Corruption is something we encounter almost every day. We even abet it on for the sake of convenience. Perhaps corruption has become part of our DNA without our knowing it. Could that be why every private, public or government mass project in India becomes a victim of mismanagement, lag, inaccuracies and corrupt practices? Like the UID project … waiting in queue to join the regular Indian diet of scams.

UID – From whence it comes

UID, Unique Identification or Aadhaar Card as it is more commonly known is vigorously supported by the Congress government. Aadhaar registrations kicked off in September 2010 without “proper debate” in parliament. In fact, the proposed bill was firmly rejected by the parliamentary standing committee on finance chaired by Yashwant Sinha in December 2011. Home minister P. Chidambaram has also expressed his reservations of the project that has no cabinet clearance, making it open to question at any time.

The UID project, guidelines and related technology are coordinated by the Unique Identity Development Authority of India, UI DAI at the center. Implementation at field level is the responsibility of respective state governments. They in turn work with authorized registrars who need UIDs for their own operations. And at the ground there are private or publicly owned agents or NGOs that serve as empanelled enrollment centers. The NPR is an important partner registrar in the enrollment process.

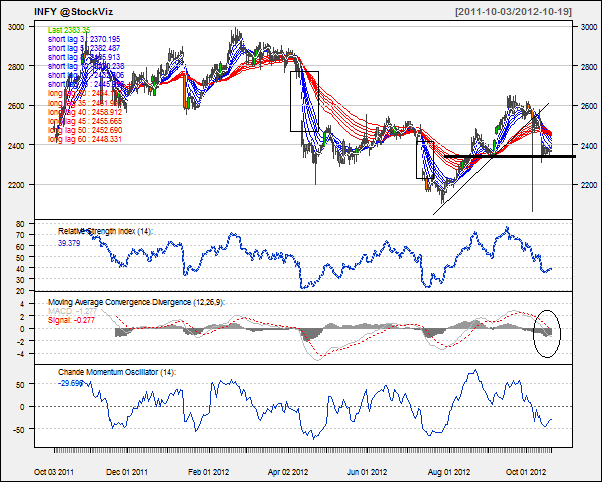

The UID project is headed by Nandan Nilekani, former CEO of Infosys. He was called in for the task by PM, Dr. Manmohan Singh. His team includes enterprisers from private and government circles. Some volunteered for free, some were invited to join. The mammoth project will certainly be a once in a lifetime experience for the UIDAI team but will it have an enduring impact on the lives of the average Indian too?

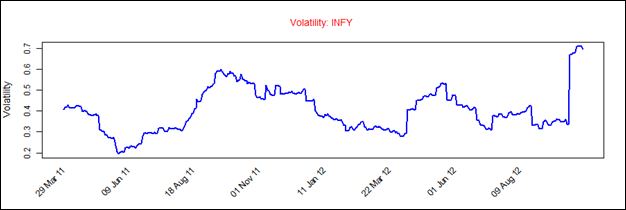

The UID scheme is expected to cost the country a whopping ₹150,000 crore though some estimate it as higher. At least ₹598 crore rupees have been funneled into services outsourced to partners like MindTree and Accenture among others. While the amount is shocking, what’s worse is the inept execution of the project at ground level.

Misguided, mishandled and misused

Projected as a pro-poor people’s initiative, UID is expected to streamline the delivery of food, water, homes, jobs, security, fuel, and the like to India’s poor as sanctioned under various national schemes. Because analysis tells us that the reason NREGA and other “feed the poor” schemes are falling on their face is because poor people can’t be identified correctly? You’ve got to be kidding. How will fingerprinting and iris scans stop unscrupulous agents from exploiting the poor?

Reports of UID’s shoddy implementation continue to pour in. Almost 30,000 bogus registrations were submitted by an “ex-employee” at a Hyderabad enrollment center. Turns out his credentials were used by other agents across 20 centers. This … when the fingerprint scan of the agent is part of the authentication process. Clearly, the involvement of a technocrat like Nandan Nilekani in the UID project has not prevented technological loopholes from entering the system, allowing miscreants to take advantage.

In other places, free Aadhaar forms are being sold to people standing in queues at MLA’s houses; like black tickets for a show but without the promise of entertainment. Delhi’s MPs and MLAs are blindly handing out necessary documents for UID to woo voters. Diligent people who registered in 2011 are still waiting.

UID – It begs the question WHY?

Inept execution aside, why do we need UID anyway? As an aid for the poor, its usability is suspect. With the way Aadhaar registrations are being manipulated and mishandled, building a clean, accurate and verified UID database of Indian citizens is out of the picture.

From a legal standpoint, the Aadhaar project can be challenged as it hasn’t received parliamentary approval. It allows non-citizens to avail the same benefits as citizens in violation of the Citizenship Act, 1955. And collecting biometric data is an invasion of individuals’ privacy rights in a free country.

Strangely and worryingly, UID is not mandatory. Nilekani says UID is voluntary but service providers might make it mandatory. In the long run I wouldn’t call it compulsory. I’d rather say it will become ubiquitous. This play of words means this: Common people will register on Aadhaar because they naturally want access to subsidies. The uncommon man with plenty to hide can conveniently opt out as he certainly doesn’t need subsidies nor wants his biometrics and private information on record. Bottom line? The UID scheme changes nothing except adding to the taxpayer’s burden.

Related articles

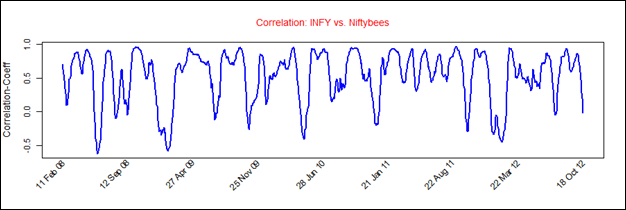

[stockquote]INFY[/stockquote] [stockquote]MINDTREE[/stockquote]