Risk taking is inherently failure prone. Otherwise, it would be called sure-thing taking. –Jim McMahon (American Football Player)

The most favored assets for the Indian middle class remains gold and real-estate. And this is not a post-global-financial-crisis story, it has remained so since my grandmother’s time. The oft cited reasons are that these are “safe” i.e.: they will not depreciate in value. And evidence over the past 20 years suggests that it has indeed been so. But will it be forever into the future?

So lets see what happened over the last few years:

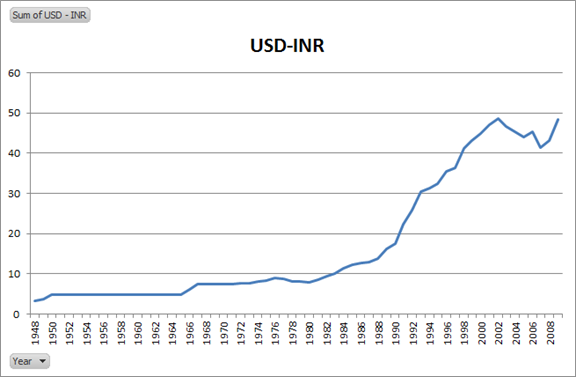

Devaluation: in 1980 1 USD bought about 8 INR. Now it buys about 50 INR.

The stock market had its share of controversies, roller-coasters and outright fraud.

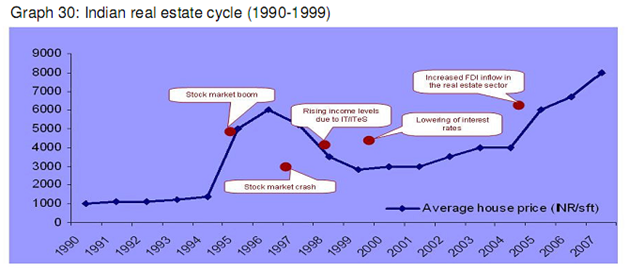

Increasing urbanization post 1990 lead to a real estate boom in the cities.

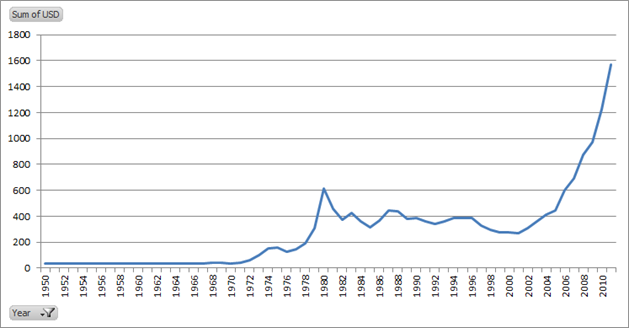

And Gold went parabolic.

So basically, if you ask your mom, wife or uncle, the underlying belief would be that these trends are going to continue forever.

Please allow me to make a counter-point: What is the bid-offer for all these “investments”? For gold ornaments it about 20% (try selling a bunch of old jewelry). For real estate (land) it’s a 3-6 month process and trying to sell a 5 year old residential flat might give you a heart attack.

Stocks and ETFs, on the other hand, are liquid. If you want to buy gold as part of an investment portfolio, buy GOLDBEES or if you want to buy real estate as an investment, buy a basket of RE stocks. I am not advocating an “either/or” scenario. Its just that conventional wisdom has such a strong recency bias that you need to verify why it so by taking a step back every once in a while.