Equities

Commodities

| Energy |

| Brent Crude Oil |

-4.18% |

| Ethanol |

+4.04% |

| Heating Oil |

-3.48% |

| Natural Gas |

-4.43% |

| RBOB Gasoline |

-7.66% |

| WTI Crude Oil |

-5.83% |

| Metals |

| Copper |

+0.00% |

| Gold 100oz |

+0.69% |

| Palladium |

+0.44% |

| Platinum |

-1.99% |

| Silver 5000oz |

+0.58% |

| Agricultural |

| Cattle |

+1.77% |

| Cocoa |

+1.08% |

| Coffee (Arabica) |

+10.84% |

| Coffee (Robusta) |

+5.01% |

| Corn |

+4.28% |

| Cotton |

+3.95% |

| Feeder Cattle |

+0.92% |

| Lean Hogs |

+1.99% |

| Lumber |

+0.38% |

| Orange Juice |

-3.85% |

| Soybean Meal |

+10.54% |

| Soybeans |

+0.60% |

| Sugar #11 |

+3.25% |

| Wheat |

+4.13% |

| White Sugar |

+1.08% |

Credit Indices

| Index |

Change |

| Markit CDX EM |

-14.82% |

| Markit CDX NA IG |

+2.60% |

| Markit CDX NA IG HVOL |

+22.00% |

| Markit iTraxx Asia ex-Japan IG |

+18.07% |

| Markit iTraxx Australia |

+11.93% |

| Markit iTraxx Europe |

+4.57% |

| Markit iTraxx Europe Crossover |

+93.24% |

| Markit iTraxx Japan |

+7.25% |

| Markit iTraxx SovX Western Europe |

-0.82% |

| Markit LCDX (Loan CDS) |

-0.17% |

| Markit MCDX (Municipal CDS) |

+3.90% |

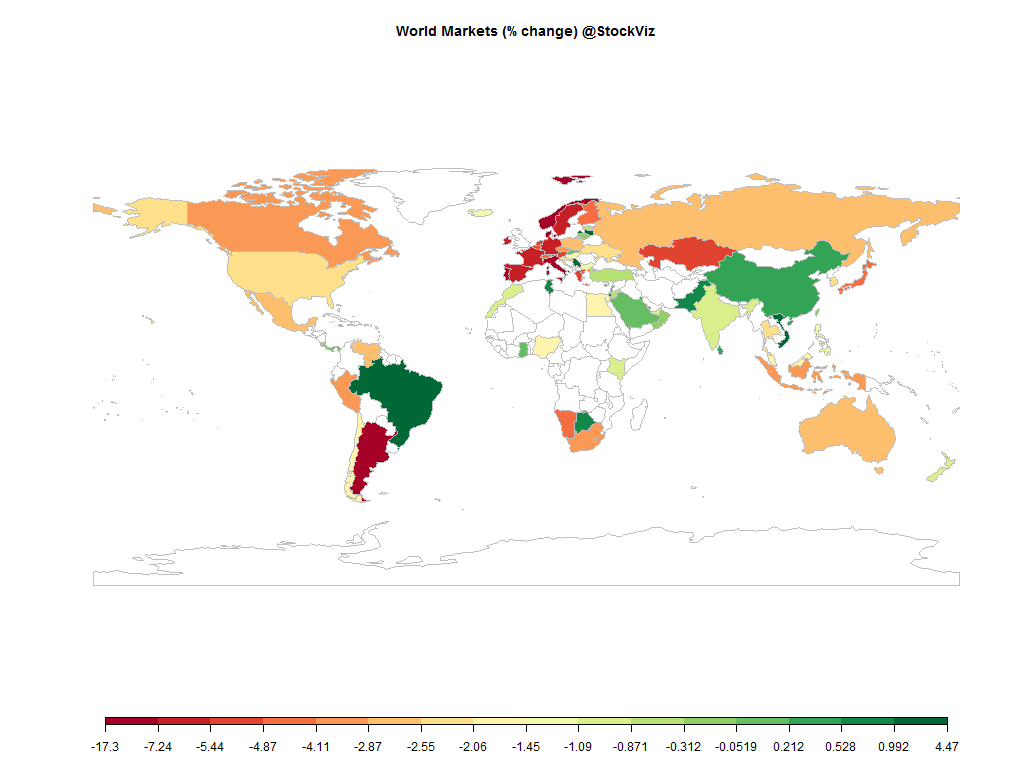

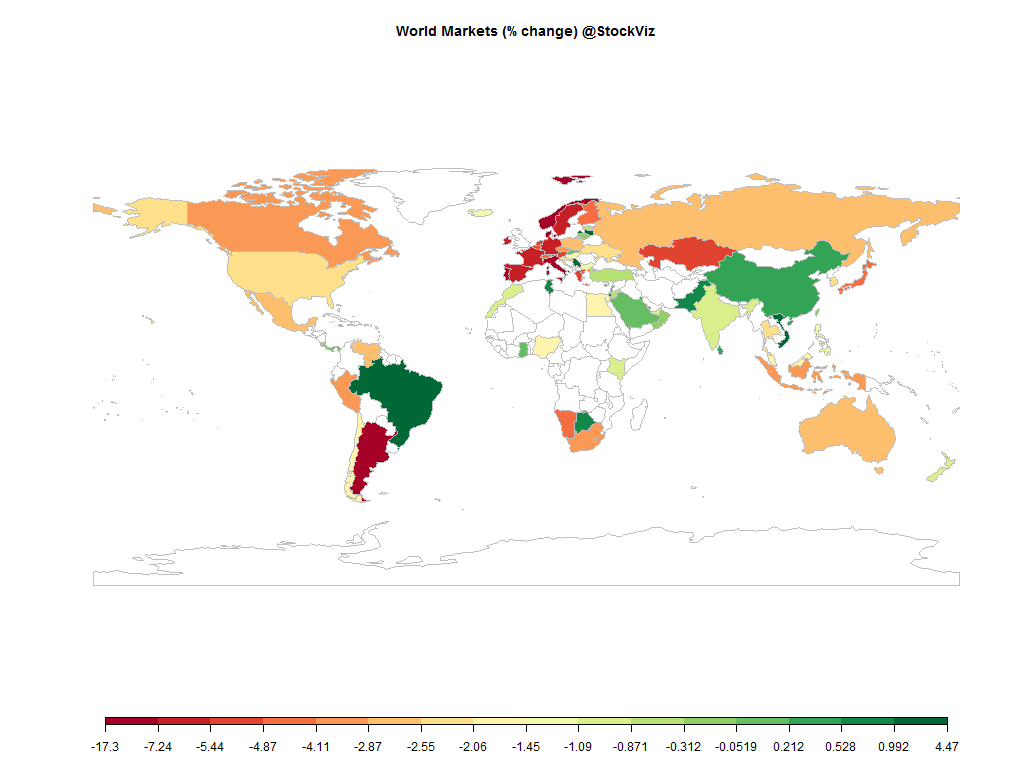

Markets seesawed between “good news is bad news” (US recovery means end of ZIRP) and “bad news is bad news” (slowing global growth) resulting in some serious whiplash. Credit blew out, European markets tanked and oil got crushed…

