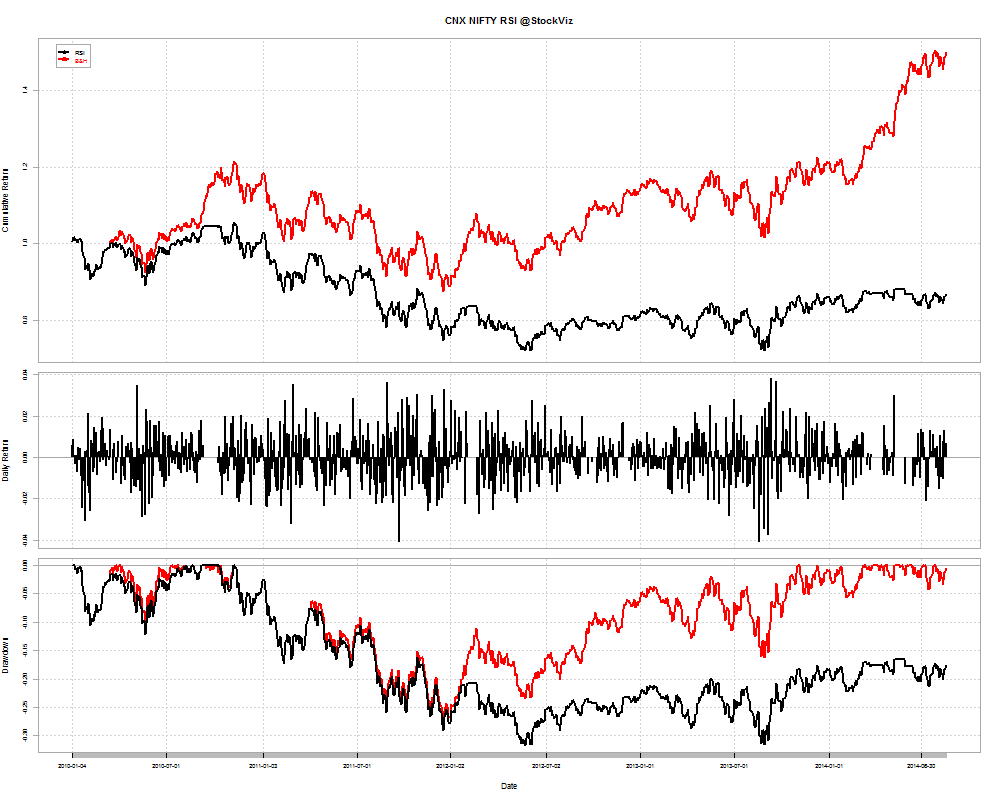

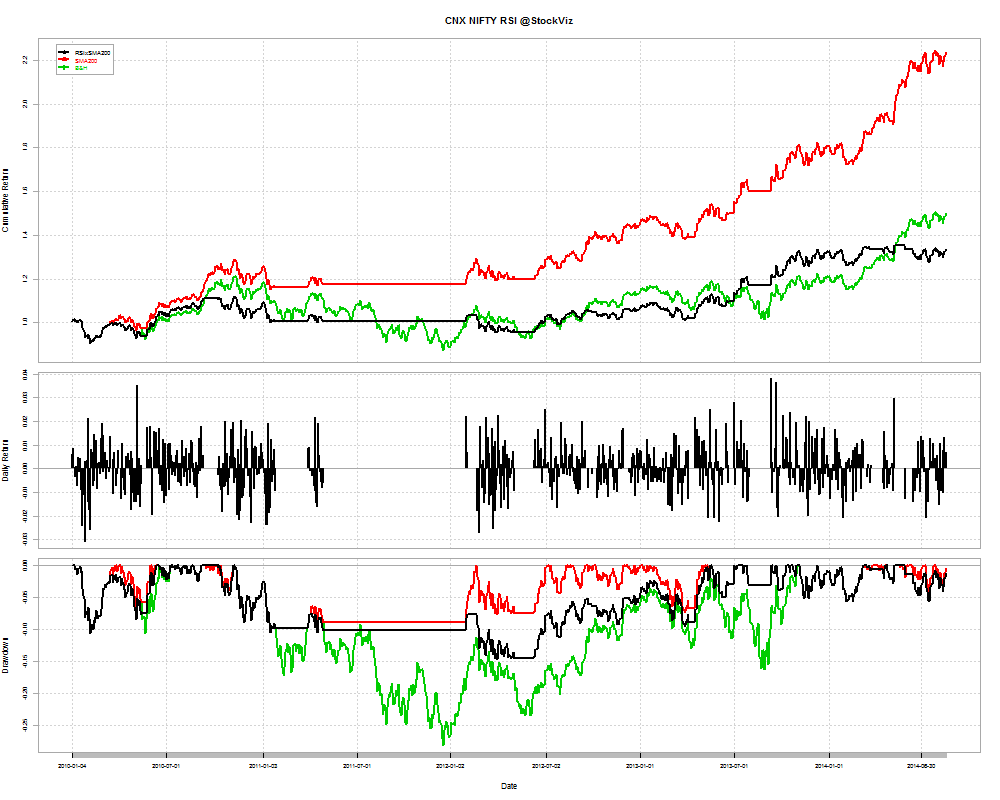

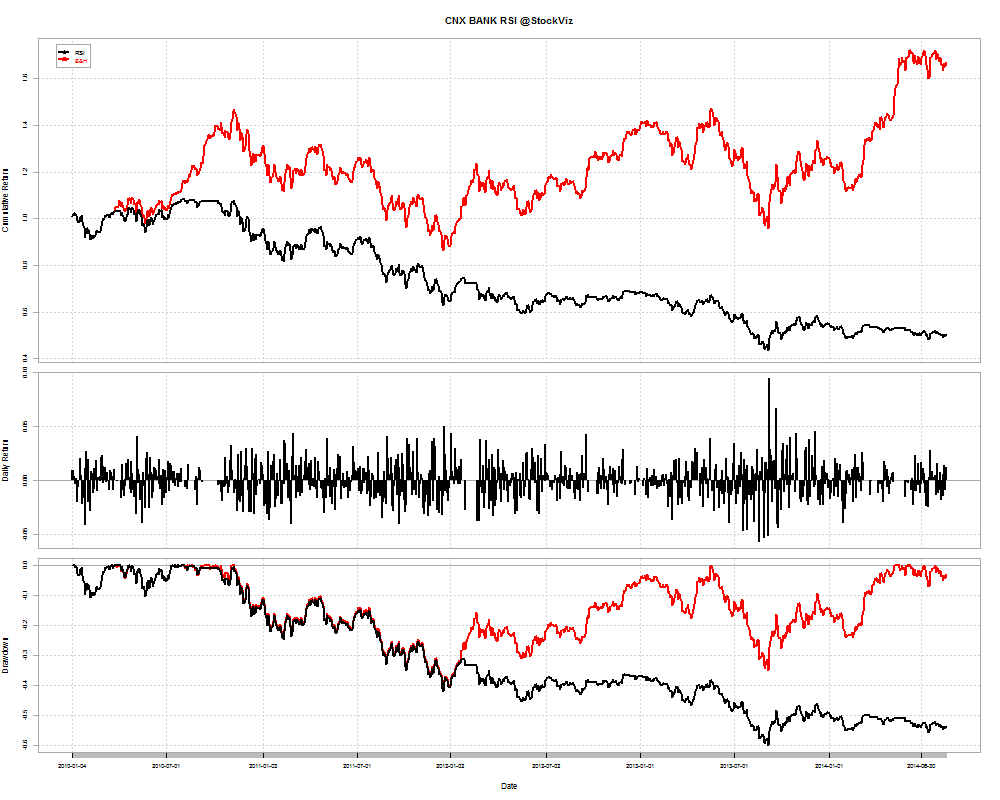

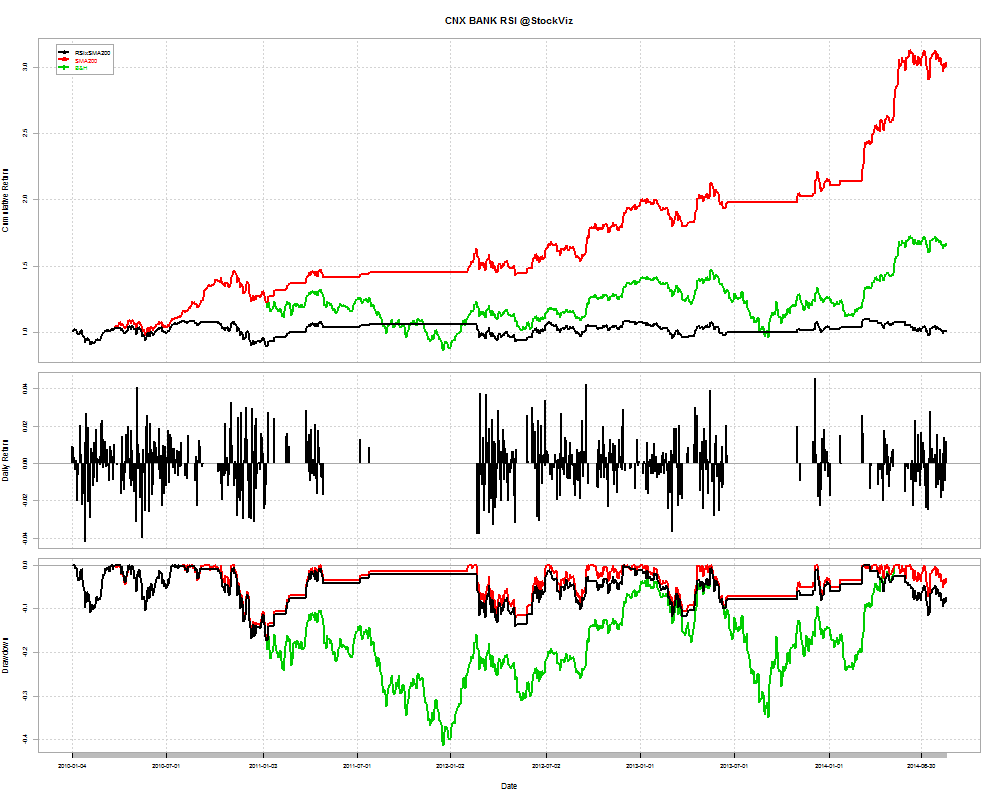

Yesterday, we asked a question: How would an SVM (Support Vector Machine) train if we gave it a 14-day RSI and 50-day SMA of the Nifty index? The goal was to use the SVM to first see if it can figure out a relationship between RSI and NIFTY and then check if we can turn that into a set of trading rules.

