The telecom sector is finally beginning to turn the corner after a difficult two years that was marked by weak operational performance, record low tariffs due to intense competition and regulatory hurdles.

Late last month, India’s biggest mobile carrier Bharti Airtel and Idea Cellular Ltd slashed discounts and freebies on offer to customers, effectively raising calling costs for mobile users. Vodafone India, the second biggest operator, has also hinted at raising tariffs.

Earlier in September, RCom had raised tariffs by 25% for both post-paid and pre-paid customers. Since these top four operators account for nearly half of mobile phone users in the country, more than 400 million subscribers will have to shell out more by way of mobile bills.

With the exit of players like Etisalat, Swan Telecom and Videocon, consolidation has already begun giving room for large operators to hike tariffs. The tariff hikes will come as a huge relief for the industry struggling with increasing regulatory costs and weak pricing power.

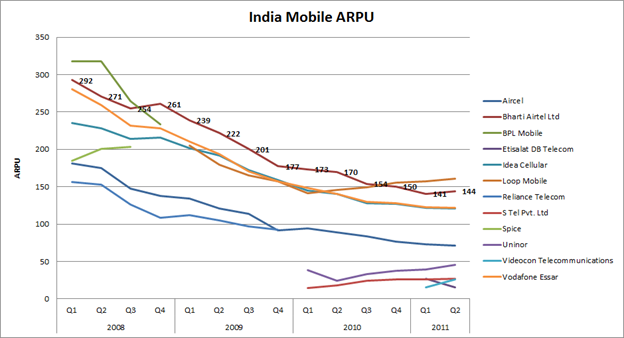

To improve their operational efficiency, many telcos have deactivated inactive subscribers and instead turned focus towards retaining active users rather than aggressively acquiring new ones. The move reflects an operational shift from volume/subscriber growth to increased focus on pricing/margin front.

On the regulatory front, liabilities with regards to one-time spectrum fee and spectrum re-farming are now clear although the exact payout is yet to be determined. News agency PTI has estimated that the government may get around Rs 23,177 crore by way of one-time spectrum fee from operators.

Spectrum re-farming would mean another blow for incumbent operators as re-allotment of spectrum in a higher frequency band will lead to higher capital investment to maintain current service levels.

If 2012 was a year of regulatory uncertainty, 2013 will be a year of a string of litigation as telcos are likely to contest several decisions like abolition of roaming charges, invalidity of 3G roaming agreements and spectrum re-farming.

The three leading operators and the government are fighting it out in the courts on offering 3G services in areas where they do not hold 3G spectrum. Even the reduction of up to 50% in the reserve price of spectrum in the 800 megahertz (MHz) band, used by CDMA operators, has irked GSM operators.

Removal of roaming charges, if implemented, will hit telcos further as earnings from roaming and STD charges will vanish. Coupled with higher re-farming costs of spectrum, tariffs will only rise further from the current levels despite TRAI’s warning that it may intervene in pricing by fixing a cap.

But the biggest turnaround will come once data revenues start picking up as earnings from voice services have stagnated. Future growth will revolve around data services through 3G and broadband wireless services. While currently, high pricing and higher cost of handsets are a major deterrent, accessibility will improve going forward and that would drive average revenues per user.

In short, it all depends on how telcos navigate regulatory headwinds and avoid a race to the bottom on the pricing front. Exciting times ahead!

[stockquote]BHARTIARTL[/stockquote] [stockquote]RCOM[/stockquote] [stockquote]IDEA[/stockquote]