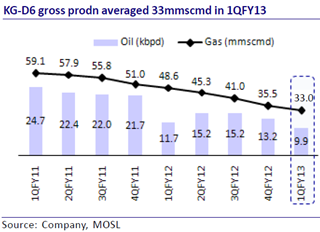

From being a prized asset to a pain in the neck for Reliance Industries (RIL) [stockquote]RELIANCE[/stockquote], the government, investors and other stakeholders, KG-D6, the country’s biggest gas discovery, has been mired in several off-field controversies than on-field exploits. Production was expected to touch 80 mmscmd by April this year as per the original development plan after all the 31 wells are drilled and brought to production. However, in the last few months, output has dipped to below 30 mmscmd, sparking a ugly row between the government and operator of the eastern offshore block, Mukesh Ambani-owned RIL. This will be the lowest level since RIL began production from KG-D6 block in April 2009.

While a drop in pressure in the wells and increased water and sand ingress pulled down per-well gas output, the flagging Krishna-Godavari (KG)-D6 fields has been subjected to several other distractions like sharp downward revision in provable reserves by partner Niko Resources, tussle between RIL and the government after the centre refused to clear the operator’s investment proposals of over $1.5 billion and delays in regulatory approvals forcing the company to defer investments.

While a drop in pressure in the wells and increased water and sand ingress pulled down per-well gas output, the flagging Krishna-Godavari (KG)-D6 fields has been subjected to several other distractions like sharp downward revision in provable reserves by partner Niko Resources, tussle between RIL and the government after the centre refused to clear the operator’s investment proposals of over $1.5 billion and delays in regulatory approvals forcing the company to defer investments.

Under the production sharing contract, the government allows companies to recover their cost from revenues and then share profits with the government.

Last November, RIL sent an arbitration notice to the government over recovering its investments in the KG basin after the oil ministry disallowed the cost recovery saying RIL failed to meet drilling commitments, accusing it of violating the production sharing contract.

Some voices in the street also believe that RIL is deliberately allowing production to drift downwards as it is unhappy with the gas price of $4.2/ mmbtu that stays till 2014.

The ugly battle has created a climate of uncertainty and loss of confidence among global oil & gas majors, forcing them to stay away from India’s hydrocarbon sector.

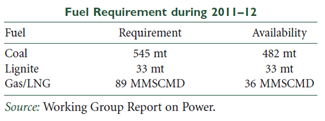

Instead of adopting a confrontationist stance, the oil ministry and the company need to bridge the gap and work in tandem for the sake of the country’s energy security. Sagging output from KG-D6 has forced companies to import gas at almost double or triple rates. While KG-D6 gas is available at $4.2/mmbtu plus taxes and marketing margin, imported gas varies anywhere from $8.5/ mmbtu to $14/mmbtu.

Instead of adopting a confrontationist stance, the oil ministry and the company need to bridge the gap and work in tandem for the sake of the country’s energy security. Sagging output from KG-D6 has forced companies to import gas at almost double or triple rates. While KG-D6 gas is available at $4.2/mmbtu plus taxes and marketing margin, imported gas varies anywhere from $8.5/ mmbtu to $14/mmbtu.

While the government must get rid of its bureaucratic hurdles and cut down on red tape, RIL must ensure greater transparency in terms of the problems facing the basin, the costs undertaken, etc. Both the sides have taken steps in this direction. While the oil ministry has conditionally approved RIL’s KG budget for the last three years, the Mukesh Ambani-controlled company has agreed to provide the Comptroller and Auditor General of India (CAG) access to records of the KG D6 block. This paves the way for the company to obtain green signal for its integrated field development plan (IFDP), which is crucial to revive the declining KG-D6 production.

The conditional approval will not only facilitate investments but also lead to an amicable resolution of the pending arbitration between RIL and Oil Ministry over reduction in KG – D6 cost-recovery.

The conditional approval will not only facilitate investments but also lead to an amicable resolution of the pending arbitration between RIL and Oil Ministry over reduction in KG – D6 cost-recovery.

For RIL, its fortunes and growth outlook are linked to quick recovery in gas production from KG-D6 basin. Last fiscal (FY12) saw the company’s share price slump by 28.6% against a 10.5% fall in the Sensex during the same period, reflecting investors’ unease over the standoff. If RIL is to regain its aura as the darling of D-Street, it needs to step up the gas and ramp up declining production.

Comments are closed, but trackbacks and pingbacks are open.