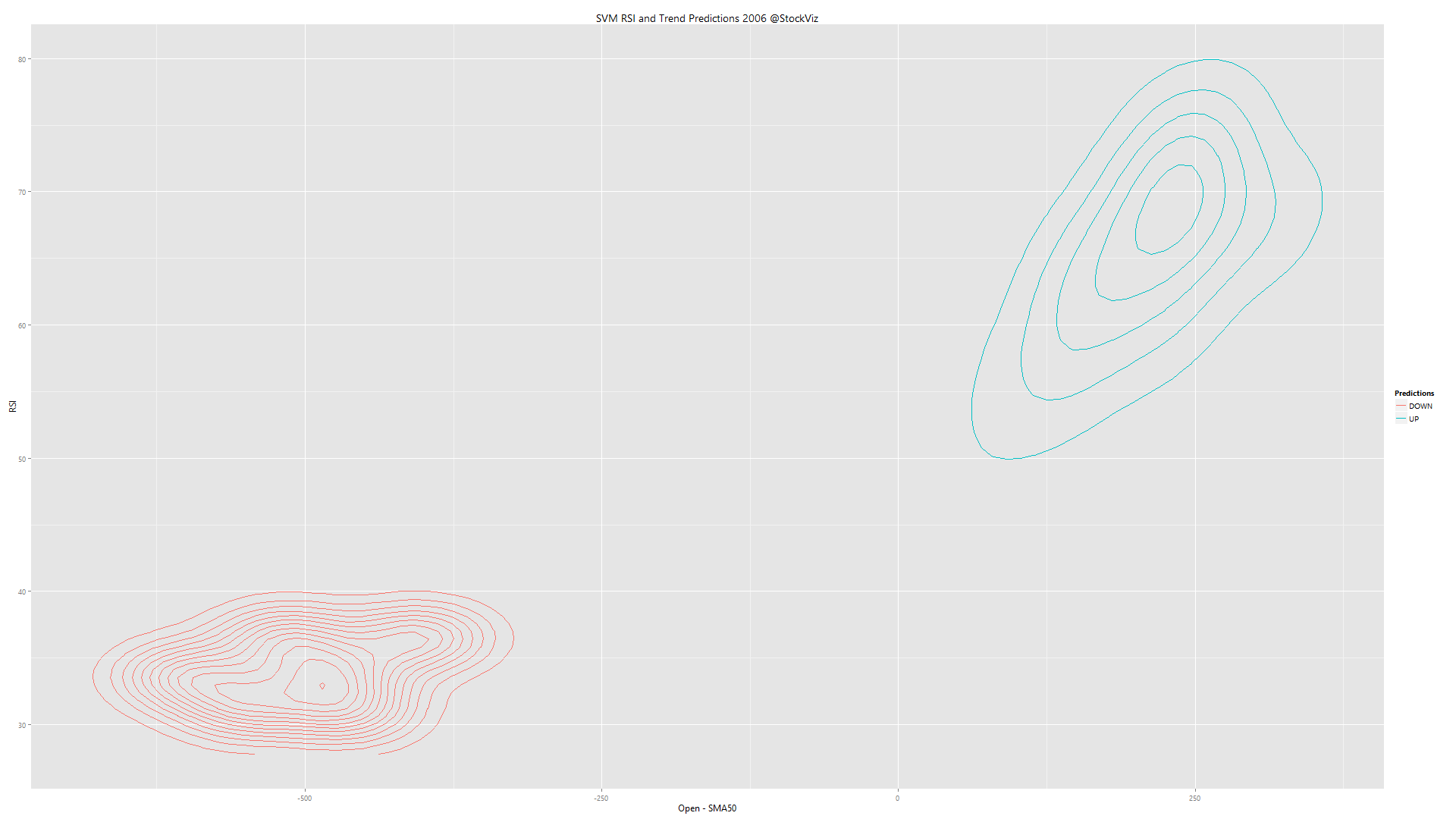

If you look at the predictions that the SVM gave for 2006, you can see two distinct areas where it went short (red contours) and where it went long (blue contours.) But the funny thing is, it went long when RSI > 50 (when the market is supposed to be overbought) and short when RSI < 40 (supposed to be oversold.)

The kicker is that it followed the trend (x-axis) more than RSI (y-axis). In terms of predictive