India, the third largest economy in Asia, saw its lowest growth rate in a decade for the fiscal year ending March 2013. The yearly average of 5% was only a tad higher than the last quarter growth rate of 4.8%. Slow economic growth has also affected banks, drastically so for state-run sectors. Loan defaults are piling up as companies go bankrupt. And the companies that can pay via their loaded promoters are trying to wheedle out through corporate data restructuring (CDR).

Private or public, the graph slopes down

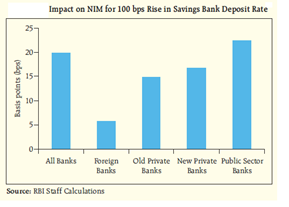

Banks saw a 51% hike in non-performing assets (NPA) in 2012-13, with the scale tipping towards public sector banks (PSB) that lend funds out of noblesse oblige. Since the government holds a majority stake in PSBs, the banks have to finance groups and projects that may not be commercially viable but need to be supported for “social good” or “nation building.” The fact that these government initiatives are eventually funded by the taxpayer makes no difference.

Furthermore, state-run banks have a different investment agenda from private players that’s often triggered by a “me too” mindset. It’s common for PSBs to pool funds into industries backed by the government or supported by other state-run banks. Risk assessment checks are inadequate even though public sector banks typically involve more documentation and longer approval cycles, at least for the common man.

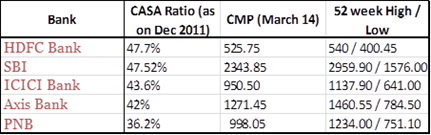

The net profit of 38 listed banks in the private and public domain showed a mild rise of 3.63% in the March quarter with private banks outpacing their public counterparts. The net profit of PSBs actually fell by 6.64% while that of private banks rose by 24.63%. The growth rate for the fiscal year amounts to -2.63% and +28% for respective sectors.

State Bank of India, Punjab National Bank, Bank of Baroda, Bank of India and Canara Bank – all showed loss in the March quarter though SBI’s net profit rose 20.5% over the year. Private sector banks such as ICICI Bank Ltd, HDFC Bank Ltd, Axis Bank Ltd, Kotak Mahindra Bank Ltd, Yes Bank Ltd and IndusInd Bank Ltd saw quarter and year net profit rate hikes ranging from 21% to 47%.

Next up, operating profits across banks rose by 6.78% through the March quarter, with private banks experiencing close to 25.41% growth and PNBs only 0.52%. The underlying difference seems to be better control of bad loans by private banks. Public sector banks have had to set aside hefty amounts to cover bad debt, impacting their net profit substantially.

CDR misuse

Indian banks have recast over ₹2 trillion under the CDR mechanism that gives companies under stress some relaxation through lower lending rate and extension of repayment periods. While the objective of CDR is to give debt-laden companies a second chance, it is being grossly misused by companies with affluent promoters well able to infuse funds into the dying business. Kingfisher Airlines is one such case.

In a bid to control CDR misuse and reduce bad debt, Finance Minister P Chidambaram has come down hard on loan defaulters, recommending strict steps for banks to recover funds without hurting the industry. The RBI too is working on the final guidelines to increase the promoter’s contribution in restructuring to a minimum of 15% of the diminution or 2% of the restructured debt, whichever is higher. Banks can demand more from promoters depending on the risk of the project and the promoter’s financial ability to commit.

As a result, banks are showing some clout to recover debts – UCO Bank issued a public notice against Nitin Kasliwal, chairman and MD of S Kumars Nationwide Ltd, guarantor of a ₹110.07 crore loan taken by Reid & Taylor. The ad carries Kasliwal’s picture as well in a bid to “name and shame.” Kingfisher Airlines is not having it easy either.

The banking slowdown hasn’t bottomed out yet as the chances of accelerated economic growth is dim for another few quarters. Regulatory tightening and control of willful loan defaulters will help banks to a degree but no respite is expected from the RBI this time in view of inflation and high current account deficit. Banks will just need to cut their loss and swim with the tide for now.

Related articles

[stockquote]AXISBANK[/stockquote] [stockquote]BANKBARODA[/stockquote] [stockquote]BANKBEES[/stockquote] [stockquote]BANKINDIA[/stockquote] [stockquote]CANBK[/stockquote] [stockquote]HDFCBANK[/stockquote] [stockquote]ICICIBANK[/stockquote] [stockquote]INDUSINDBK[/stockquote] [stockquote]KFA[/stockquote] [stockquote]KOTAKBANK[/stockquote] [stockquote]PNB[/stockquote] [stockquote]PSUBNKBEES[/stockquote] [stockquote]SBIN[/stockquote] [stockquote]UCOBANK[/stockquote] [stockquote]YESBANK[/stockquote]

![clip_image001[6]](http://stockviz.biz/wp-content/uploads/2012/03/clip_image0016_thumb.png)