Meet the worst nightmare of stock-pickers and the best friend of technical traders: Correlation.

This year has been unkind to stock-pickers as markets have tended to move in unison, with price moves increasingly driven by the ebb and flow of investors’ fears (risk-on/risk-off) over the economic environment. We setup a correlation matrix between the NIFTY50 stocks and the index itself to see how we faired this year.

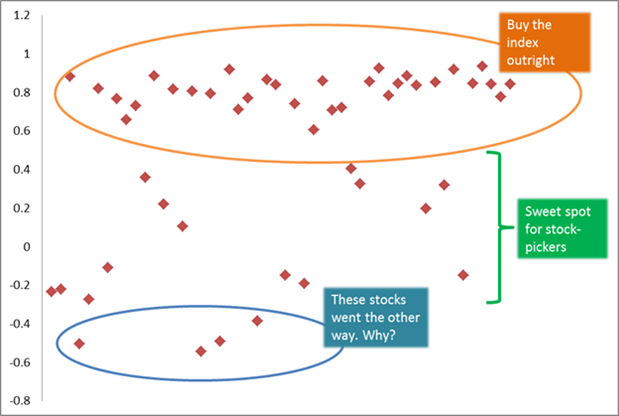

The vertical axis here is the correlation between individual stocks (dots) with the index.

Now lets do a quick gut-check. The top 3 stocks with the highest correlations with the index were:

RELCAPITAL, ICICIBANK and STER. A quick look at their charts show that it is indeed so. The ones that were closer to zero are: GRASIM, SIEMENS and RANBAXY. They may have been highly volatile, but we are only looking at correlation for now.For stocks that went the other way, we have: HEROMOTOCO, BAJAJ-AUTO and HINDUNILVR.

There’s really no actionable information here, except that instead of tracking close to 30 stocks in the index, you are better off just buying the NIFTYBEES and saving yourself a lot of effort.

For the more inquisitive, the data can be found on google docs.