power, trend seems to be way more powerful than RSI, at least for the year 2006.

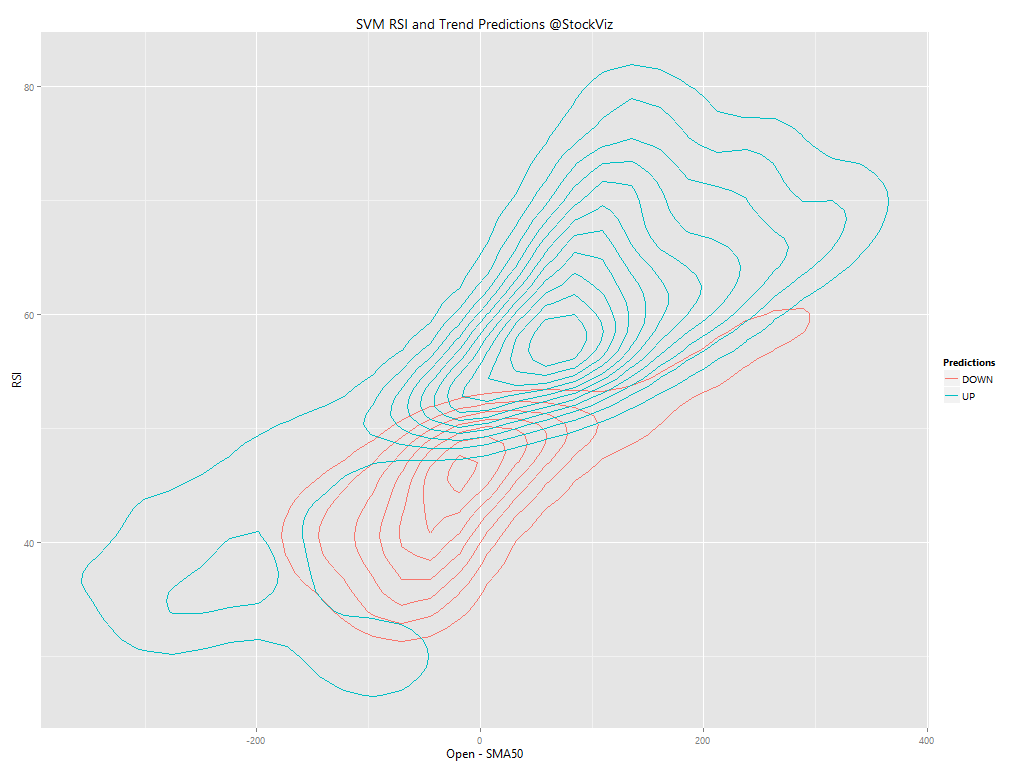

To check if we can actually setup any trading rules (trend x RSI = 4 combinations for buy/sell), we ran yearly training data through an SVM to check if there were any stable relationships. Here’s the video:

The contours change year to year, with little stability between them. Basically, a trading strategy based on RSI is going to be random.