Equities

Commodities

| Energy |

| Brent Crude Oil |

+1.06% |

| Ethanol |

-9.04% |

| Heating Oil |

-1.02% |

| Natural Gas |

+0.03% |

| RBOB Gasoline |

+3.15% |

| WTI Crude Oil |

+0.06% |

| Metals |

| Copper |

-0.32% |

| Gold 100oz |

-0.71% |

| Palladium |

-2.65% |

| Platinum |

-2.27% |

| Silver 5000oz |

-4.30% |

| Agricultural |

| Cattle |

-0.59% |

| Cocoa |

+2.78% |

| Coffee (Arabica) |

+0.17% |

| Coffee (Robusta) |

-2.17% |

| Corn |

-0.38% |

| Cotton |

-7.18% |

| Feeder Cattle |

+0.40% |

| Lean Hogs |

+0.09% |

| Lumber |

-5.73% |

| Orange Juice |

-2.53% |

| Soybean Meal |

-25.03% |

| Soybeans |

-12.21% |

| Sugar #11 |

-2.24% |

| Wheat |

-4.43% |

| White Sugar |

+4.07% |

Credit Indices

| Index |

Change |

| Markit CDX EM |

-0.28% |

| Markit CDX NA HY |

-0.08% |

| Markit CDX NA IG |

-0.35% |

| Markit CDX NA IG HVOL |

