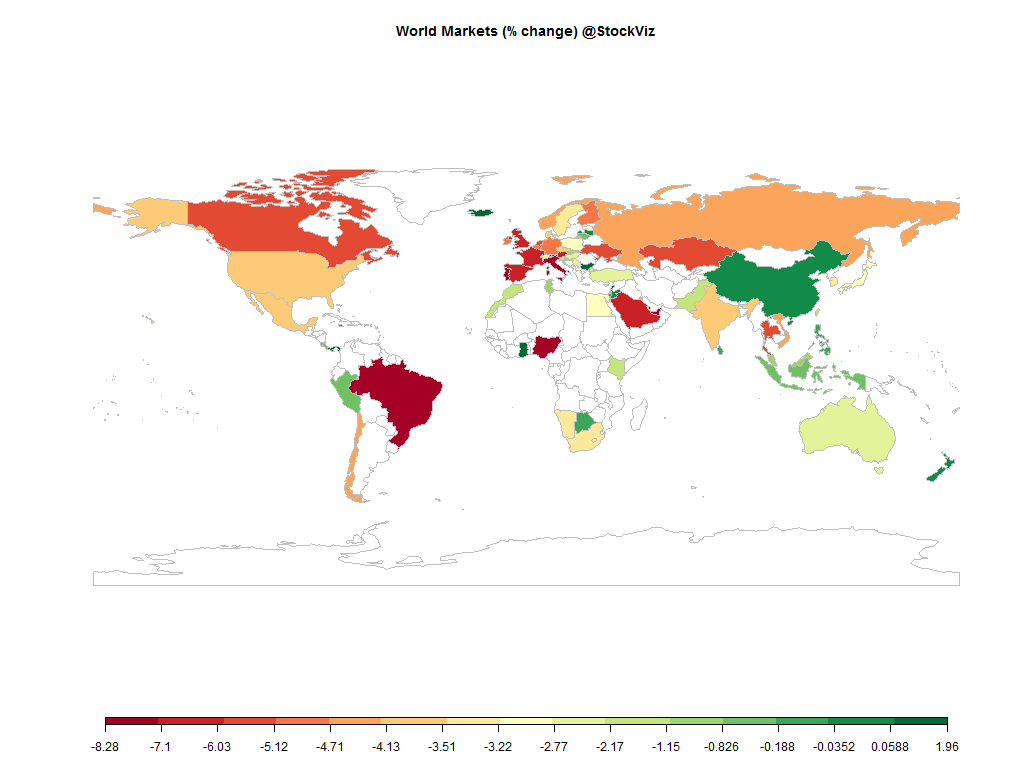

Equities

Commodities

| Energy |

| RBOB Gasoline |

-10.98% |

| Ethanol |

-3.18% |

| Natural Gas |

-0.87% |

| WTI Crude Oil |

-13.42% |

| Brent Crude Oil |

-11.22% |

| Heating Oil |

-5.34% |

| Metals |

| Copper |

+0.34% |

| Gold 100oz |

+2.74% |

| Palladium |

+1.51% |

| Platinum |

+0.66% |

| Silver 5000oz |

+5.56% |

| Agricultural |

| Corn |

+4.55% |

| Cotton |

-0.49% |

| Lean Hogs |

-4.11% |

| Wheat |

+3.80% |

| Cocoa |

-3.08% |

| Sugar #11 |

-0.92% |

| White Sugar |

-1.09% |

| Coffee (Arabica) |

-2.77% |

| Feeder Cattle |

-4.18% |

| Orange Juice |

+4.01% |

| Soybean Meal |

-3.86% |

| Cattle |

-2.12% |

| Coffee (Robusta) |

-4.66% |

| Lumber |

+0.24% |

| Soybeans |

+1.82% |

Credit Indices

| Index |

Change |

| Markit CDX EM |

-2.51% |

