India Gate (Photo credit: aroris)

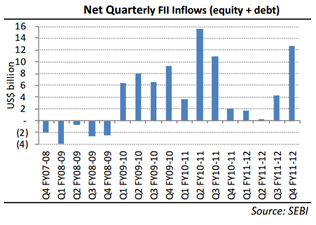

Just when it seemed like foreign institutional investors (FIIs) have reaffirmed their faith in Indian equities, the enthusiasm has fizzled. After pouring hefty funds into the Indian equity market in the first two months of the year, overseas investors turned bearish in April and pulled out Rs 777 crore.

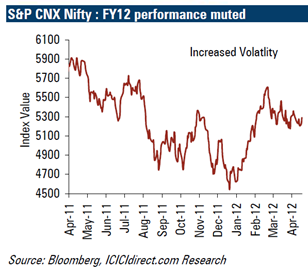

Jan and Feb saw a smart rally with the Sensex jumping over 2000 points or over 12% as foreign funds pumped $8.72 billion into Indian stocks on hopes of monetary easing by the Reserve Bank of India (RBI) and the improving liquidity position. Nifty, which hit a high of 5600 points in mid-Feb, has consistently drifted downwards and has been trading in a narrow range. Higher foreign inflows have also been aided by cheap loans doled out by the European Central Bank (ECB) through long term refinancing operations (LTRO).

Post the Union Budget in mid-March, uncertainty surrounding General Anti Avoidance Rules (GAAR) and continued paralysis in decision making at the centre has resulted in foreign investors adopting a wait and watch stance. Especially, proposals regarding GAAR have spooked foreign investors as they fear tax authorities could use them to deny the benefits of Double Taxation Avoidance Agreement (DTAA) to a private investment fund or vehicle organized in Mauritius. A huge chunk of foreign funds in equities comes from companies that are registered in the tiny island nation and are exempted from tax in India under DTAA with Mauritius.

Post the Union Budget in mid-March, uncertainty surrounding General Anti Avoidance Rules (GAAR) and continued paralysis in decision making at the centre has resulted in foreign investors adopting a wait and watch stance. Especially, proposals regarding GAAR have spooked foreign investors as they fear tax authorities could use them to deny the benefits of Double Taxation Avoidance Agreement (DTAA) to a private investment fund or vehicle organized in Mauritius. A huge chunk of foreign funds in equities comes from companies that are registered in the tiny island nation and are exempted from tax in India under DTAA with Mauritius.

Last year, the index fell by nearly 25%, the second worst annual loss, as foreign investors pulled out over Rs 27,000 crore after a series of rate hikes by the RBI to fight inflation hurt factory output while Europe’s debt crisis stalled global growth and tempered demand for emerging-market assets.

Last year, the index fell by nearly 25%, the second worst annual loss, as foreign investors pulled out over Rs 27,000 crore after a series of rate hikes by the RBI to fight inflation hurt factory output while Europe’s debt crisis stalled global growth and tempered demand for emerging-market assets.

But India’s problems are far from over. While fiscal deficit has been a problem for sometime now, the ballooning current account deficit is a major cause of worry.

The current account deficit was $19.6 billion in the December quarter, higher than $9.7 billion a year earlier. The widening current account deficit coupled with sluggish capital inflows will further worsen the macro-economic picture and cloud outlook for Indian equities.

Twin deficits, policy logjam, regulatory flip-flops on tax issues like GAAR and retrospective amendments and the likelihood of a rebound in inflation threatens to derail India’s growth story.

Twin deficits, policy logjam, regulatory flip-flops on tax issues like GAAR and retrospective amendments and the likelihood of a rebound in inflation threatens to derail India’s growth story.

Since FIIs are the driving force of Indian markets, any thoughts of regaining 21k and 6k for both Sensex and the Nifty rests on the government getting its act together on both policy and execution front, lower global commodity prices, mainly oil, and inflation staying in ‘comfort zone’.