+0.88% |

| Markit iTraxx Asia ex-Japan IG |

+2.32% |

| Markit iTraxx Australia |

+1.30% |

| Markit iTraxx Europe |

-0.32% |

| Markit iTraxx Europe Crossover |

-0.36% |

| Markit iTraxx Japan |

-0.21% |

| Markit iTraxx SovX Western Europe |

+0.68% |

| Markit LCDX (Loan CDS) |

-0.06% |

| Markit MCDX (Municipal CDS) |

+3.00% |

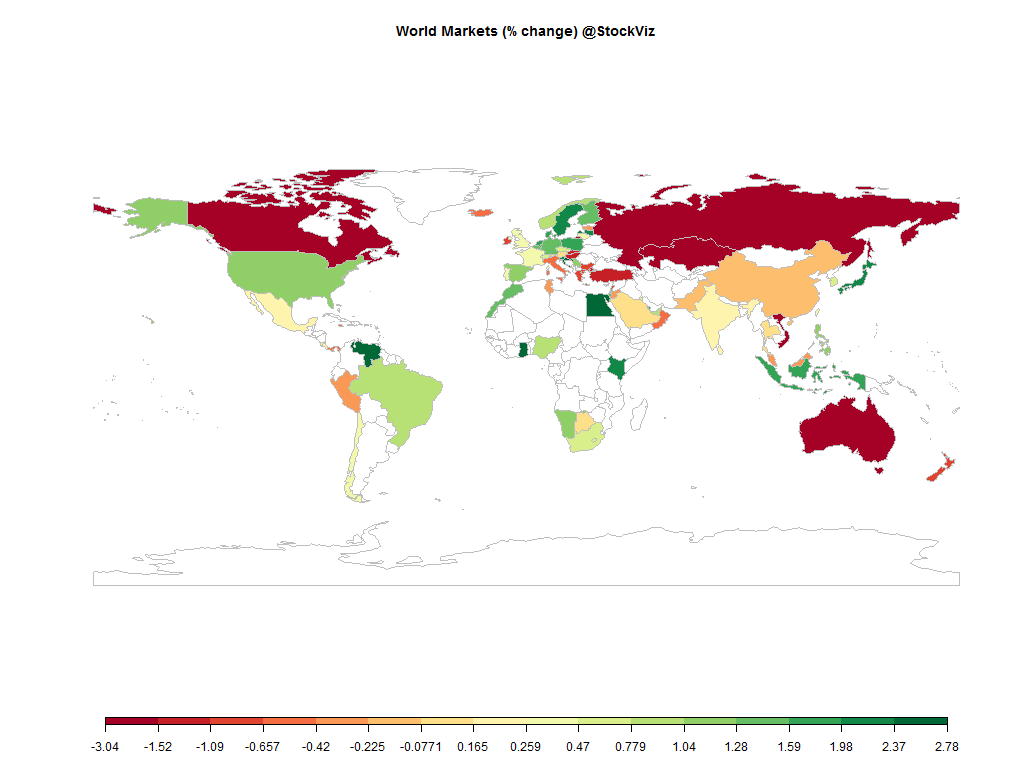

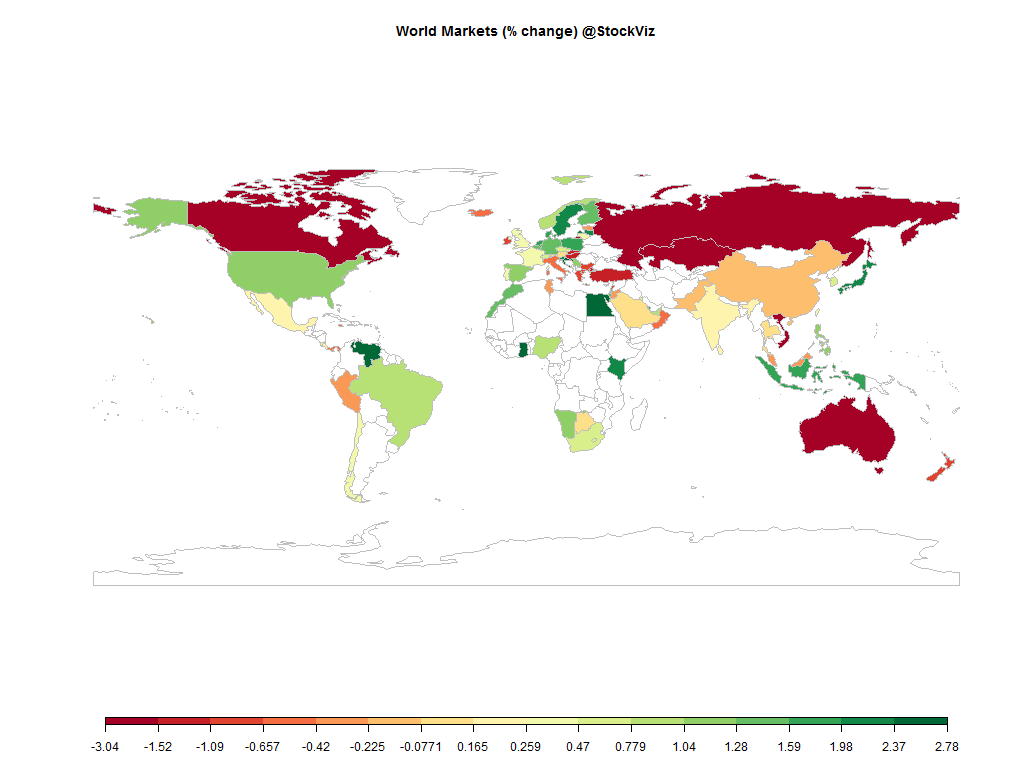

The Dollar rallied across the board and precious metals took it on the chin. Bad news about the economy is good news for Japanese markets – BOJ will continue to hoover up any and all assets as it fights deflation and tries to kick start a moribund economy. The Scotland “No” vote prevented a disintegration of the British Pound and their banking system. Alibaba popped at its debut in NYSE to a market value of $230 billion on a fully diluted basis.

