ATR: Average True Range

Developed by J. Welles Wilder, this is an indicator measuring volatility. Volatility measures that only look at closing prices distort the picture. To capture the essentials of volatility even in gap or limit moves, he came up with the Average True Range indicator. This indicator does not indicate the direction of move it just provides indication of volatility.

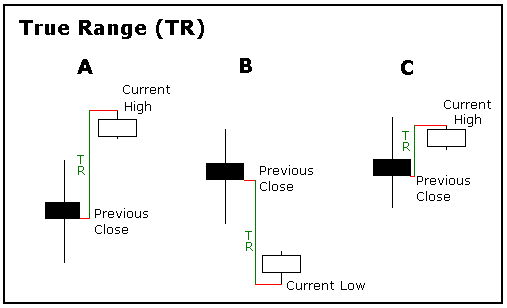

Let us first understand True Range: It is defined as the greatest of the following:

- Method 1: Current high less current low

- Method 2: Current high less the previous close (Absolute value)

- Method 3: Current low less the previous close (Absolute value)

You must be wondering about the use of absolute value, please remember that this indicator gives you the volatility (and hence positive or negative values do not impact indicator).

The three different methods discussed are being portrayed in the above image. Note how the true range will always be positive because of the use of absolute value.

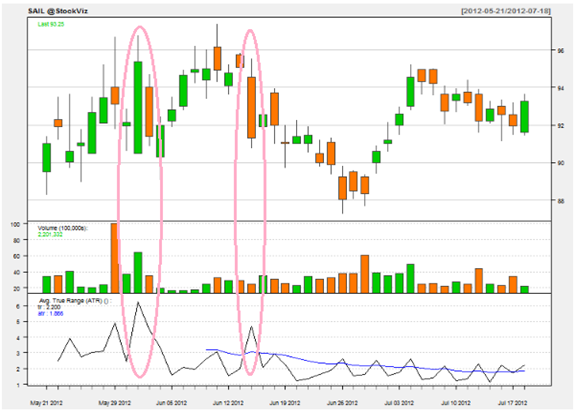

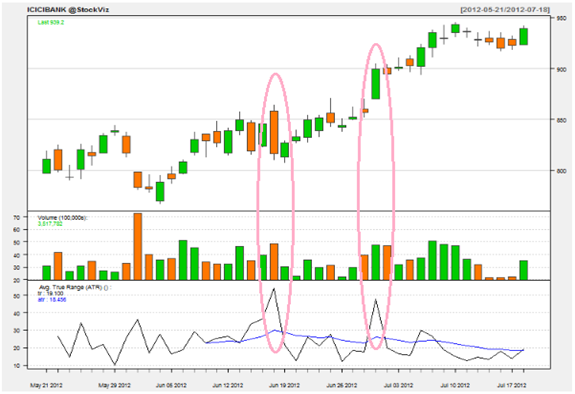

So, how to read the ATR values? A volatile period will usually have a high ATR value. So long candlesticks are accompanied with higher ATR values.

Another point to remember is because of the absolute values being used in the calculation, the ATR values of lower priced stocks and higher priced stocks are quite different and are not comparable. The good thing about the indicator is how well it indicates the volatility changes. The ATR value might be different (different ranges) but a similar volatility will produce similar graph.

See how the large moves are accompanied by a spike in ATR values? ATR is a unique indicator that reflects the degree of interest and disinterest in a move. Strong moves in either direction are accompanied by large ranges, uninspiring moves might be accompanied by relatively narrow ranges. Hence ATR can be used to validate enthusiasm behind a move or a breakout.

So be on a lookout for the ATR ranges if you want to keep a track of the volatility of your scrip.

Happy technical trading!