The Indian steel industry is on a slow growth curve. Domestic demand for steel has fallen because of inflation and high interest rates. Low availability of raw materials, high cost, upheaval in the mining sector, state bans, and environmentalist pressures are creating more problems for steel producers. The Editorial March 2013 reveals that the growth rate of the Indian iron and steel industry fell from 11% in 2010 to 4.3% in 2011.

India is the fourth largest producer of crude steel in the world today. It is also an importer of steel since 2007. It is projected that if the 12th Five Year Plan proposals are implemented as per schedule, India could grab second place by 2015-16. However, as the 12th Plan Period (2012-17) commences, the prospect does not look bright for domestic demand of steel though per capita consumption in India has increased from 36.6kg in 2005 to 51.7kg in 2010.

Challenges facing the Indian steel industry

There are many problems that are hurting the growth of the Indian steel industry:

- Non-availability of iron ore: Iron ore is available in plenty in India but unregulated mining and large scale exports have raised concerns on the long-term availability of raw materials to address domestic demand. For the sake of sustainability, the Ministry is restricting exports and making efforts to preserve the non-renewable iron ore fields.

- Non-availability of coking coal: Coking coal is largely imported as domestic availability of the resource is limited. Raw material security and price volatility are challenges. Non-coking coal used for sponge iron production is growing scarce; imports will create heavy cost burdens on the steel sector.

- Inadequate infrastructure: Inadequate sintering and pelletisation facilities for steel as well as domestic technology to process low grade iron ore are significant challenges. Existing road, railway, port and power facilities are not good enough to support the 12th Plan working group’s optimistic projection of steel production doubling in the next 5 years.

- Outdated technology and R&D: The performance of Indian steel plants is lagging because of low quality inputs, obsolete technology in treating resources, and insufficient R&D on alternate technologies to reduce wastes and cost, and address environmental concerns.

- Cheap steel imports: Indian steel industry players are concerned about the cheap steel dumped into India by Japan and Korea, following the Free Trade Agreement and lower import duties. “India has spent over $5.5 billion of precious foreign exchange Iast year in importing steel which Indian steel mills are capable of producing,” says Dilip Oommen, CEO & MD, Essar Steel India Limited.

Steel industry prospects

As per the 12th Five Year Plan, infrastructure will receive an investment of $1 million. If that happens, domestic demand, infrastructure and the economy will receive a boost. The Steel Ministry proposes to increase steel production to 60 million tonnes in the next 5 years with an investment of ₹2.5 crore. Therefore, the Ministry plans to review steel-related sectoral caps by banks and consider relaxation of norms on External Commercial Borrowings (ECBs).

The Steel Ministry also expects domestic steel demand to rise by 10.3% annually by the final year of the 12th Plan. World Steel Association, a leading global steel body, predicts steel consumption will increase by 5% in India in 2013.

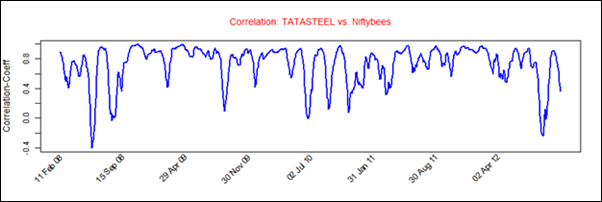

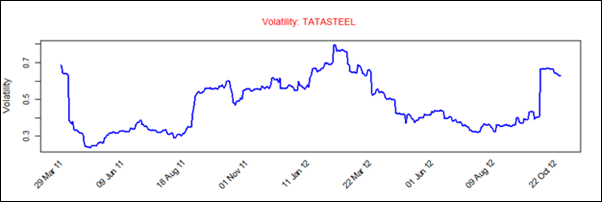

As of now, the steel industry is experiencing immense pressure on profit margins. Rising input costs have increased steel production outlay. At the same time, low demand has created over-capacity. JSW Steel reported ₹669 crore in losses (analysis) in the second quarter of this fiscal. Tata Steel also saw profits going down by 89% (analysis). Steel companies may have to look at export options to maintain profits but the global scenario is hardly more encouraging. To be sure, it’s a tough time for steel manufacturers.

[stockquote]JSWSTEEL[/stockquote] [stockquote]TATASTEEL[/stockquote]