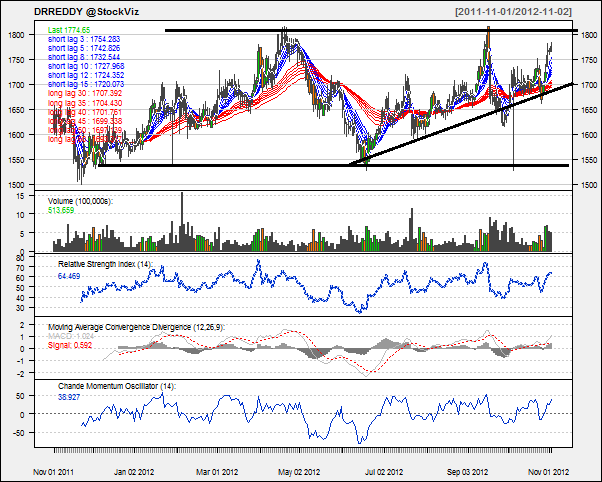

Today’s pick is DRREDDY [stockquote]DRREDDY[/stockquote]. The stock started the year with an up-move to Rs. 1,800 levels. After experiencing resistance at those levels, the stock started its move down. It then saw head-and-shoulders bottom formation during May to July, and since then it has been on an up-trend. It saw the 52 weeks high of Rs. 1,970 in February, but since then was on a down-trend to find support on the trend-line. In the last three months, the stock moved -1% vs. +1 of the Nifty’s.

Oscillator RSI and CMO are in no man’s land. The stock is currently trading in the middle of the Bollinger bands. Short-term technical just saw 4X9 and 4X18 bullish SMA cross-over combined with a Dragonfly bullish Doji yesterday.

The MACD line has just penetrated the signal line in a bullish manner. However, the Long-term and short-term GMMA lines are contracting, unable to provide any outlook for the stock.

DRREDDY’s average correlation with the Nifty is 0.35 which is positive. The scrip will be replicating movement of Nifty. [stockquote]NIFTYBEES[/stockquote]

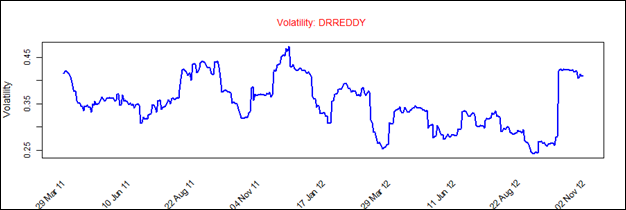

DRREDDY has a historical volatility in the narrow range of 0.25 to 0.45. The scrip’s volatility is currently in the lower end of the range.

Given these technicals, we suggest a short-term BUY. A long-term BUY is also suggested based on the support provided by the trend-line. However, it is advisable to have a relaxed trailing stop-losses level to book profits in case of a trend-reversal.

Related articles