Image via Wikipedia

When markets wobbled, central banks slashed interest rates.

As a result governments are reluctant to cut the deficit too quickly for fear of sending their economies back into recession.

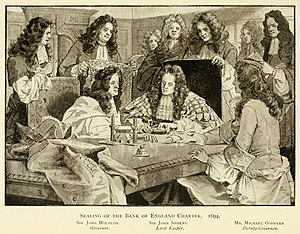

Turning to monetary policy, interest rates are 1.5% or below in most of the developed world and are negative in real terms (the Bank of England kept rates at 2% or more for the first 300 years of its existence).

But high debt ratios (particularly in the household sector) make central banks very uneasy about raising interest rates for fear of ushering in another round of the credit crunch.

Governments and central banks have thrown a lot of stimulus at the economy and the result has been a fairly sluggish recovery.