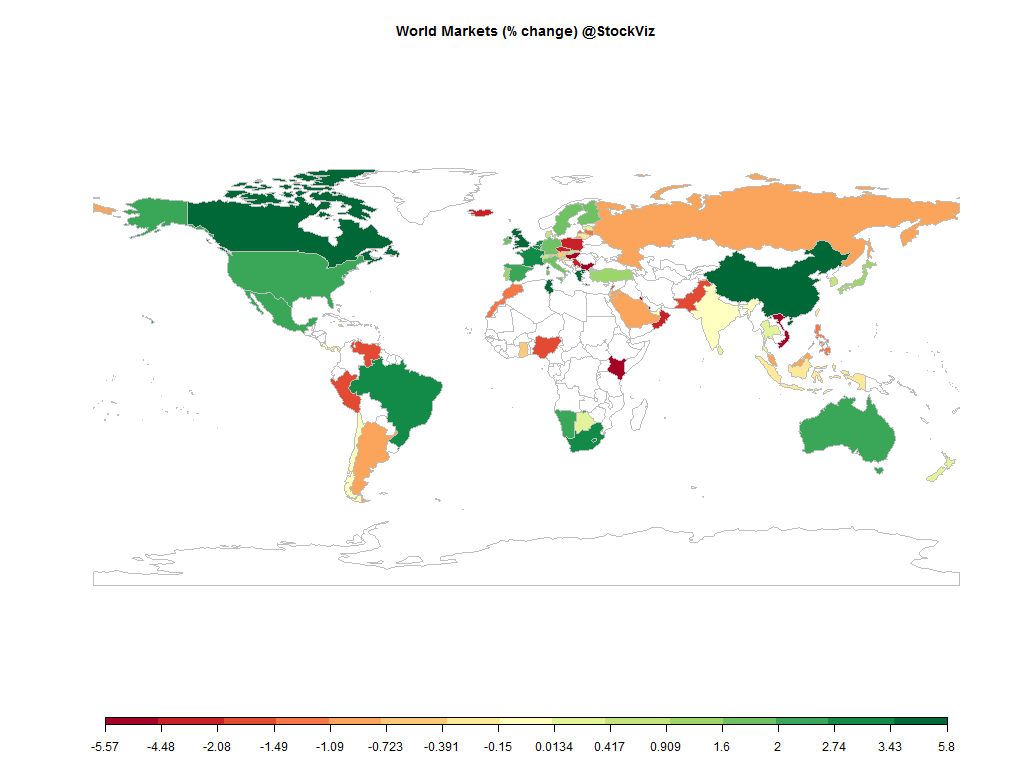

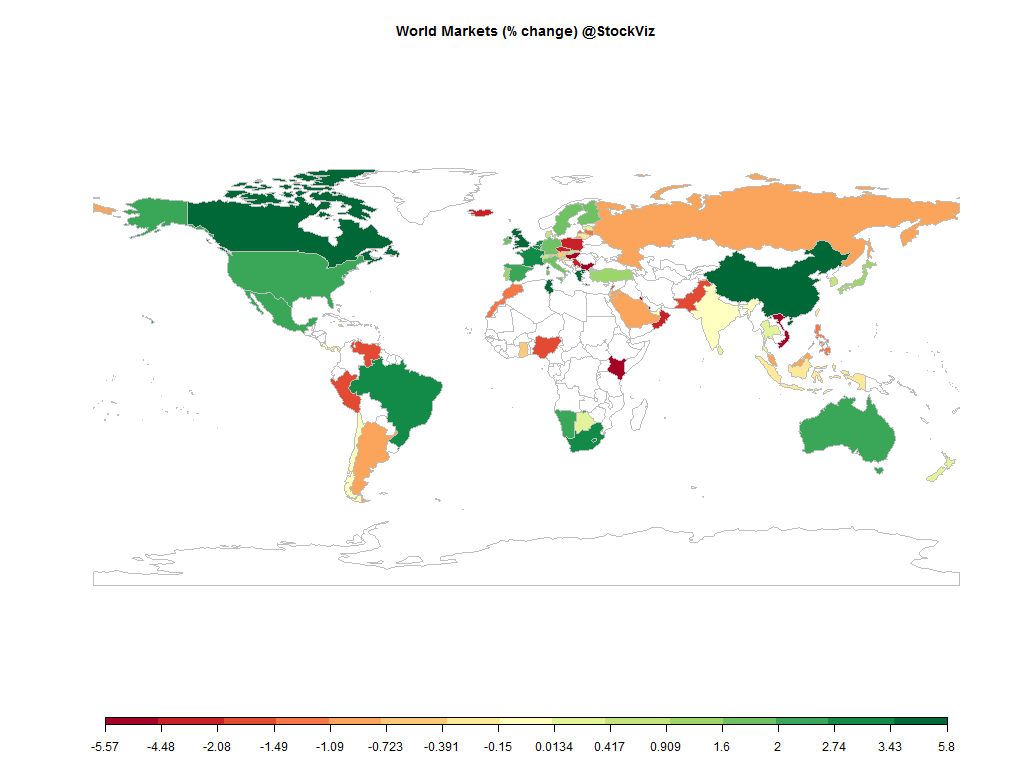

Equities

Commodities

| Energy |

| Ethanol |

-5.78% |

| WTI Crude Oil |

-0.41% |

| RBOB Gasoline |

-1.60% |

| Brent Crude Oil |

-1.00% |

| Heating Oil |

-2.34% |

| Natural Gas |

-8.76% |

| Metals |

| Gold 100oz |

-2.18% |

| Palladium |

-1.18% |

| Platinum |

-2.83% |

| Copper |

-0.68% |

| Silver 5000oz |

-7.02% |

| Agricultural |

| Cocoa |

+3.59% |

| Corn |

+3.53% |

| Soybean Meal |

-3.96% |

| Soybeans |

-1.39% |

| Coffee (Arabica) |

+0.57% |

| Cotton |

+0.12% |

| Feeder Cattle |

-2.39% |

| Orange Juice |

-5.25% |

| Sugar #11 |

-0.40% |

| Wheat |

+0.88% |

| Cattle |

-0.34% |

| Coffee (Robusta) |

-2.21% |

| Lean Hogs |

-6.49% |

| Lumber |

+0.29% |

| White Sugar |

+0.10% |

Credit Indices

| Index |

Change |

| Markit CDX EM |

-0.30% |

| Markit CDX NA HY |

+0.52% |

| Markit CDX NA IG |

+0.73% |

| Markit iTraxx Asia ex-Japan IG |

+8.59% |

| Markit iTraxx Australia |

+7.20% |

| Markit iTraxx Europe |

+4.16% |

| Markit iTraxx Europe Crossover |

+16.58% |

| Markit iTraxx Japan |

+2.11% |

| Markit iTraxx SovX Western Europe |

+2.94% |

| Markit LCDX (Loan CDS) |

-0.18% |

| Markit MCDX (Municipal CDS) |

+2.46% |

All I can say about this week is that I am glad that its over.

The NIFTY ended flat for the week but that hides the roller-coaster ride it put investors through. After all the oil-related panic, the S&P ended up more than 2% for the week.

Oil ended down, dollar up.

Hopefully Santa visits before expiry.