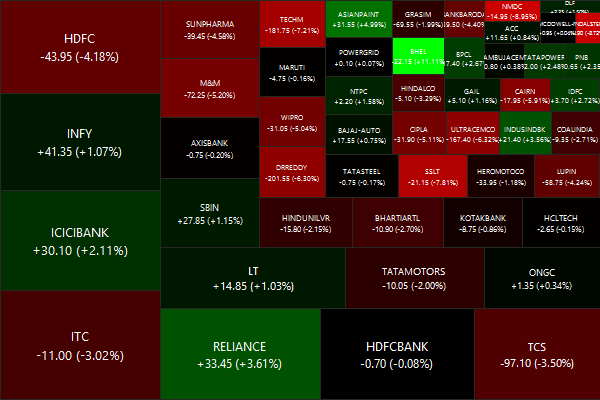

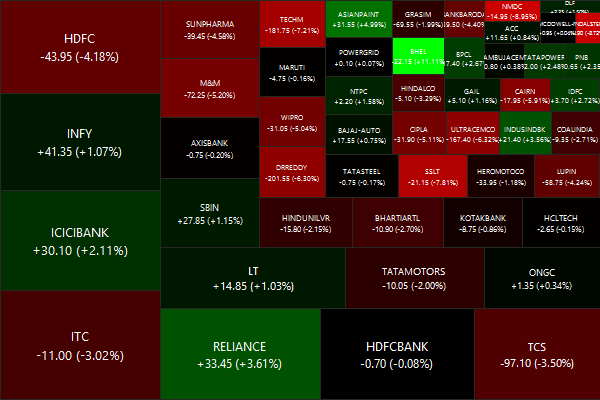

Nifty Heatmap

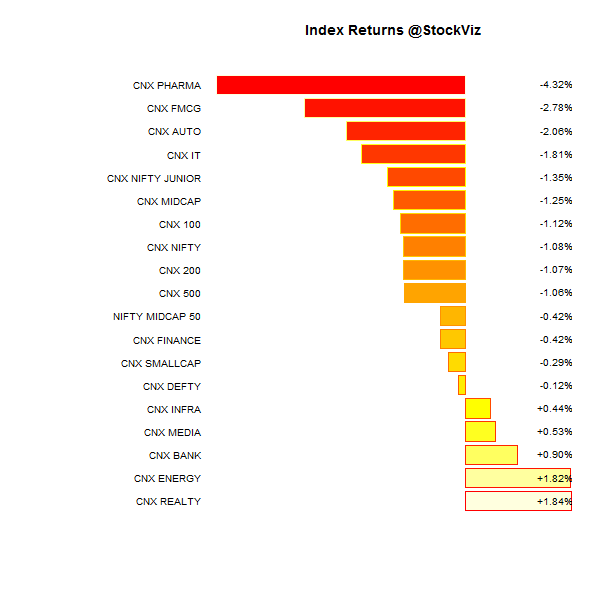

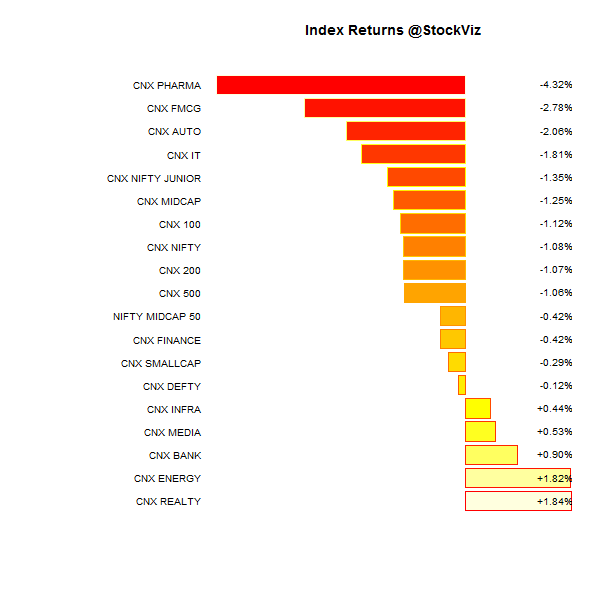

Index Returns

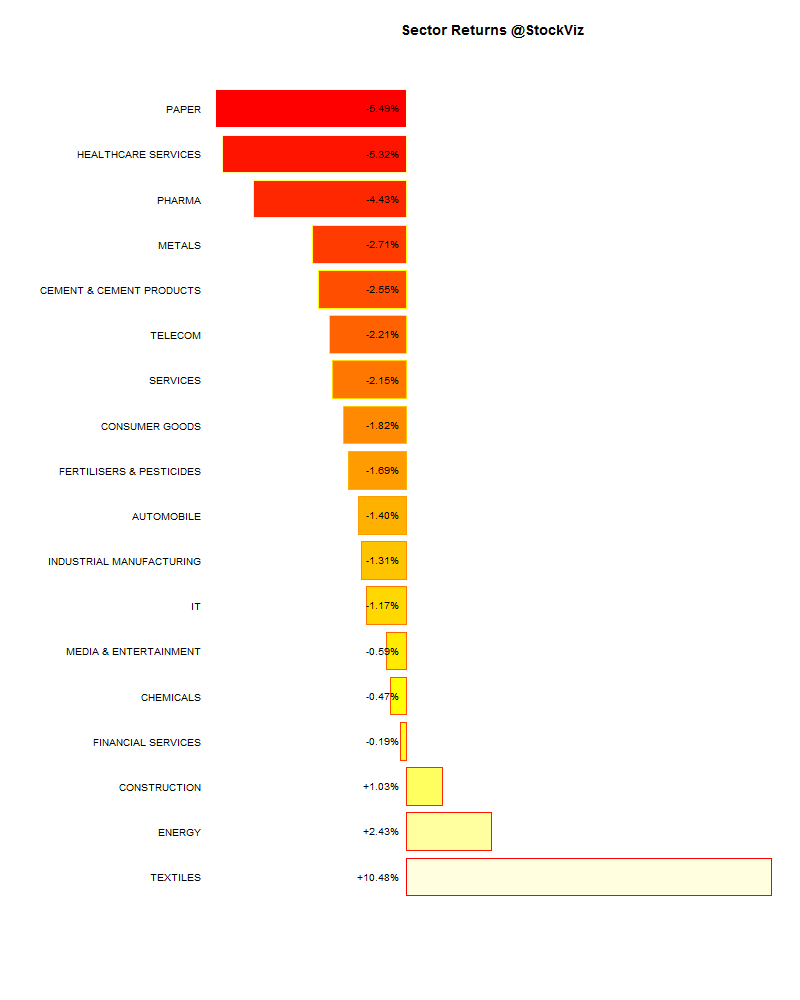

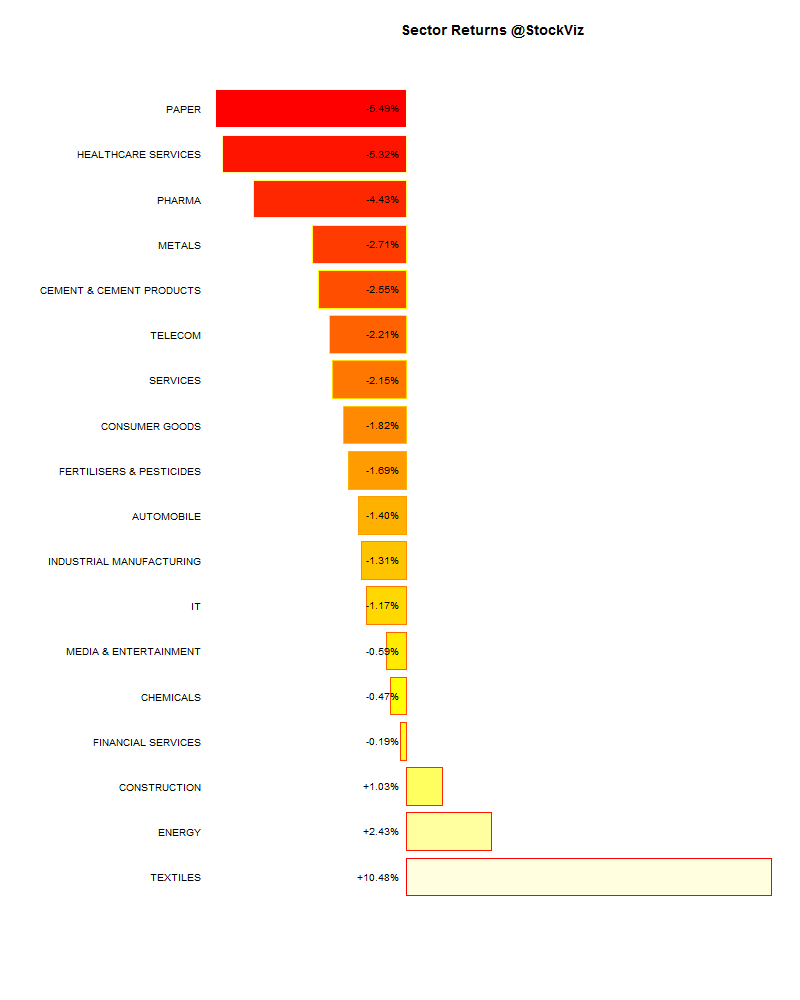

Sector Performance

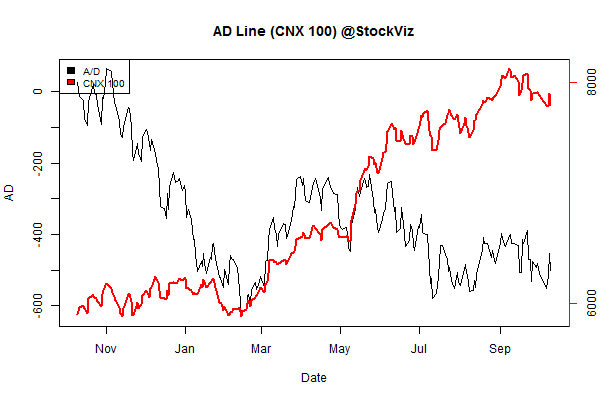

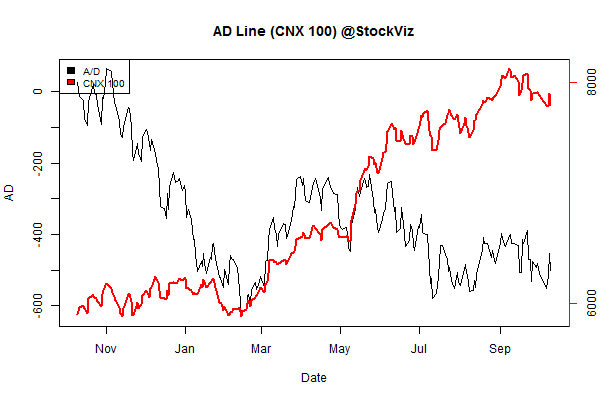

Advance Decline

Market cap decile performance

| Decile |

Mkt. Cap. |

Adv/Decl |

| 1 (micro) |

-6.80% |

69/66 |

| 2 |

-2.31% |

63/70 |

| 3 |

-0.18% |

66/69 |

| 4 |

-2.54% |

65/70 |

| 5 |

+0.24% |

62/72 |

| 6 |

-1.06% |

60/75 |

| 7 |

+0.00% |

72/63 |

| 8 |

-0.35% |

74/61 |

| 9 |

-0.53% |

66/69 |

| 10 (mega) |

-1.15% |

66/69 |

Small-caps bore the brunt of the market correction.