| Markit CDX NA HY |

-1.44% |

| Markit CDX NA IG |

+6.32% |

| Markit iTraxx Asia ex-Japan IG |

+1.58% |

| Markit iTraxx Australia |

+2.31% |

| Markit iTraxx Europe |

+2.14% |

| Markit iTraxx Europe Crossover |

+18.62% |

| Markit iTraxx Japan |

+2.77% |

| Markit iTraxx SovX Western Europe |

+0.48% |

| Markit LCDX (Loan CDS) |

-0.37% |

| Markit MCDX (Municipal CDS) |

+2.93% |

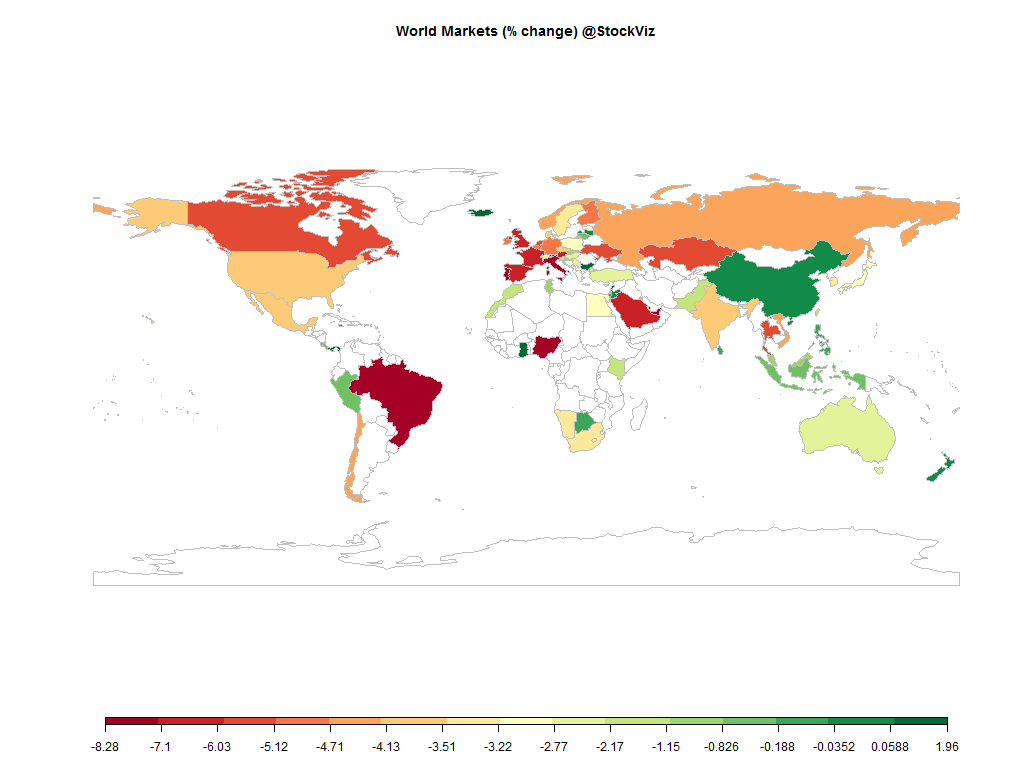

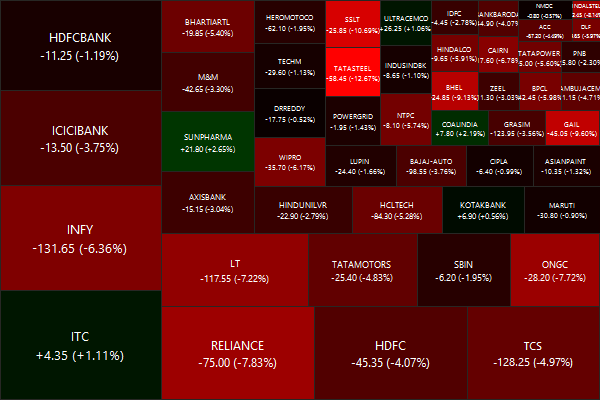

It was a brutal week at the markets. All major indices went down like a rock. Dollar rallied and the precious metal complex found a bid. The energy sector is like a drunk grouping in the dark for a bottom. But don’t you worry, SEBI will soon some up with a rule where your broker will have to send you a bag of cash whenever you lose money in the markets.

