Image via Wikipedia

According to Wikipedia, inflation is a rise in the general level of prices of goods and services in an economy over a period of time.When the general price level rises, each unit of currency buys fewer goods and services. Consequently, inflation also reflects an erosion in the purchasing power of money – a loss of real value in the internal medium of exchange and unit of account in the economy.

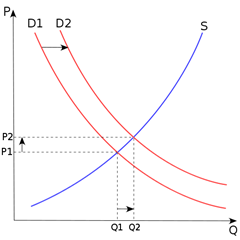

In order to understand where inflation comes from, lets begin something that we all intuitively understand: demand & supply. As demand for a good goes up, for the same level of supply, the price goes up.

Here, S is the supply curve, D is the demand curve, P is the price level and Q is the quantity of the product sold.

So if Demand increases from D1 to D2, price increases from P1 to P2.

What causes the shift in the Demand and Supply curves?

In India, as recently as Nov/Dec 2010, we had a supply-side shock in onions. In a matter of weeks, prices of onions shot up 3x-4x the regular price. This is typical in local food supplies (happens to tomatoes and sugar on a regular basis as well.) Typically, supply-side shocks are acts of nature and can be handled by warehousing enough supplies to tide over bouts of disruption. For example, if we had sufficient food-processing capabilities, we should not be seeing seasonal spikes and cliffs in food prices.

Typically, supply-side shocks also come from herding behaviour of suppliers: seeing onion prices hit Rs. 50, they may plant more onions for the next season, resulting in a glut and collapsing price. The glut causes them to reign-in onion growing for the next season resulting in shortages and higher prices. It also comes from distortion in pricing signals. For example, the government sets a floor-price for most grains. The floor-price typically has more to do with favouring a particular demographic than with market levels. This distortion in pricing signals means that the farmer is now forever dependent on the government both as his largest customer and as a price setter.

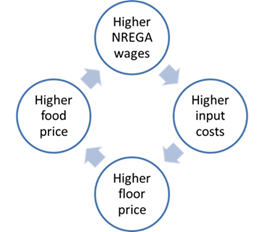

Another way inflation gets embedded is when there is a shortage in labour market that leads to increasing wages that in turn leads to increasing end prices. And seeing end prices increase, labour starts demanding higher wages, leading to an inflationary spiral. The NREGA program has been accused of st oking such a spiral by setting a floor on rural wages. Higher NREGA wages meant land-owners had to compete with the government for labour, resulting in higher input costs which were then compensated by higher floor prices for grains. Higher food prices meant that NREGA wages had to increase to keep up.

oking such a spiral by setting a floor on rural wages. Higher NREGA wages meant land-owners had to compete with the government for labour, resulting in higher input costs which were then compensated by higher floor prices for grains. Higher food prices meant that NREGA wages had to increase to keep up.

Inflation also goes up when the government increases the amount of money in the system either by running huge deficits or by just printing money (Quantitative Easing, in the US Fed’s words). When you have more money chasing the same amount of goods, inflation has nowhere to go but up. In fact, currency debasement has been the preferred choice of governments to tide over funding gaps when tax hikes are no longer feasible. For example, Roman coins – the silver denarius, was 95% silver when they were first introduced. By 117 AD, it was 85% silver, in 180 AD it was 75% and by 211 AD (Caracalla’s reign) it was 50%. But the real crisis came after Caracalla, between 258 and 275, in a period of intense civil war and foreign invasions. The emperors simply abandoned, for all practical purposes, a silver coinage. By 268 there was only 0.5% silver in the denarius. The fascinating account of the fall of the Roman empire can be read here.

So there you go. To summarize, the most common reasons for inflation are:

- Supply-side shocks

- Increasing Demand

- Disruption of pricing signals

- Shortage of labour

- Currency debasement

Thanks for making it so simple… I hadn’t known about all the factors for inflation.

Cheers

Freya

Thanks Freya. Let me know if you want me to write about anything else. Cheers!