Top winners and losers

JSPL continued to get pummeled, it is now -38.74% for the year.

ETFs

Negative for the most part…

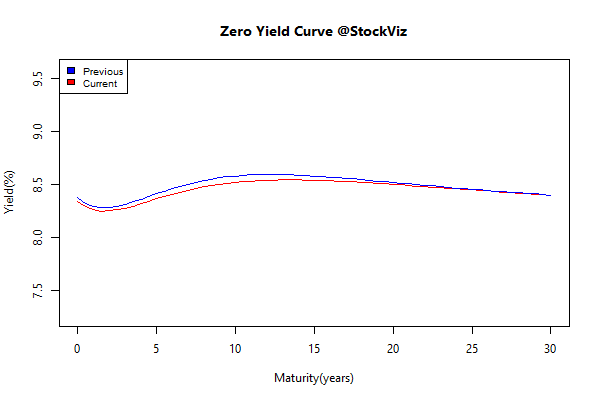

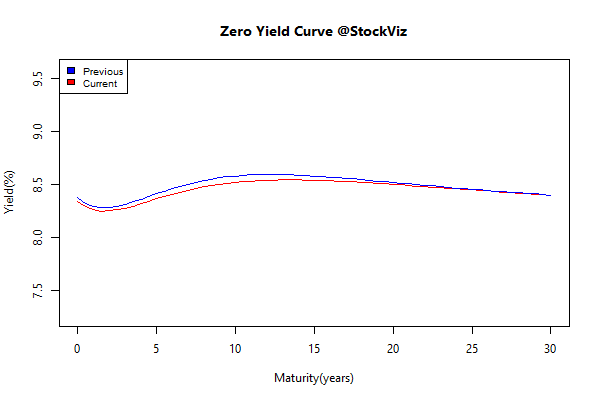

Yield Curve

Bond Indices

| Sub Index |

Change in YTM |

Total Return(%) |

| GSEC TB |

-0.03 |

+0.21% |

| GSEC SUB 1-3 |

+0.04 |

+0.36% |

| GSEC SUB 3-8 |

-0.06 |

+0.66% |

| GSEC SUB 8 |

+0.05 |

-0.04% |

The long end was affected by RBI’s OMO – apparently they were mopping up excess liquidity…