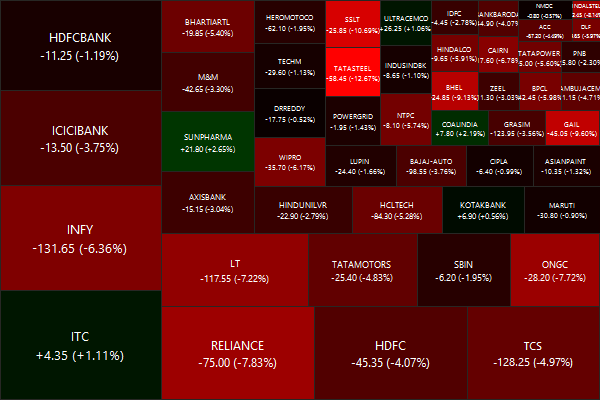

Nifty Heatmap

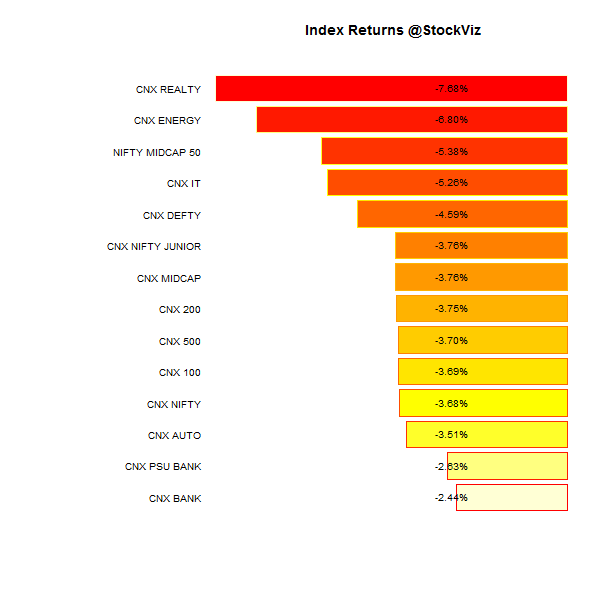

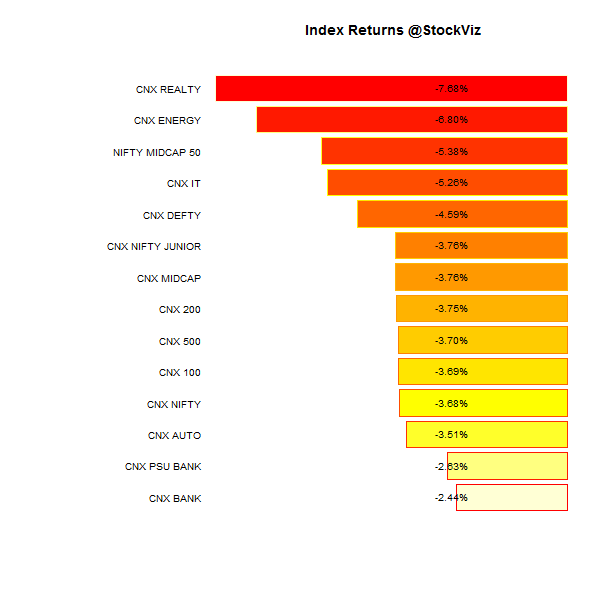

Index Returns

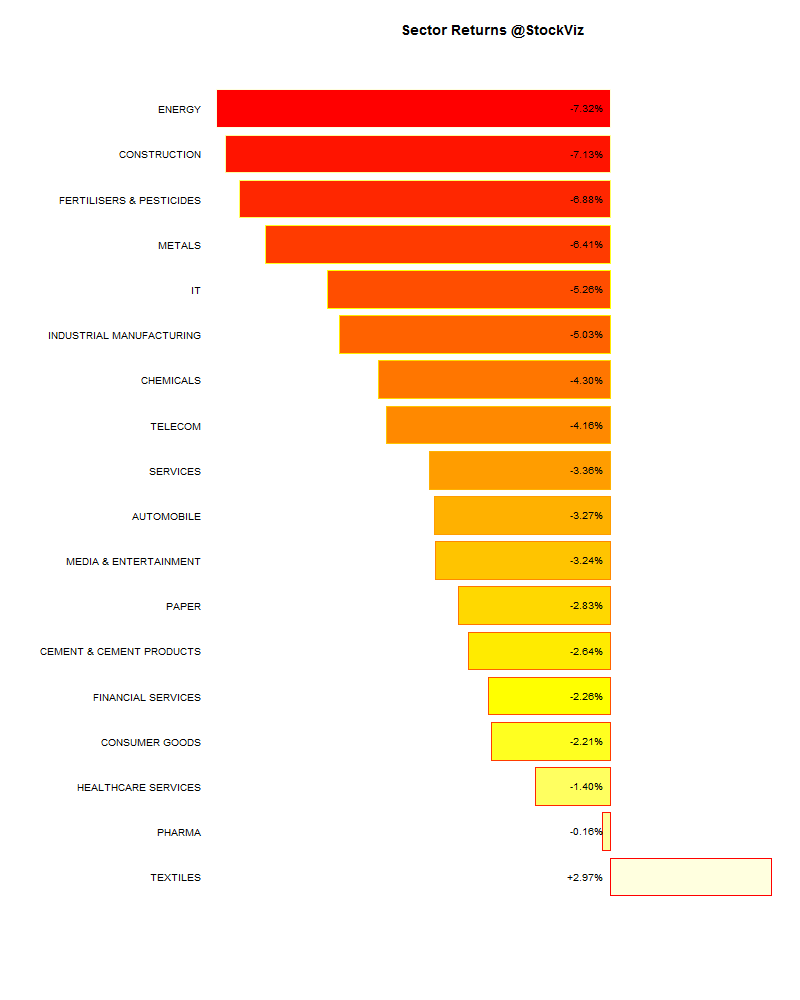

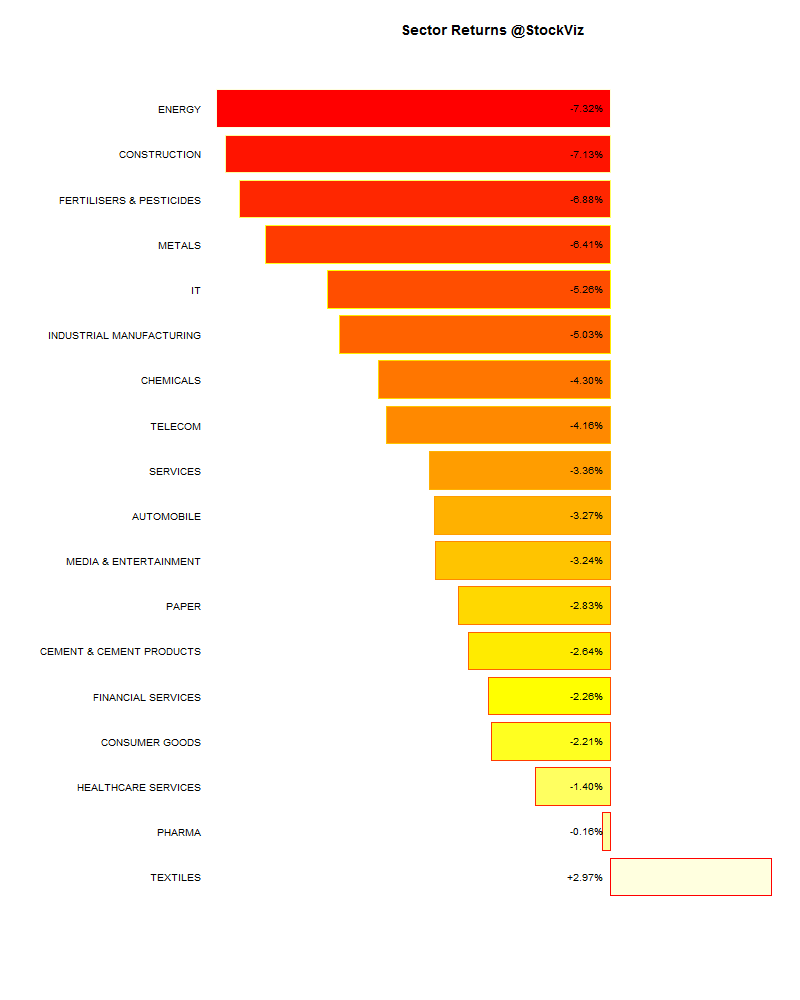

Sector Performance

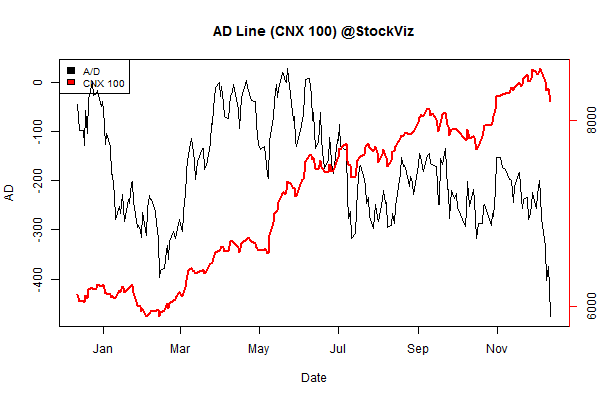

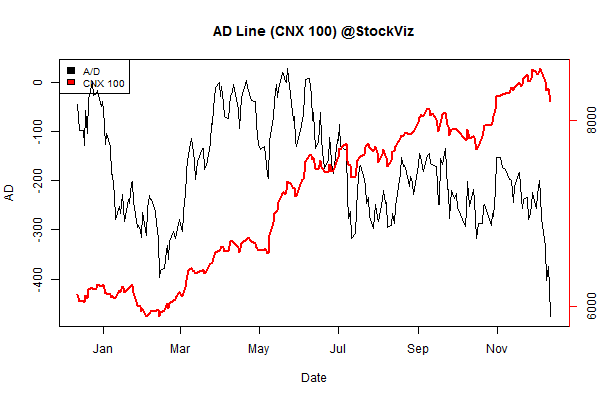

Advance Decline

Market Cap Decile Performance

| Decile |

Mkt. Cap. |

Adv/Decl |

| 1 (micro) |

-7.17% |

67/72 |

| 2 |

-4.35% |

62/77 |

| 3 |

-4.12% |

55/84 |

| 4 |

-4.96% |

56/83 |

| 5 |

-5.77% |

54/85 |

| 6 |

-5.63% |

61/78 |

| 7 |

-4.51% |

61/79 |

| 8 |

-3.75% |

