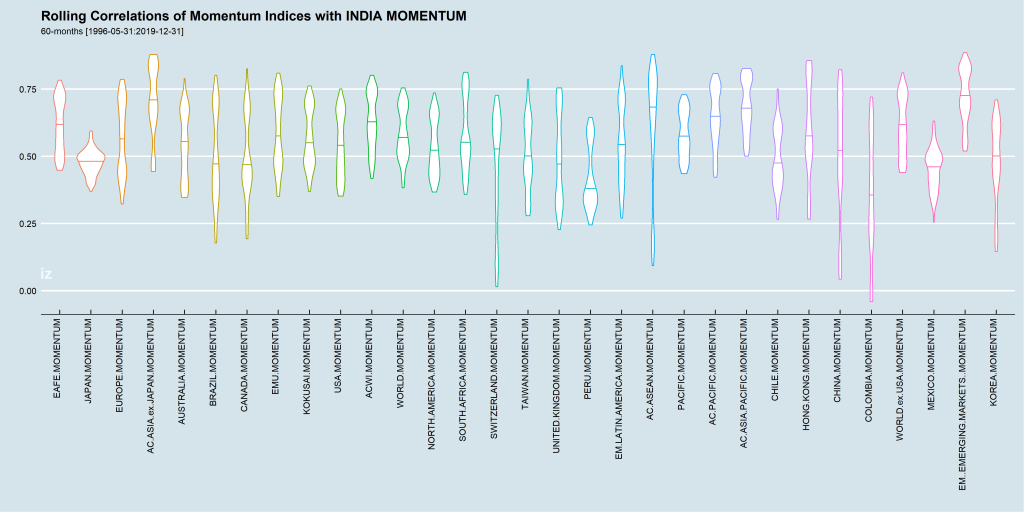

Five-year Rolling Correlations

Take-away

Momentum is a lose proxy for sentiment and the tides of optimism floats all boats. All equity markets are correlated with each other – some strongly (HONG KONG) and some weakly (CANADA.)

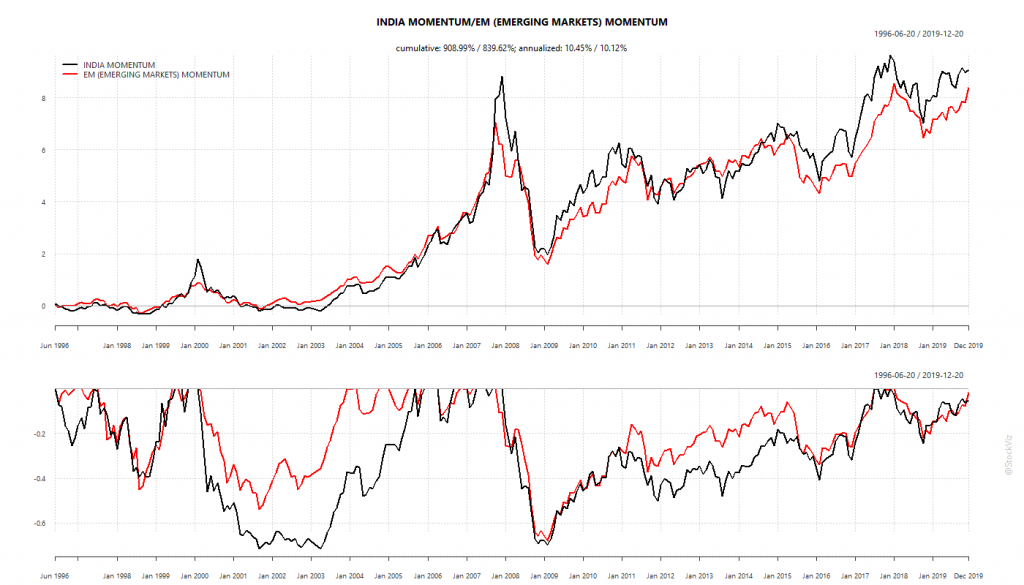

The median correlations across both 3- and 5-year rolling periods are greater than +0.70 between INDIA MOMENTUM and EMERGING MARKETS MOMENTUM.

No market is an island. Sentiment is tail that wags the dog.