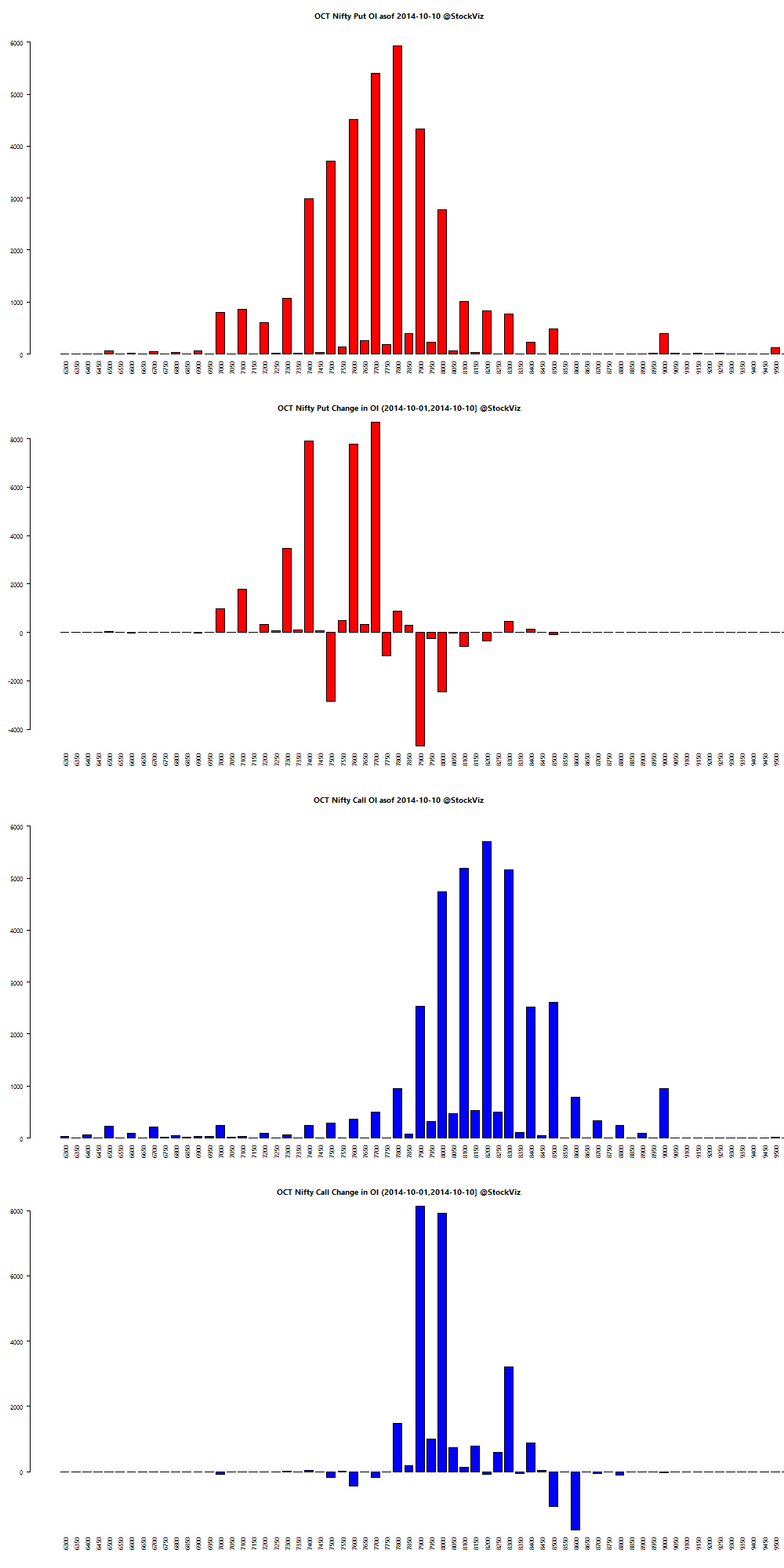

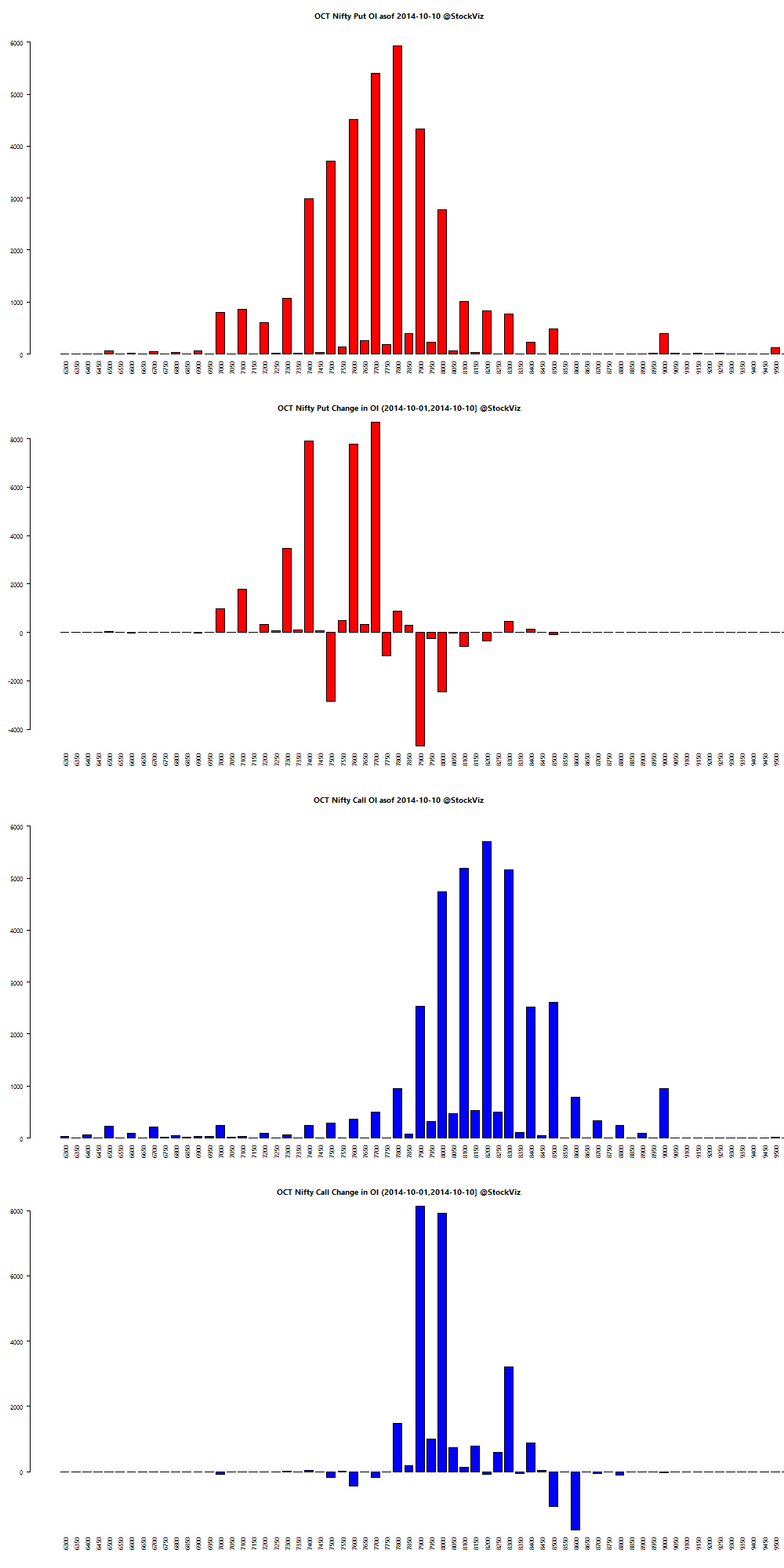

Nifty OI

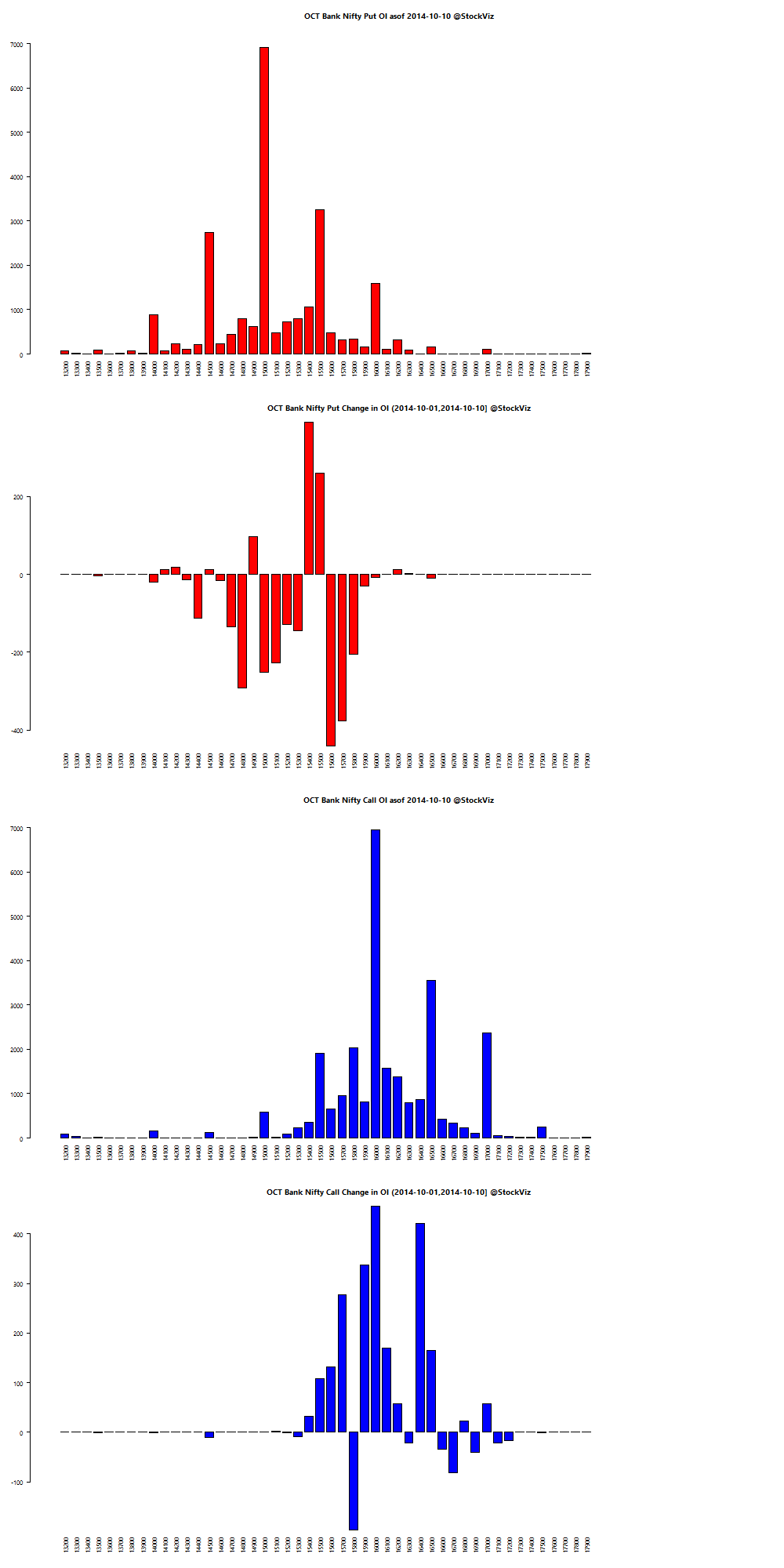