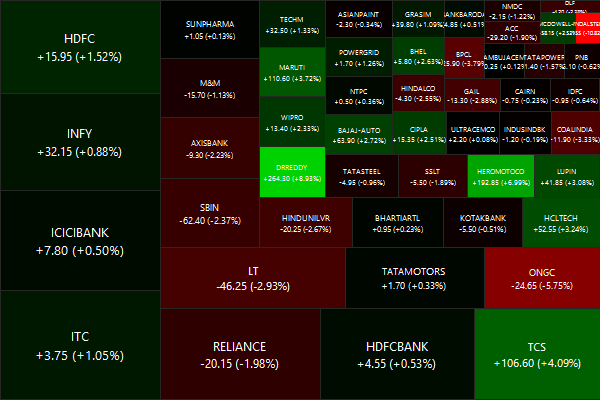

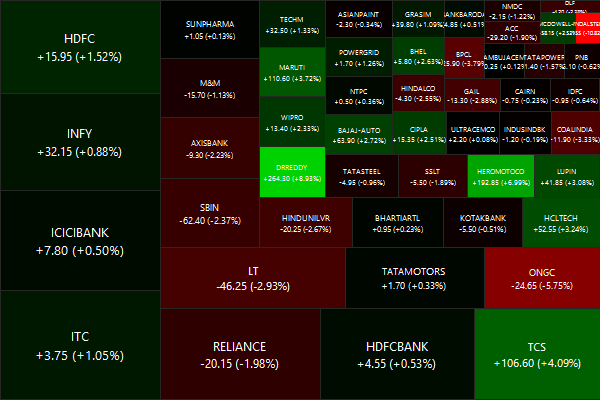

Nifty Heatmap

Index Returns

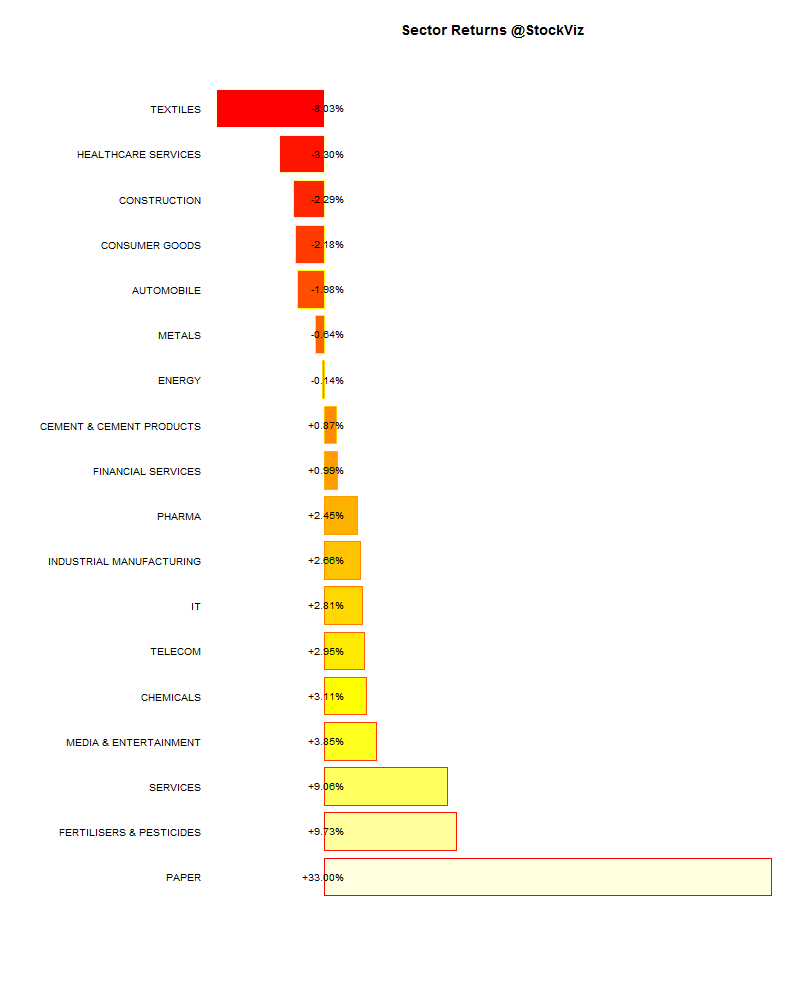

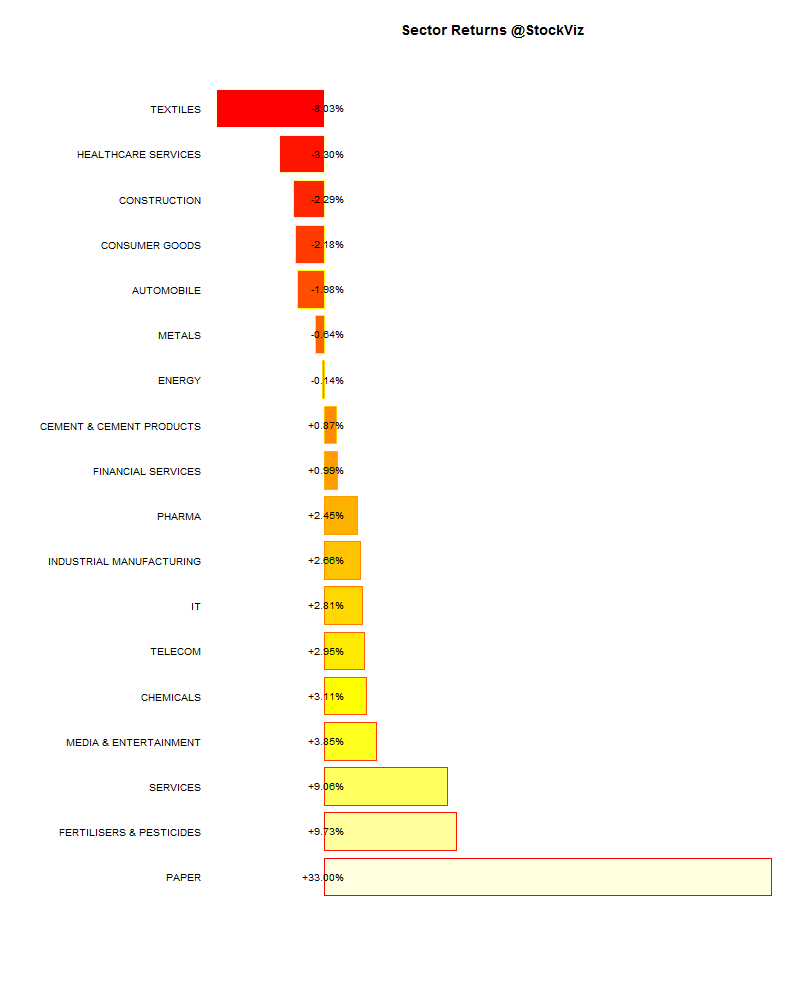

Sector Performance

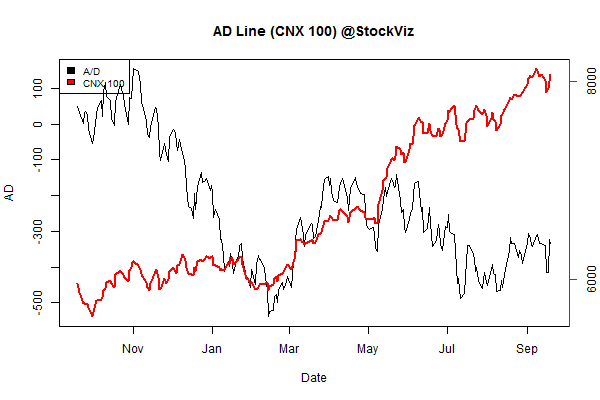

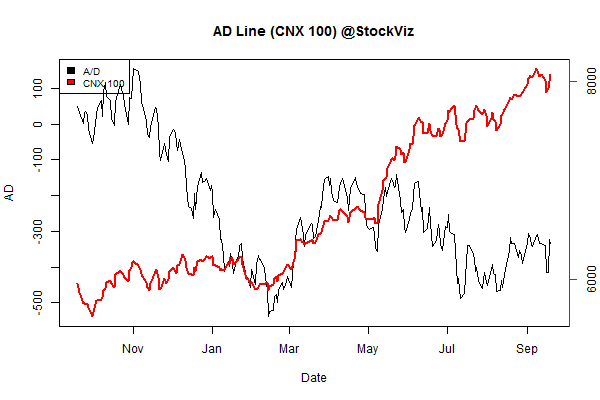

Advance Decline

Market Cap Decile Performance

| Decile |

Mkt. Cap. |

Adv/Decl |

| 1 (micro) |

-1.51% |

74/71 |

| 2 |

-2.23% |

72/72 |

| 3 |

-1.08% |

67/77 |

| 4 |

-0.32% |

69/75 |

| 5 |

-1.86% |

67/77 |

| 6 |

-1.24% |

70/75 |

| 7 |

+0.60% |

70/74 |

| 8 |

-0.34% |

76/68 |

| 9 |

-0.32% |

74/70 |

| 10 (mega) |

-0.16% |

67/78 |

One wonders how the NIFTY ended in the green this week…

Top Winners and Losers

Infratel: the volatility in the stock is enough to give you ulcers. Yes Bank collapsed on hitting its FDI cap. It will be a good buy soon…

ETFs

PSU banks will be hitting the market soon with fund raising plans… we should all do our duty as tax-paying Indian citizens and avoid them.