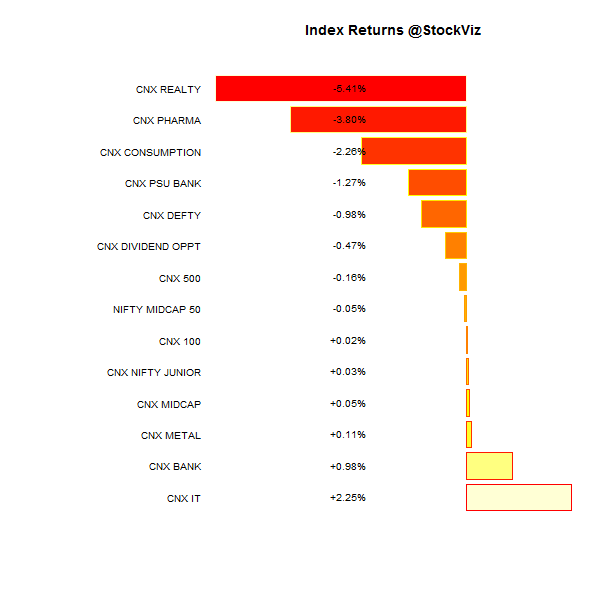

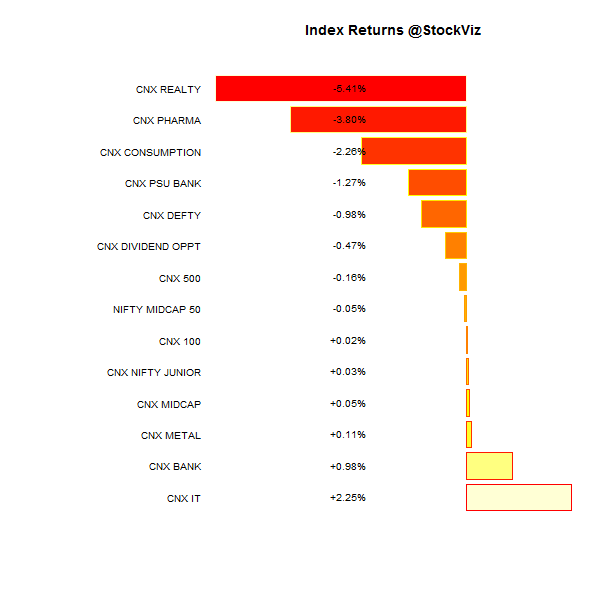

Index Returns

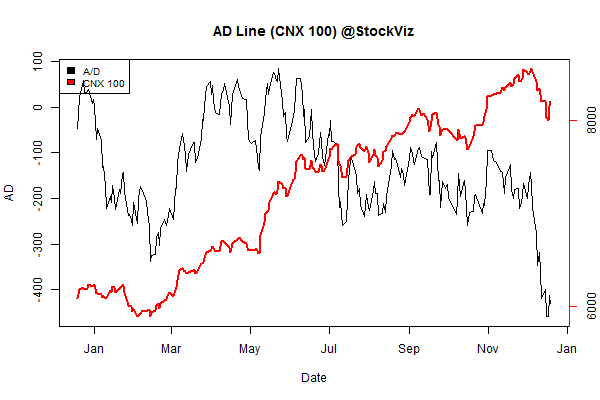

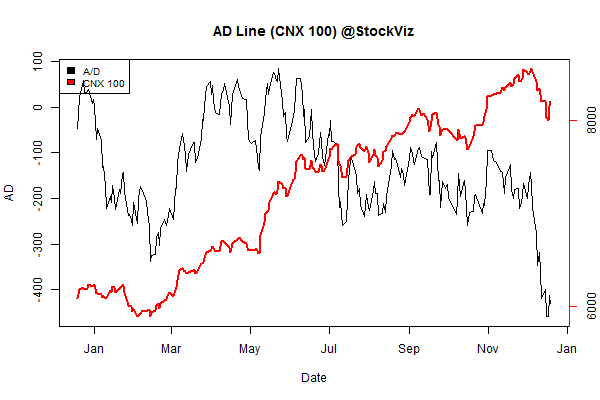

Advance Decline

Market Cap Decile Performance

| Decile |

Mkt. Cap. |

Adv/Decl |

| 1 (micro) |

-6.25% |

63/74 |

| 2 |

-3.65% |

63/73 |

| 3 |

-2.93% |

64/73 |

| 4 |

-2.21% |

61/75 |

| 5 |

-3.07% |

63/73 |

| 6 |

-1.98% |

65/72 |

| 7 |

-2.00% |

56/80 |

| 8 |

-1.38% |

64/73 |

| 9 |

-1.17% |

64/72 |

| 10 (mega) |

-0.01% |

68/69 |

The sell-off was brutal below the mega-caps…

Top Winners and Losers

Broad based action saw a mix of winners and losers…

ETF Performance

Banks withstood the onslaught well…

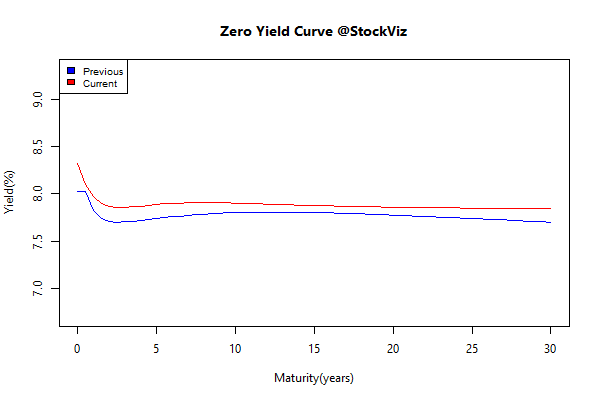

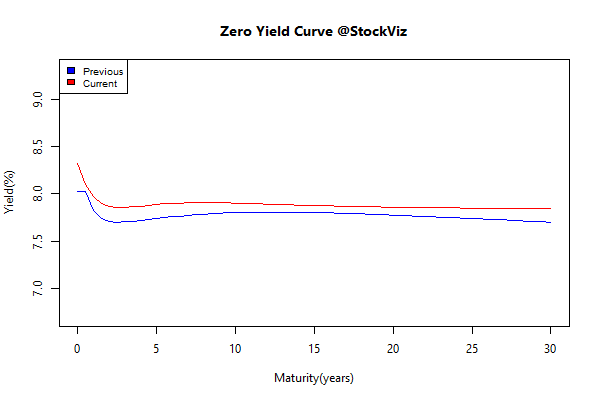

Yield Curve

Bond Indices

| Sub Index |

Change in YTM |

Total Return(%) |

| GSEC TB |

+0.44 |

+0.04% |

| GSEC SUB 1-3 |

+0.43 |

-0.43% |

| GSEC SUB 3-8 |

+0.19 |

-0.53% |

| GSEC SUB 8 |

+0.08 |

-0.34% |

Yields went up – breaking a long streak of falling rates.

Investment Theme Performance

Thought for the weekend

Asset managers and asset owners have a relationship beset with natural conflicts.

- Asset owners want fees below 10 bps; asset managers prefer “2% + 20%.”

- Asset owners want transparency; asset managers favor black-box opacity.

- Asset owners want simplicity; asset managers hire rocket scientists to create complex optimized solutions for sex appeal.

- Asset owners want “future” outperformance after they fund a manager; asset managers would be satisfied with strong past outperformance to facilitate future asset gathering.

- Asset owners want a bigger alpha; asset managers would happily sell them the possibility of alpha and charge handsomely for the service of selling hope.

Source: The Promise of Smart Beta

Comments are closed, but trackbacks and pingbacks are open.