66/72 |

| 9 |

-4.15% |

68/71 |

| 10 (mega) |

-3.60% |

74/66 |

Maximum pain in the lower market cap tiers…

Top Winners and Losers

Select “Story” stocks ended the week in the green.

ETF Performance

Nice to see gold in the green after weeks in the red.

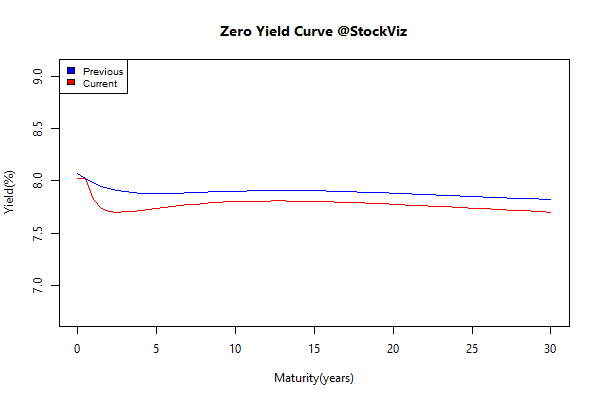

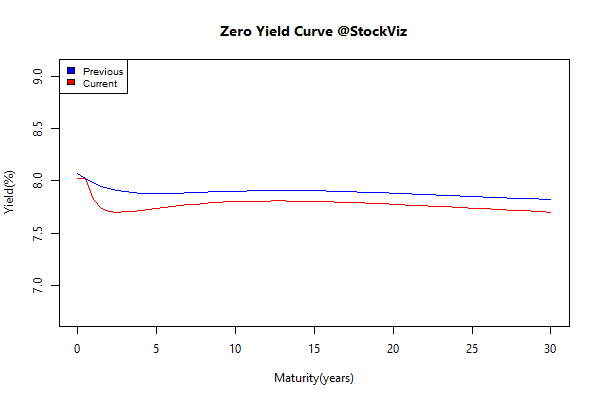

Yield Curve

Bond Indices

| Sub Index |

Change in YTM |

Total Return(%) |

| GSEC TB |

-0.10 |

+0.18% |

| GSEC SUB 1-3 |

-0.01 |

+0.35% |

| GSEC SUB 3-8 |

-0.17 |

+0.64% |

| GSEC SUB 8 |

-0.17 |

+0.89% |

Falling inflation, slowing growth and a dash for safe assets.

Investment Theme Performance

Not a single strategy worked this week. Here’s to hoping for better days ahead…

Thought for the weekend

They’re watching market prices fluctuate and assigning meaning where none exists. Stories are being told and headlines are being crafted so that there is something for you to click on from your app when you check the news.

They’re giving you an ex-post description of the beliefs of your fellow guessers who are no better at explaining day-to-day randomness than you are.

Source: They’re all making it up.

Related: Why Do Models Beat Experts?

Comments are closed, but trackbacks and pingbacks are open.