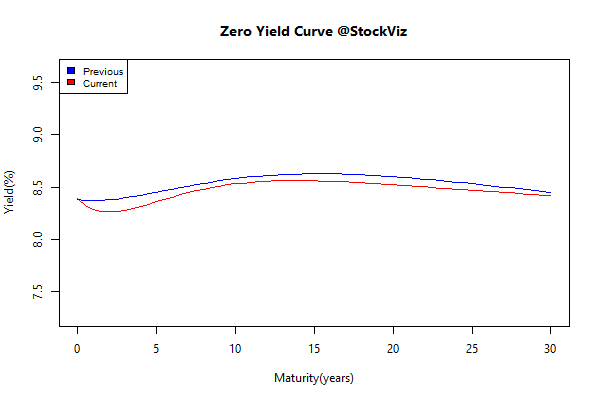

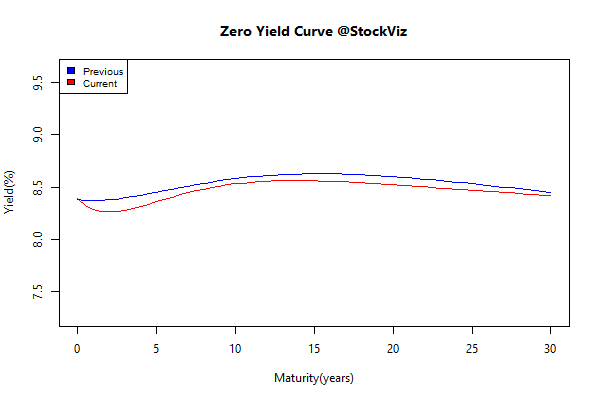

Yield Curve

Bond Indices

| Sub Index |

Change in YTM |

Total Return(%) |

| GSEC TB |

+0.36 |

+0.06% |

| GSEC SUB 1-3 |

+0.31 |

-0.28% |

| GSEC SUB 3-8 |

+0.08 |

-0.01% |

| GSEC SUB 8 |

-0.06 |

+0.78% |

The long end of the curve is getting bid up on rate-cut expectations next year…

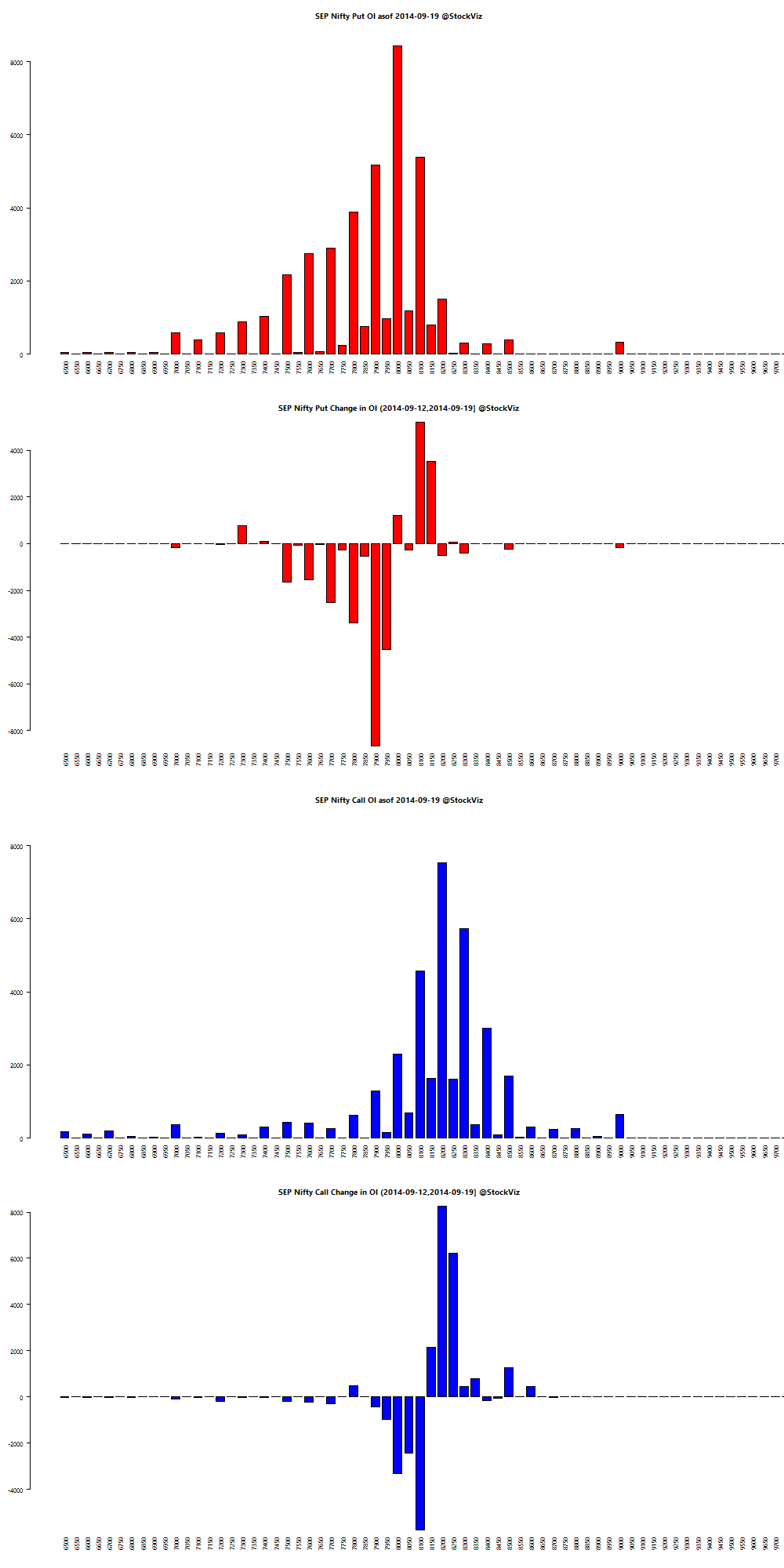

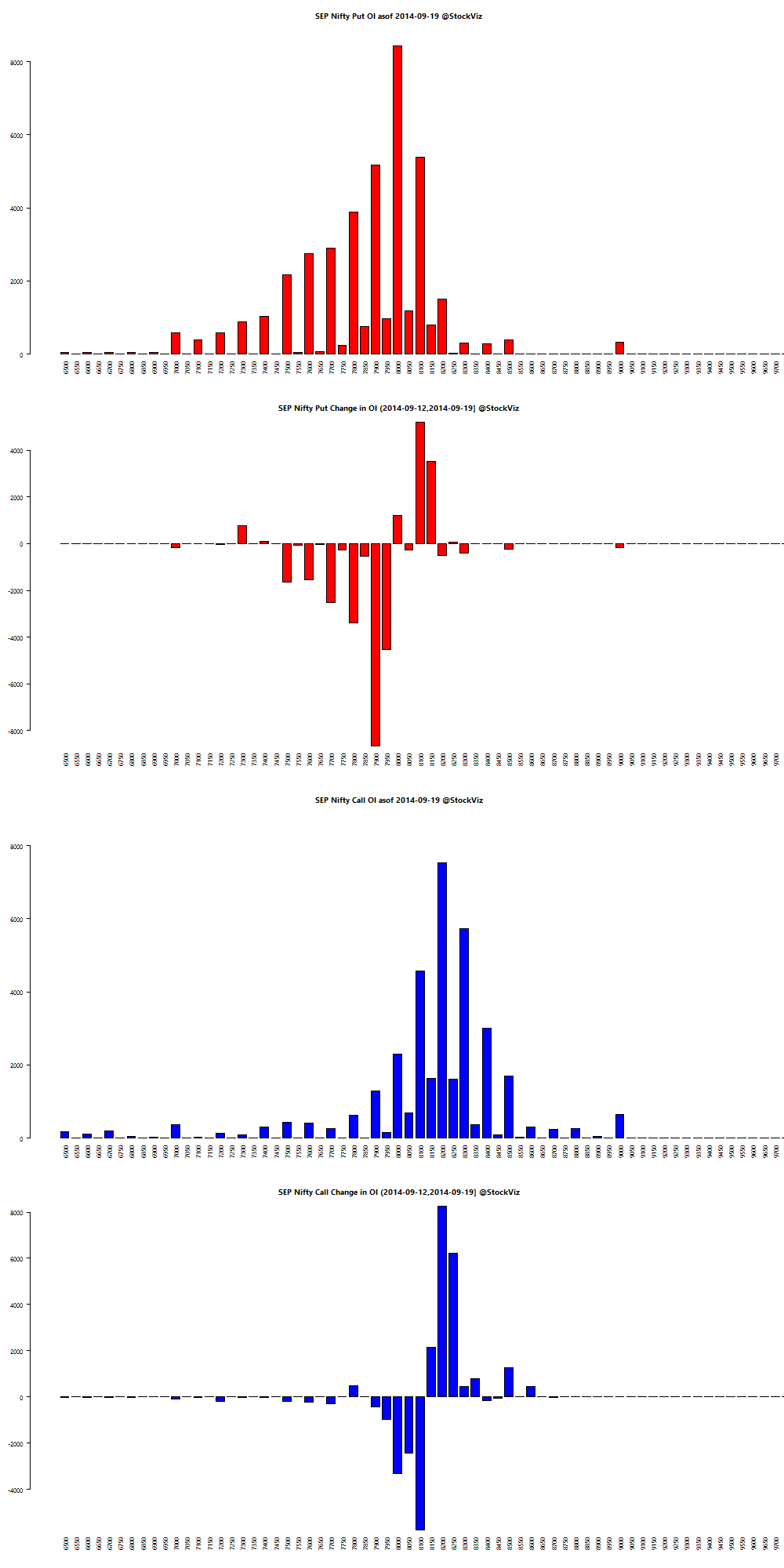

Nifty OI

Bank Nifty OI

Theme Performance

IT stocks got bid up this week, probably because of the Dollar rally. The rest of them were mixed bags.

Thought for the weekend

The real challenge to Adam Smith’s invisible hand is rooted in the very logic of the competitive process itself.

Charles Darwin was one of the first to perceive the underlying problem clearly. One of his central insights was that natural selection favors traits and behaviors primarily according to their effect on individual organisms, not larger groups. Sometimes individual and group interests coincide and in such cases we often get invisible hand-like results.

In other cases, however, mutations that help the individual prove quite harmful to the larger group. This is in fact the expected result for mutations that confer advantage in head-to-head competition among members of the same species. This conflict pervades human interactions when individual rewards depend on relative performance.

Source: The Darwin Economy – Why Smith’s Invisible Hand Breaks Down