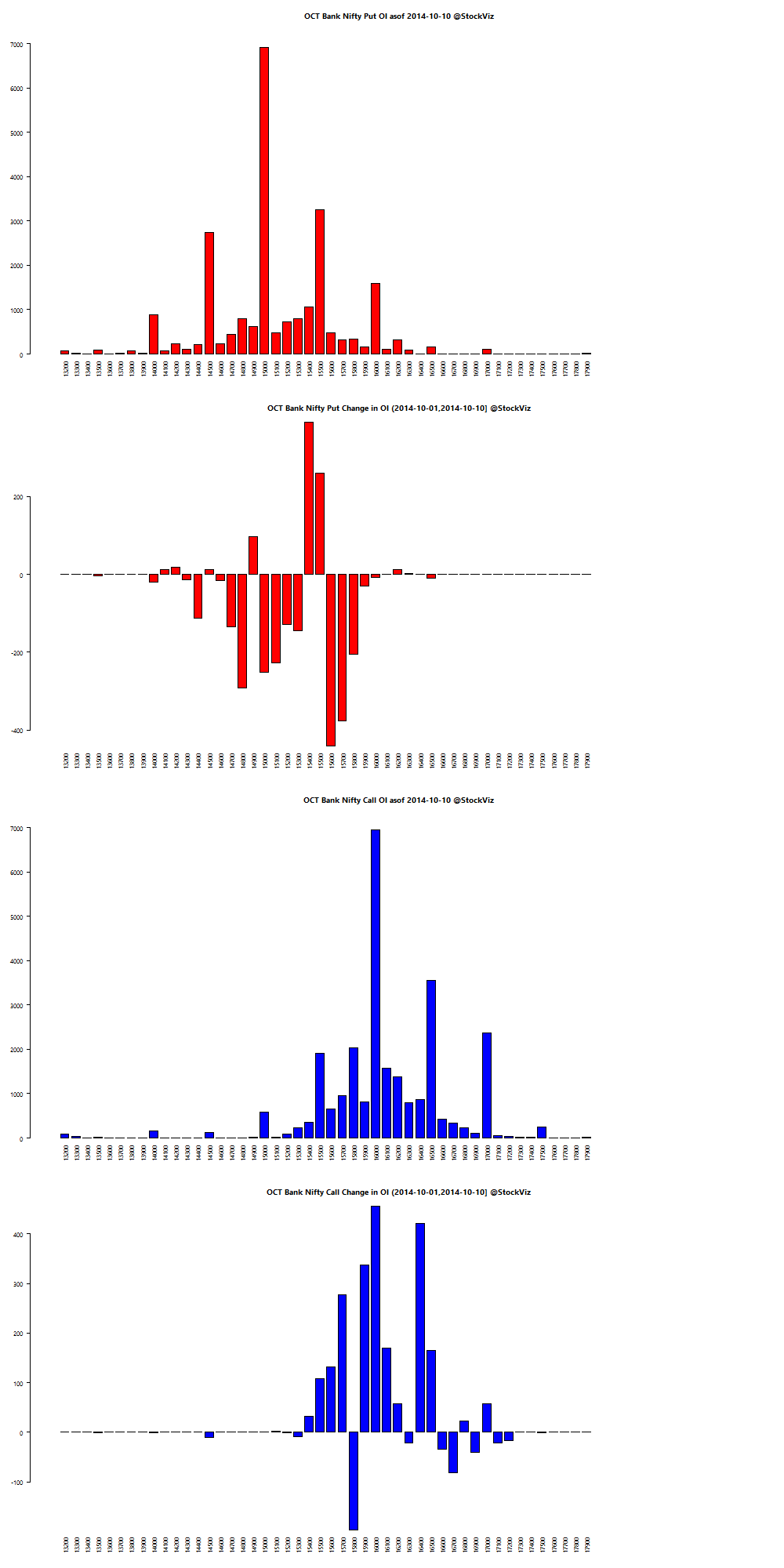

Bank Nifty OI

Theme Performance

Momentum carried through this week, but barely. Most themes ended in the red.

Thought for the weekend

Comments are closed, but trackbacks and pingbacks are open.